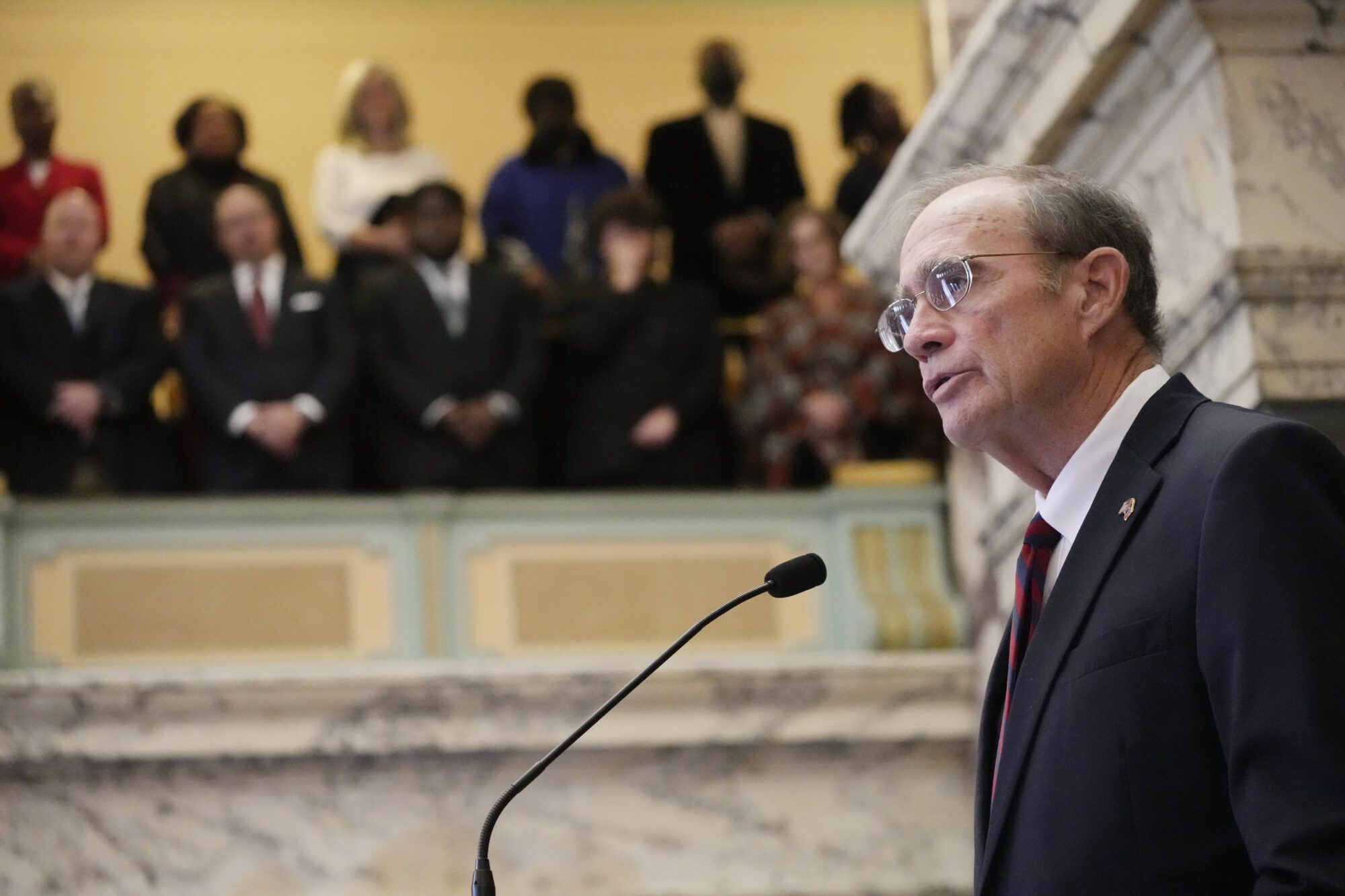

Trey Dellinger

Columnist Trey Dellinger says that while some worry that the recent growth in tax revenues is just an inflationary phenomenon, revenue numbers show policymakers can give Mississippians more tax relief.

Last week I discussed recent Mississippi tax rate cuts. Now, let’s look at how revenues are faring. What will be the impact of currently scheduled tax cuts on future revenues? Will we have enough revenues for the public investments and additional tax relief needed to foster opportunities for Mississippians?

First it helps to understand a little budget background. Mississippi income tax rates apply on a calendar-year basis, while state government follows a fiscal year (“FY”), which runs from July 1 to June 30 each year. Each session the legislature makes appropriations for the upcoming fiscal year. The 2023 legislative session, for example, made appropriations for FY2024.

In the last fiscal year before the COVID-19 pandemic, FY2019, the state collected general fund revenues of about $6.0 billion. Since then, we have experienced historically rapid state revenue growth.

Legislative Budget Office (“LBO”) numbers for FY2023 show Mississippi collected recurring general fund revenues of just under $7.7 billion and appropriated general funds of about $6.3 billion.

As of the end of December, 2023, state government was halfway through FY2024 and was on pace to collect total general fund revenues of about $7.7 billion for the fiscal year. Total general fund appropriations for FY2024 were about $6.7 billion.

The spending growth reflects in large part historic increases in teacher pay and school funding, measures policymakers implemented as part of their continuing education emphasis. They raised standards and doubled down on those higher standards with strong financial commitments. Those policies are working, as Mississippi has gone from perennial basement dweller to national leader in education gains.

The FY2024 revenue numbers reflect the elimination of the 4% tax bracket, which was effective in calendar year 2023. Before accounting for the scheduled reductions in the 5% individual income tax bracket, FY2024 individual income tax revenues were on pace to bring in about $2.274 billion.

LBO very cautiously assumed general fund tax revenues would grow at 1.1% for FY2025 and 1.5% each year for FY2026 and FY2027. That would bring total income tax revenues, before considering the impact of scheduled tax cuts, to just over $8.0 billion, of which about $2.4 billion would come from the individual income tax. Dropping the income tax from 5% to 4% would be expected to reduce those individual income tax receipts by 20%, about $475 billion, leaving total general fund revenues of about $7.5 billion. At current spending levels that projects to almost a $1 billion recurring annual revenue surplus by FY2027 after all the currently scheduled income tax cuts are fully implemented.

Some worry that the recent growth in tax revenues is just an inflationary phenomenon, resulting from the COVID-era stimulus flowing from Washington. But, from FY2019 to FY2023, Mississippi general fund revenue grew by about 3.5% per year faster than the rate of inflation – essentially the same as the ten-year pre-COVID growth rate. According to the Tax Foundation, Mississippi’s experience is generally in line with the rest of the nation. State and local inflation-adjusted tax revenues are up nationwide since before the pandemic. This growth over inflation shows that even as the federal stimulus winds down, Mississippi can still expect revenue over the next several years to grow in line with the historical trend.

Mississippi policymakers have wisely followed a two-prong strategy to create opportunity for our citizens. They have returned hundreds of millions of dollars in tax relief to Mississippians to help grow our economy and create jobs. And they have invested hundreds of millions of additional tax dollars into education and workforce development so Mississippians can fill those jobs and create more.

The revenue numbers recounted here show that, even after the currently scheduled tax cuts are fully implemented, Mississippi policymakers will still have around $1 billion in recurring surpluses to give Mississippians more tax relief while at the same time making the public investments needed to foster opportunity.