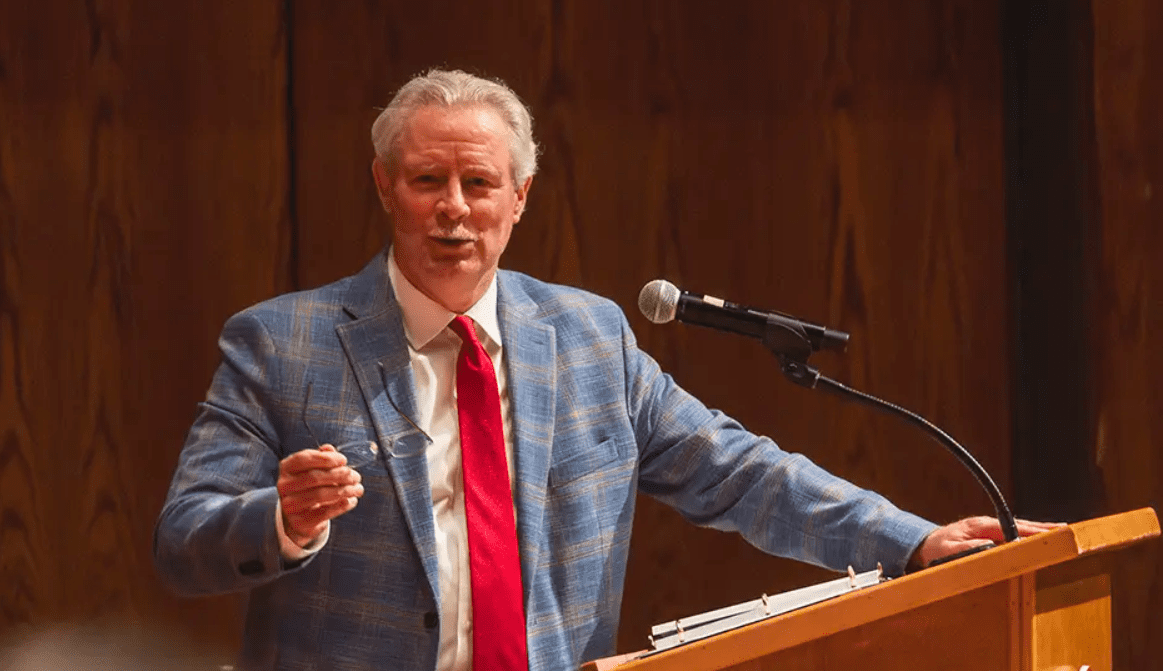

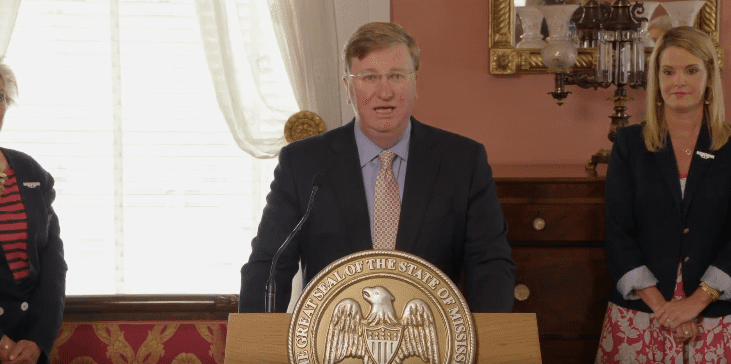

(Photo from Southern Miss showing tornado damage from Feb. 11, 2013)

- Factors include inflation, the large number of claims filed, and increasing exposure to damaging storms.

The Trustees for the Mississippi Institutions of Higher Learning (IHL) were informed during May’s meeting that the cost to insure the state’s public university system is increasing, along with deductibles.

Several factors are at play in the hike, such as inflation, an increase in the number of claims filed by IHL, and the recent escalation in the region’s exposure to various kinds of weather-related damage.

In all, the IHL will pay an additional $1.2 million in insurance premiums, while taking on more risk in the form of higher deductibles.

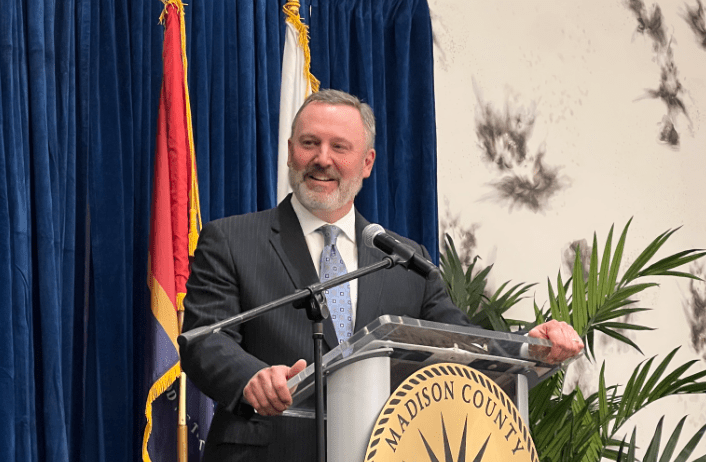

Director of Risk Management David Buford started his presentation to the IHL Board with a history of how the trustees have handled policies since 2009, which has resulted in a consolidation of policies for all eight public universities. That consolidation led to a 47 percent reduction in premiums the first year.

“Prior to 2009, each university was purchasing their insurance individually,” Buford explained. “We’ve probably saved over $150 million in premiums as a conservative number by having a pooled system program through these years.”

In terms of property values, Buford outlined that they have increased by $1.83 billion since 2021, or 15 percent, mostly due to the higher cost of labor and materials as a result of inflation.

The IHL also has properties that are close to each other. For example, IHL’s insurance broker, Jeff Estes with Arthur J. Gallagher & Co., described the University of Mississippi’s campus in Oxford, where 71 buildings with a combined value of $1.7 billion are within a quarter mile of each other.

“So, what the underwriters and reinsurers are worried about is they know it’s just a matter of time before one of these tornadoes is… going to hit one of our campuses,” Estes added.

Over the past two years, IHL has experienced two bad claim years totaling $19 million. As a result, the insuring company, Affiliated FM, almost dropped IHL last year.

Buford explained that because Affiliated FM offers lower rates, the company is able to be selective in who they insure. The company is also meticulous in conducting annual site visits to examine buildings and make suggestions to ensure proper maintenance. As a result, the company is challenging to keep if too many claims are filed.

After filing large claims, IHL was notified in October of 2023 that its policy would be dropped, said Estes. Subsequent efforts by IHL’s staff convinced the company to continue insuring the properties, but then another incident occurred.

“As soon as they agreed to renew, we had another $6 million freeze claim, so it’s been a lot of work over the last six months to get us to this point,” Estes explained to the Board.

Buford added that the change in the policy will mean if another freeze causes flood damage to a facility, the deductible will now be $2.5 million, instead of $250,000 as previously required.

“So, we are retaining more risk than we have in the past,” Buford said.

Buford further explained that some of the efforts to keep Affiliated FM included the addition of a new position to ensure all buildings are properly maintained along with the establishment of a mitigation contractor system. That system cuts the time required for repairs and entails a lower price.

Estes commended IHL staff for their work to convince Affiliated FM to continue to provide coverage.

IHL is not the only entity being affected, however. Estes, who has 30 years of experience in the industry, said the past three to five years have been bad for insurance companies.

“It really has been kind of the worst market I have seen in my career,” Estes described.

Last year, for example, there were 28 billion-dollar claims made nationwide. And, as Estes stated, over the last five years there has been double the number of claims when compared to the past four decades. Nearly all claims were due to secondary perils, such as straight-line winds, wildfires, hail, tornadoes or flood damage.

Over the past four decades there has been a shift in where most tornadoes occur in the nation, which now includes Mississippi. Additionally, the southeastern region has been included in the 2024 map for the potential of convective storms.

“You can see that the entire state of Mississippi is included in that map for wind and hail,” Estes said, describing the area to the trustees.

Under the new policy, Affiliated FM’s rate for IHL will increase by 8 percent, but combined with Mississippi State and the University of Southern Mississippi’s separate wind and hail policies for locations along the six Coastal counties, there will be a 10 percent increase in premiums and 12 percent increase in rates. The policies for the separate wind and hail mostly remained flat, but an additional property was added under USM’s policy.

In all, the total premium will increase from $12.4 million to $13.6 million in the coming year, which the IHL Board unanimously approved.