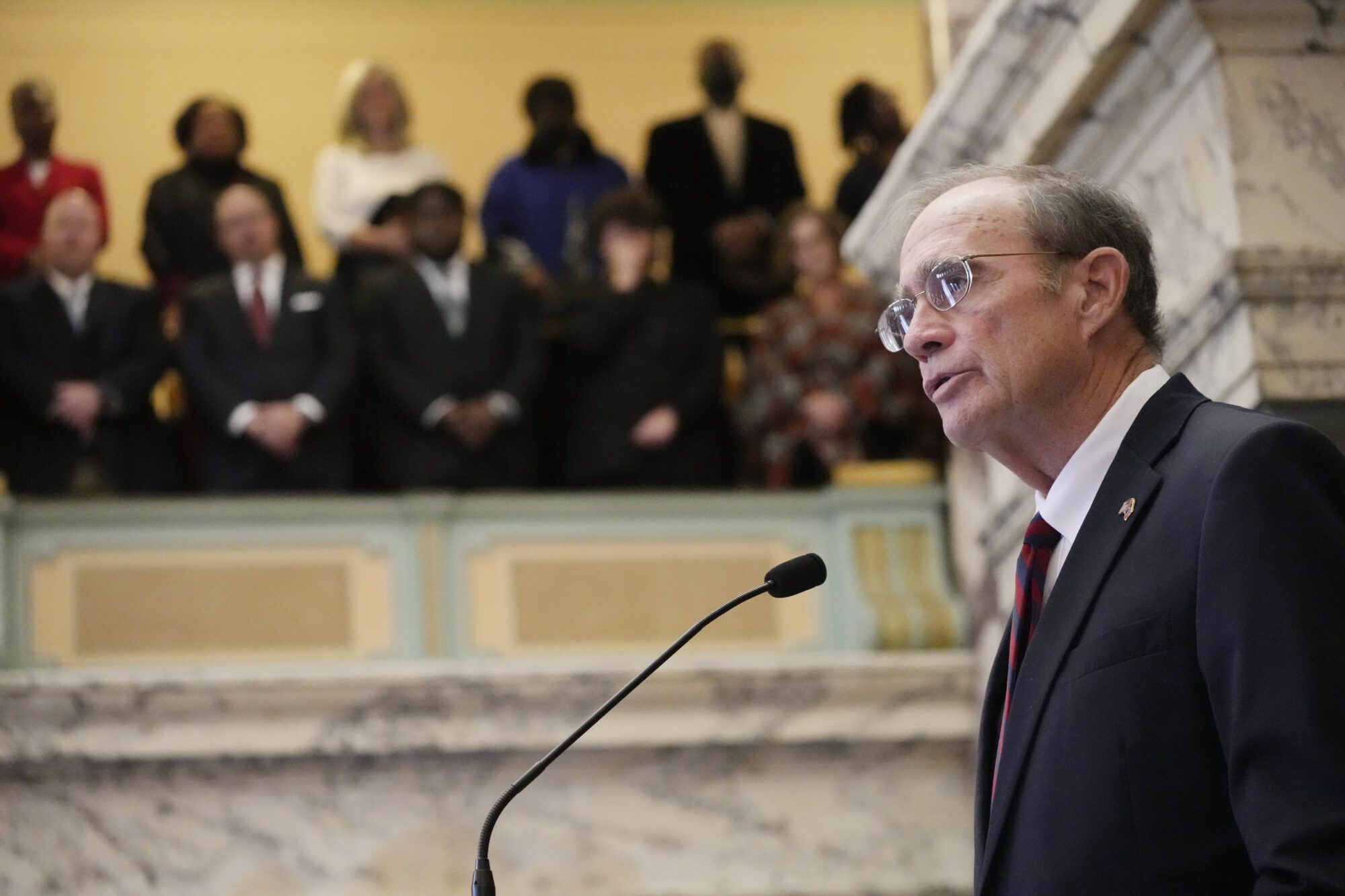

Republican Lt. Gov. Delbert Hosemann addresses the Senate Chamber prior to the start of the swearing-in ceremony at the Mississippi State Capitol in Jackson, Miss., Tuesday, Jan. 2, 2024. Both chambers of lawmakers were sworn into the new four-year term that began at noon Tuesday. (AP Photo/Rogelio V. Solis)

- The Senate plan reduces but does not fully phase out the income tax while the House proposal would achieve that goal.

The Senate passed its $538 million tax cut package Monday afternoon, setting up what could be contentious conference talks later this session. House leaders appear ready to battle for their $1.1 billion tax reform package that ultimately eliminates the income tax, something the Senate measure does not achieve.

Both versions would equate to the largest tax cut in state history.

Senators passed SB 3095 on Monday, which reduces the income tax as well as the sales tax on groceries while increasing funding for the Mississippi Department of Transportation for maintenance work.

The bill passed the Senate by a vote of 34 to 15.

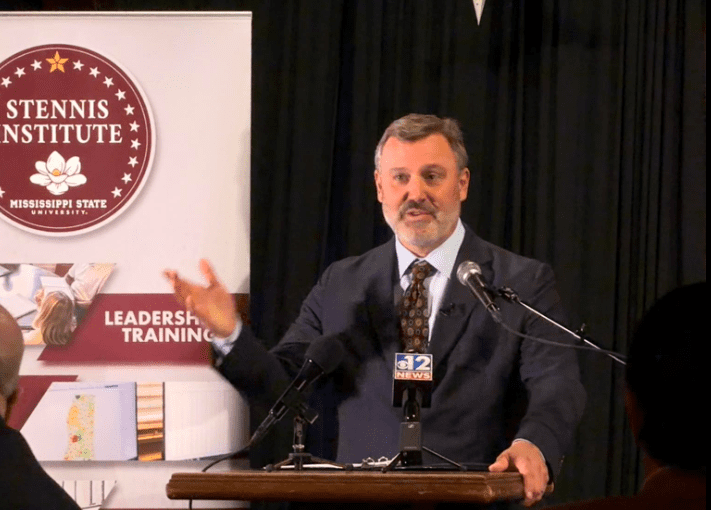

“We looked at a lot of scenarios; we looked at a lot of different ways to do this. We felt this was a responsible way to achieve a couple of goals: continue to lower the burden on taxpayers and to provide relief at the grocery store, and to provide recurring revenue for the maintenance of our infrastructure system, which is the lifeblood of our state,” said Senator Josh Harkins (R), chairman of the Finance Committee.

The bill aims to reduce the state’s income tax from 4 percent to 2.99 percent, phased in over four years. The House version calls for its complete elimination over 10 years.

The Senate tax measure also calls for Mississippi’s sales tax on groceries to be reduced from 7 percent to 5 percent starting next July, double what the House proposed after the 10-year phase in. The Senate bill also does not include a 1.5 percent optional sales tax for cities like the House version.

To help offset the cuts, the Senate measure would increase the gas tax by 9 cents over three years, ending in a 27.4 percent tax on each gallon. Senate estimates show the increase will add $212 million to the state Department of Transportation’s roadway improvement efforts.

Three amendments to the bill were offered by Democratic members. All failed on Monday.

Senator Derrick Simmons (D) offered an amendment to fully eliminate the grocery tax. Simmons said within the last decade, the state has passed around $1.3 billion in tax cuts, taking money out of the general fund.

“I’d add that we gave it back to the people who paid it,” responded Harkins.

Simmons continued, saying that many Senators believe the grocery tax is a “fair and equitable tax,” but reducing it from 7 percent to zero would allow “people in Mississippi to buy those food items they need for their families.”

Harkins responded that while he agrees with families not being taxed on groceries, “And I would say I am for lowering the grocery tax, but if you take away consumption as a basis of how we are going to raise revenue… I think you would agree with me that not everybody pays taxes. I think it’s harder for people to get out of paying sales tax when you go to the store or when you buy gas.”

That led to a debate on the proposed gas tax. Simmons asked if it was fair that his constituents should pay 9 cents more for gas. Harkins said the increase was more fair than non-drivers paying a gas tax.

“I just think the user fee is the fairest form,” he said.

The amendment failed by 16 to 33 margin.

Another amendment to address funding for the Mississippi Public Employee Retirement System was offered.

“Why in the world would we reduce the budget when we know we know we owe this money?” asked Senator David Blount (D), referring to PERS unfunded liability.

However, Senator Daniel Sparks (R) reminded the chamber that they voted earlier in the session to add a new tier to PERS aimed at partially addressing fiscal concerns.

Blount’s amendment failed on a voice vote.

The final amendment offered by Senator Hob Bryan (D) also failed. His amendment would have cut the grocery tax in half and provide funding for MDOT without touching the income tax. It also failed on a voice vote.

The bill now heads to the House for consideration as the House bill remains to be taken up in the Senate Finance Committee. Negotiations could be eventful given that the House has the support of various industry groups as well as the Governor.

Governor Tate Reeves (R) has described the Senate bill as a “non-starter” as it does not fully eliminate the income tax.