- The Mississippi House voted to concur on Senate amendments to a bill that would, among other things, end the tax on work. If signed by Governor Reeves, Mississippi would become the first state to ever eliminate an existing income tax.

As players from across the country laced up their sneakers for the start of the NCAA tournament Thursday, a different kind of game unfolded at the Mississippi State Capitol. The stakes, no less high. The thrill of victory for long-time proponents of ending the tax on work, no less sweet.

Still, for veteran onlookers of the Legislature, the Mississippi House’s decision to concur on Senate amendments to HB 1 raised eyebrows. A wide chasm separated the two chambers for most of the session on the question of whether to eliminate the income tax, and even once the Senate agreed, over how quickly to axe it.

The expectation had been a protracted fight to close out March, and possibly even a special session. If the chambers were basketball teams on the issue of tax cuttin’, the House would be fastbreak impresarios. The Senate, masters of zone defense. One hyper-aggressive. One middling-cautious.

But on Thursday, by a vote of 92-27, House members accepted the Senate’s gameplan. On its face, the bill maintains the state’s largest tax exemption in the nation. It slashes the flat rate on the remainder of earnings down from its current 4.4 to 3 percent by 2030. It reduces the sales tax on groceries down to 5 percent, while creating a new dedicated stream of revenue for MDOT.

Beginning in 2031, additional cuts to the income tax rate would occur using revenue growth triggers. Unlike the House offering, the Senate’s language contained no “offset” sales tax increase.

Not Perfect, But a Win

I said earlier this week that if I was Emperor, this bill would look different. That’s still true. But I also said this wasn’t a time to be dogmatic.

The simple fact is the Legislature just passed something historic — to do something no state has ever done before. (There are nine states that thrive without an income tax, but none of them started with one and then eliminated it).

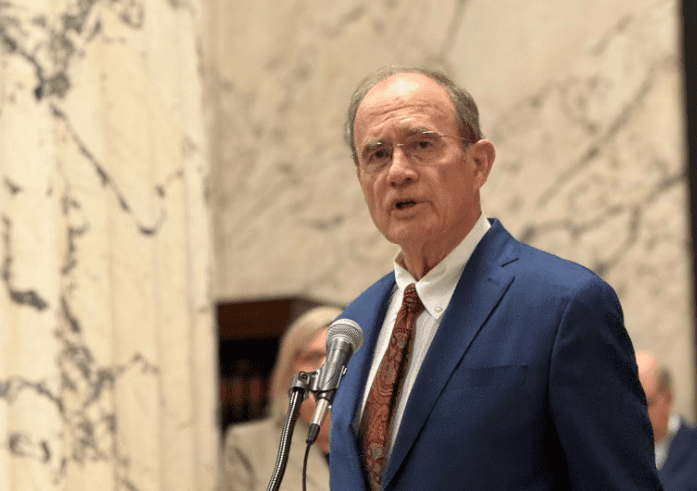

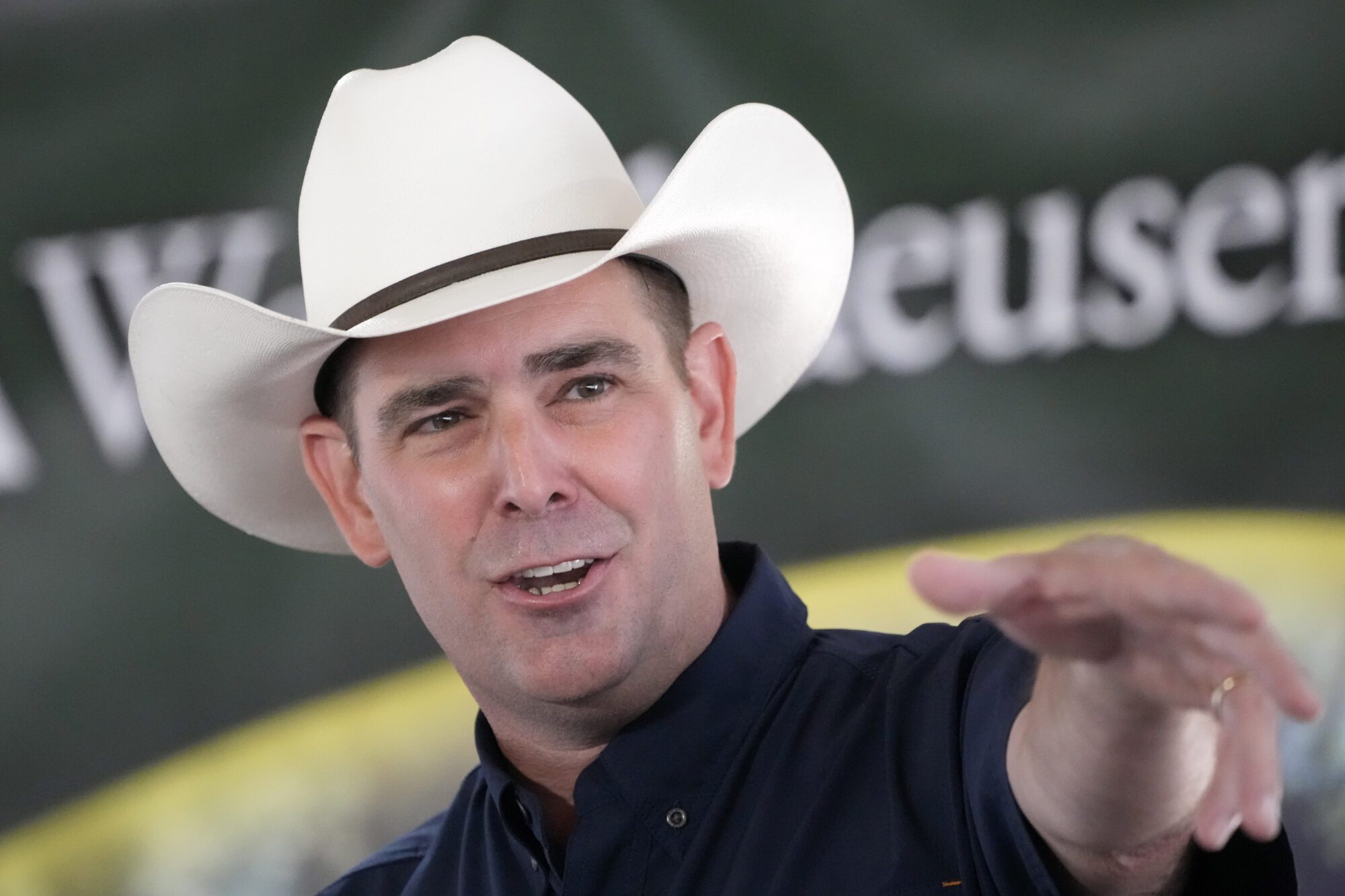

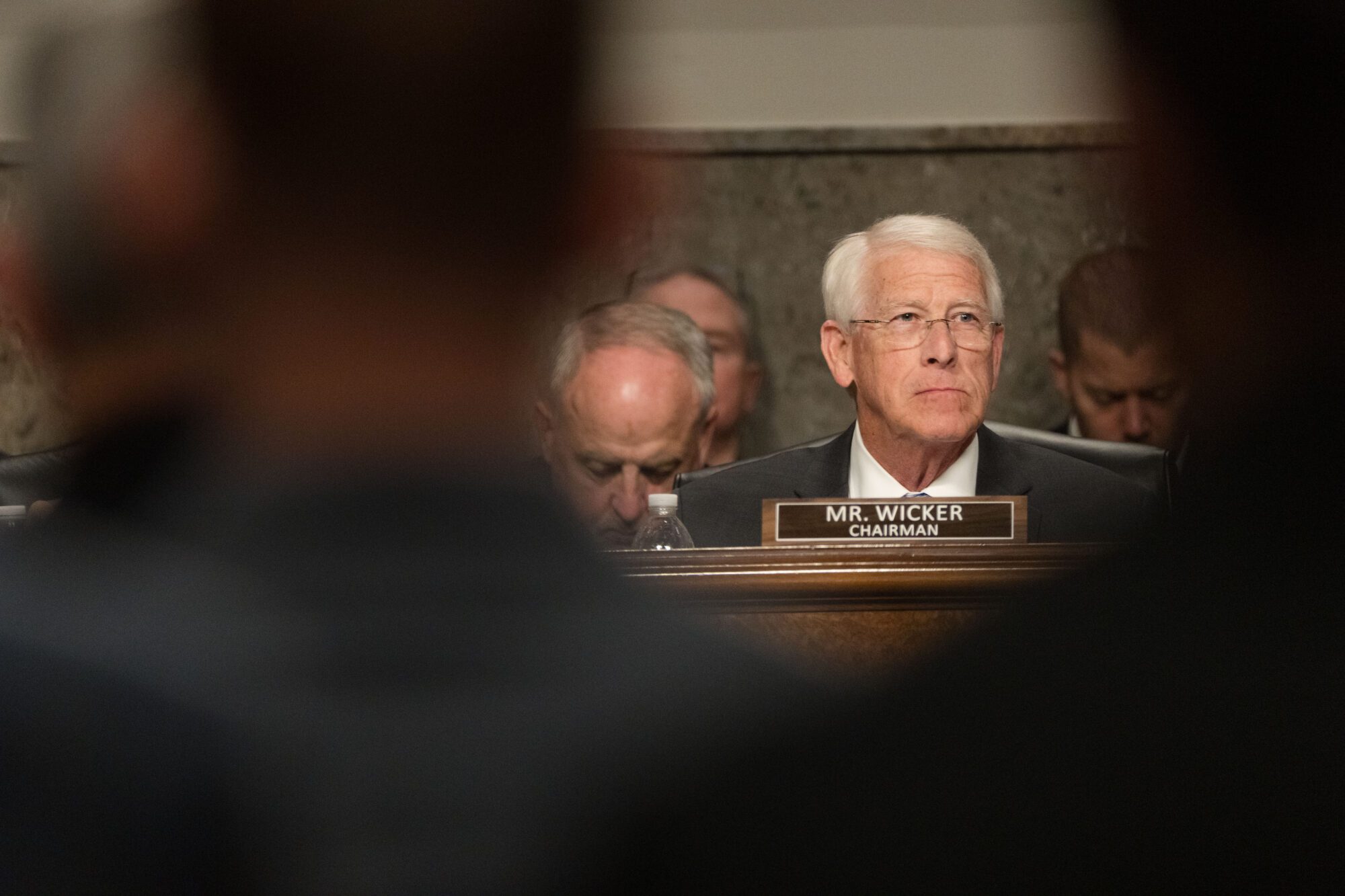

The agreement today is a win for the folks who started this push in 2016. Among them, Governor Tate Reeves, former House Speaker Philip Gunn, Speaker Jason White, and House Ways and Means Chairman Trey Lamar. All put in the serious work to advance the ball.

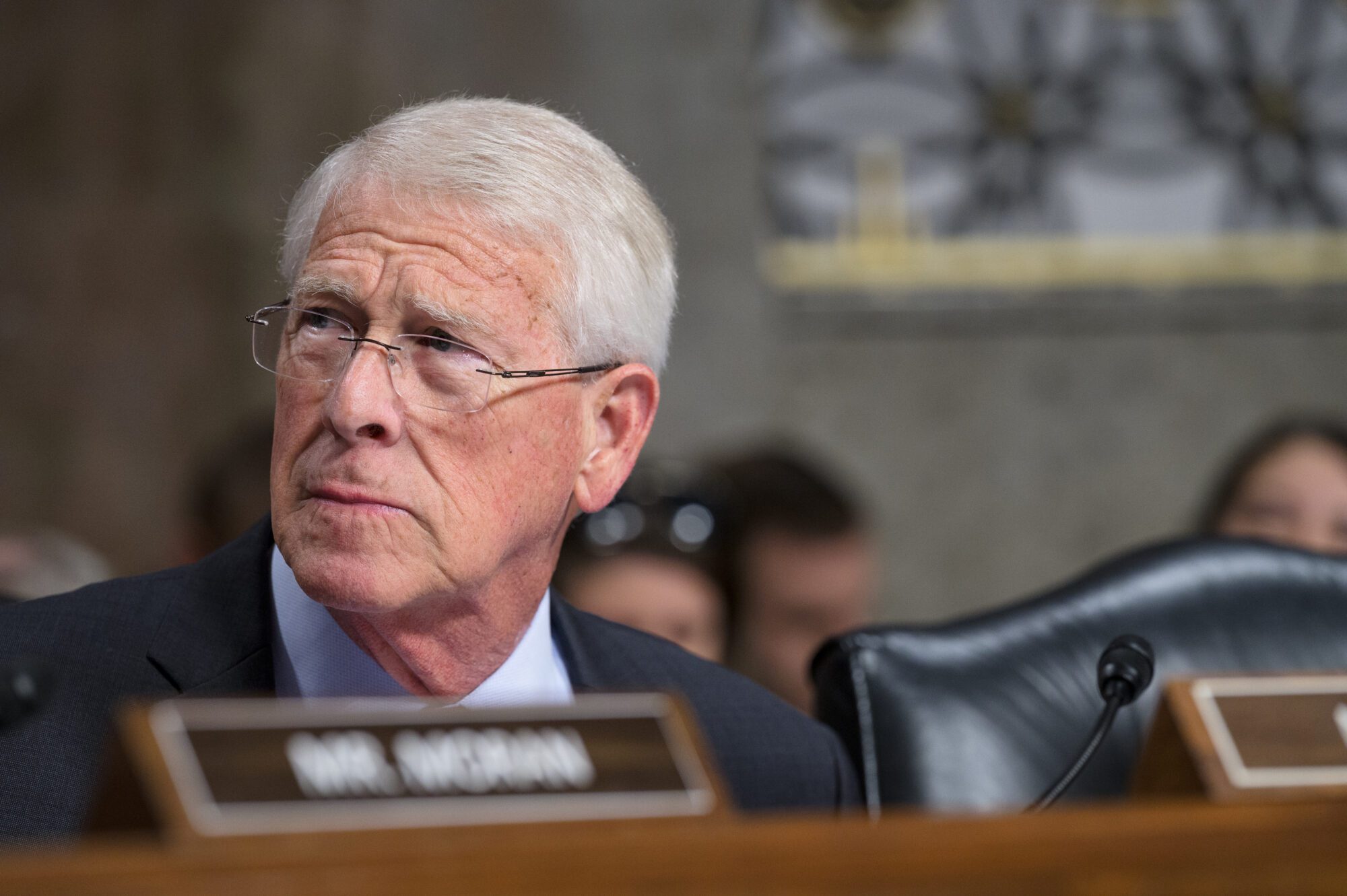

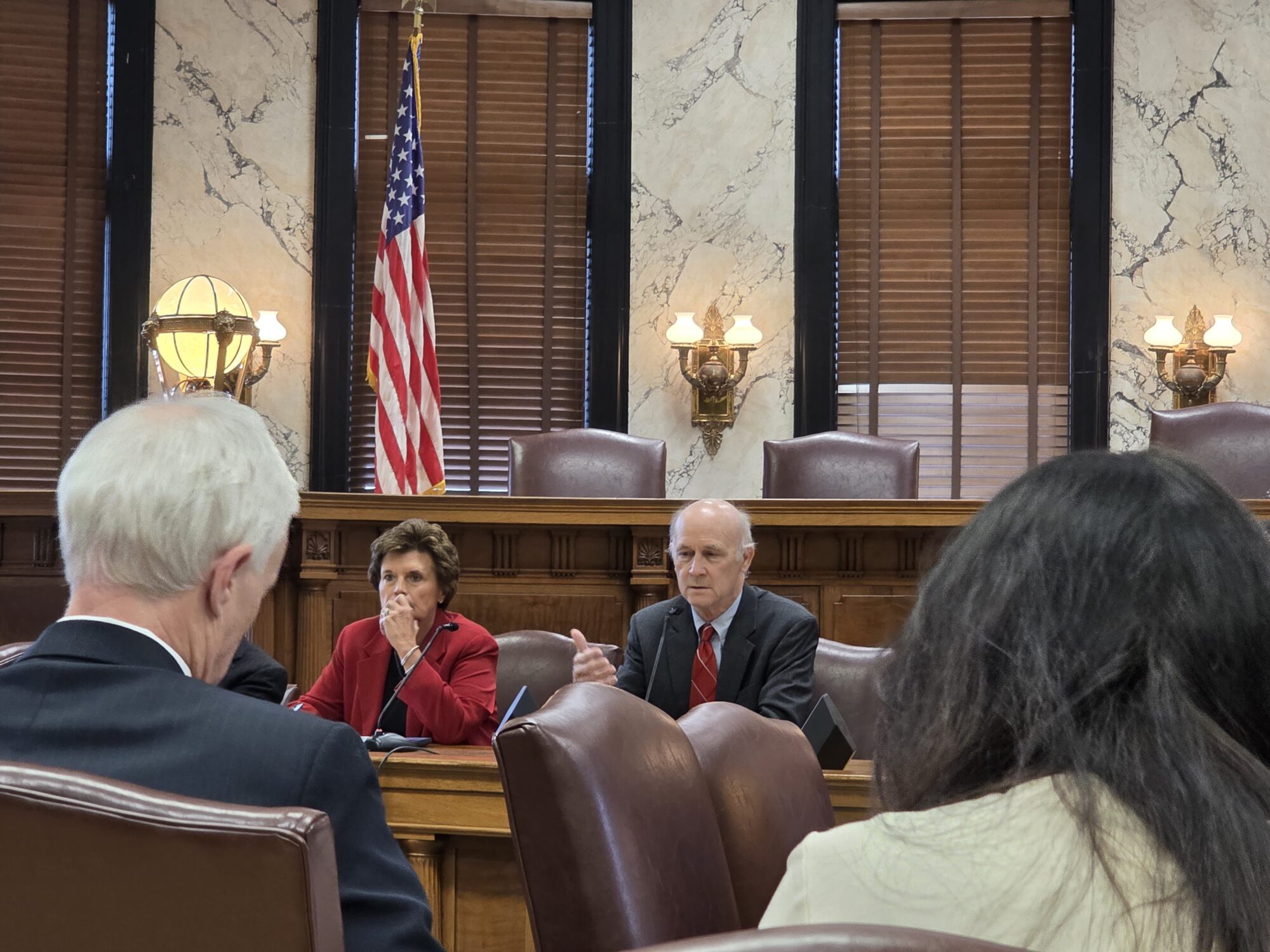

But it’s also a win for Lt. Governor Delbert Hosemann, Senate Finance Chairman Josh Harkins, Senate Appropriations Chairman Briggs Hopson, and others — who each played important roles toward refining and improving proposals in recent years. They brought a different facet to the game.

Most importantly, it’s a win for Mississippi workers, who deserve the right to keep what they earn.

Ignore the Heckles

Within an hour of the House’s vote, I began receiving tips from lawmakers, lobbyists, trade associations, and the Capitol tour guides. Okay, I made the last one up, but the point is that there’s no such thing as a state secret “under the dome.” It’s a sieve.

“Take a look at the trigger language.”

I did. Then confirmation of what I thought I saw came in the form of a tweet from a scholar from The Tax Foundation. The revenue “trigger” necessary to prompt new rate reductions beginning in 2031 was written in a way to be very low and near automatic.

Just a few million dollars in surplus would trigger even bigger cuts. Based on the Senate’s previous public comments, the written language seemed like a mistake.

Cue the breathless chatter of big government’s biggest fans — eagerly proclaiming “blunders,” pouncing with boos.

The simple truth is that even if the Senate made a mistake (it happens with complex policy drafting), there are no immediate negative consequences from it. And the long-term consequence of it would be to eliminate the income tax faster.

Don’t threaten me with a good time!

But lawmakers can either fix it now, or fix it later. They have time. The trigger component of the bill does not actually take effect until 2031. So take a deep breath and major on the major.

HB 1 was held on a motion to reconsider. This means that lawmakers could strike a different deal by Monday’s deadline. The House, who has leverage, could also table the motion to reconsider, send the bill to Reeves for his signature, and fix the trigger at a later date.

Options abound. Either way, we’re one step closer to cutting down nets. For those who have been on team “No Income Tax” since before it was cool, and in the immortal words of Dick Vitale, “It’s awesome, Baby.”