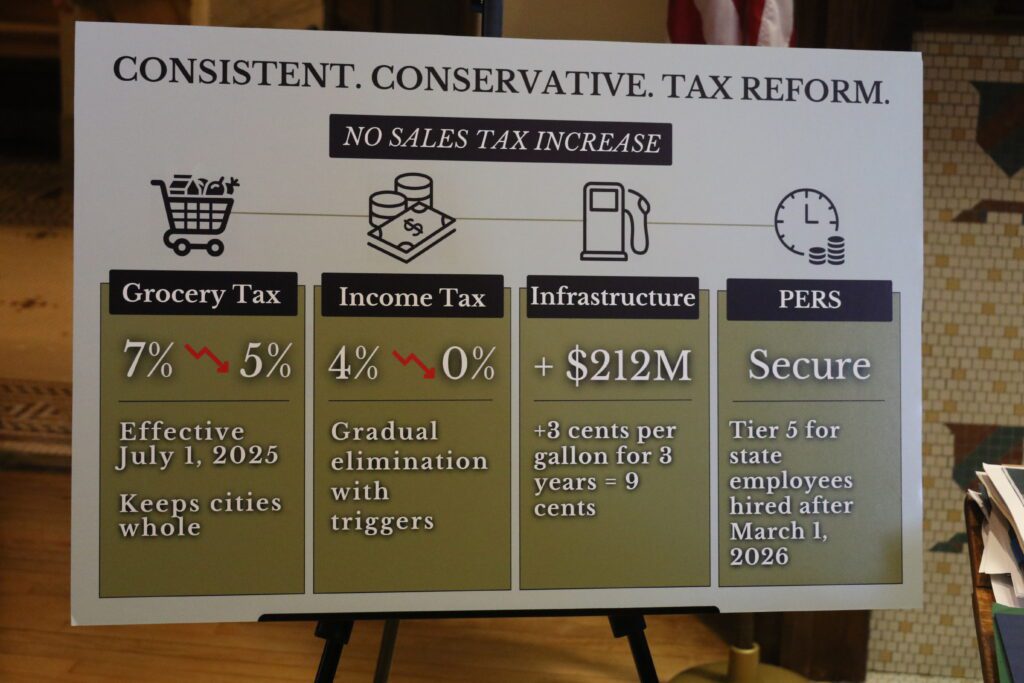

- The measure phases out the state income tax, cuts the sales tax on groceries, and addresses transportation funding and PERS.

The Mississippi House of Representatives has voted 92-27 to concur with the Senate changes to HB 1, passing a tax relief package aimed at phasing out the state’s income tax.

The measure cuts the current income tax rate of 4 percent by 0.25 percent each year until 2030. The first cut would take place in 2027. After 2031, future cuts would be determined by the performance of the state’s economy.

The bill proposes an immediate two percent cut to the sales tax on groceries, bringing the rate from 7 to 5 percent starting July 1 of this year. To keep cities whole, 18.5 percent of the general sales tax and 25.9 percent of the grocery sales tax will go to cities.

The measure includes a 3-cent increase on gasoline to occur each year for three consecutive years, making the total increase 9 cents per gallon.

It also would establish a new Tier 5 for state employees hired after March 1, 2026, where 4 percent of their retirement savings would be placed in a defined benefit plan and 5 percent would go to a defined contribution plan.