(Photo from Governor's 2024 EBR)

- Lawmakers are working to set a new fiscal year state budget as competing tax reform packages remain in limbo.

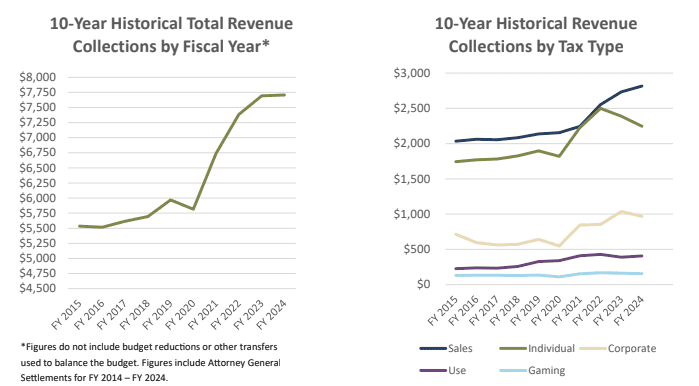

The Legislative Budget Office released February’s revenue report this week showing that total tax and revenue collections for the month were $11.3 million or 2.39 percent above legislative estimates.

Fiscal year-to-date collections continue to be below estimates, currently sitting at $13.3 million or 0.29 percent less than estimated. That is $18.6 million or 0.4 percent less than the prior fiscal year.

Four months remain in this 2025 Fiscal Year which has a Sine Die Revenue Estimate of $7.6 billion.

For the month of February, General Fund collections were $50 million or 11.6 percent above the same month of the prior year. In addition, sales tax collections, individual income tax collections and corporate income tax collections were all up for the month of February over the prior year.

Lawmakers at the Capitol have turned their attention to working through appropriations bills as they head toward setting a Fiscal Year 2026 state budget. The biggest topic on the table regarding that budget is how the tax reform proposals offered in each chamber will fare as time winds down in this 2025 legislative session.

The House has proposed a 10-year phase out plan to fully eliminate the state income tax while reducing the sales tax on groceries and raising funds for transportation infrastructure and the Public Employees Retirement System. Governor Tate Reeves (R) has voiced support for the House plan.

The Senate, on the other hand, simply wants to reduce the state income tax by a percent while also cutting the sales tax on groceries, a move Governor Reeves has called a non-starter for him as it does not achieve full elimination of the income tax.

Rumors around the Capitol have swirled in recent days that the Governor may be considering calling a special session to have lawmakers hash the issue out prior to Sine Die.