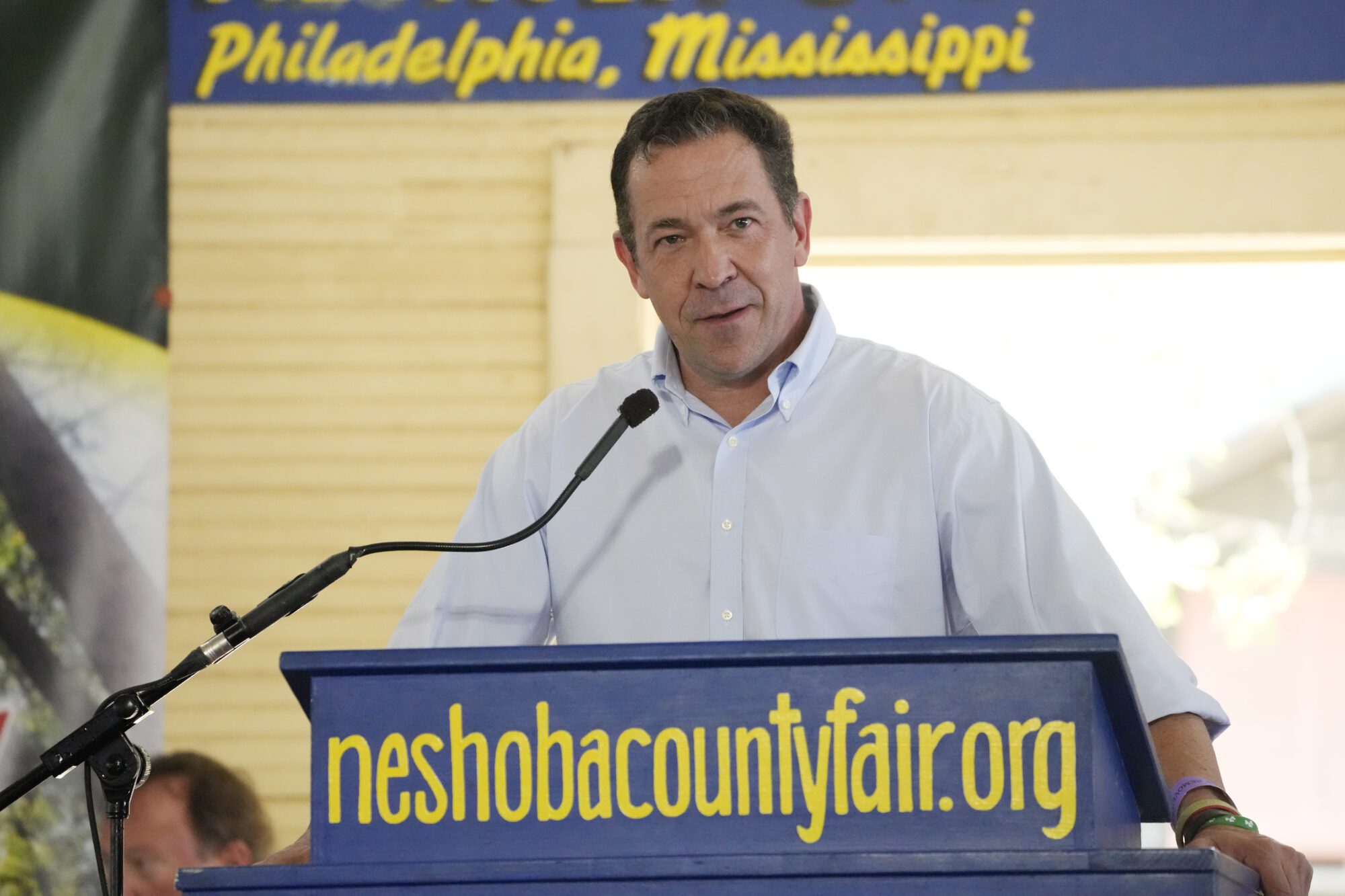

Steven O'Neill

Restaurant partner Steven O’Neill says Visa and Mastercard use their dominance to set and raise swipe fees on a schedule that’s implemented by major banks without question. He’s glad to see legislation in Congress to increase competition.

Despite slowing inflation, Americans are still struggling to afford the necessities and grapple with exceedingly high prices. Mississippians have experienced some of the lowest per capita gains in personal income both across the country and in the southern United States. What’s worse is these gains are nearly a wash once inflation is accounted for.

As a small business owner, I feel the impact of inflation on my family, my employees, and my customers. Thankfully, there is a solution pending in Congress, and our senators have a chance to reduce the financial burden on Mississippians and support Main Street businesses.

The bipartisan Credit Card Competition Act (CCCA), sponsored by Senators Roger Marshall (R-KS) and J. D. Vance (R-OH), seeks to financially benefit both customers and businesses by opening up competition in the payments sector. This competition would reduce the rate of credit card swipe fees.

While the average consumer is likely unaware of these fees, business owners like me are hard hit by the added charge. Averaging between 1.5-3.5 percent of every credit card transaction, small businesses and companies with slim profit margins like grocery stores and restaurants struggle to absorb these constantly rising fees.

As a result, business owners have to pull back investments in their company and, in many cases, pass fees onto consumers by raising prices. This makes swipe fees a driver of inflation, as higher costs lead to greater fees, and those fees force business owners to raise prices. All of this contributes to a nonstop cycle of higher costs for Mississippians.

To break this pattern, the CCCA would require a second routing option to be available to merchants, so they can choose alternative networks that might offer similar services for a fraction of the cost. This would shatter the Visa/Mastercard duopoly that has long dominated the industry. Combined, these two companies alone control over 80 percent of the market share.

Currently, Visa and Mastercard use their dominance to set and raise swipe fees on a schedule that’s implemented by major banks without question. They do so in exchange for a cut of the profit and general card services. This takes the power away from business owners who are then offered one network to route their transactions over, forcing them to accept high swipe fees or reject credit cards as a payment method.

By allowing just one additional routing option, the CCCA would break the stranglehold of these non-competitive fees. Merchants would finally have leverage to reduce excessive swipe fees, and competition in the American payments system would spur innovation and encourage investments that enhance security measures.

This adds to the critical nature of the CCCA, which would further protect the private financial data of consumers and help to bring down the cost of goods and services through free market competition. I hope Senators Cindy Hyde-Smith (R-MS) and Roger Wicker (R-MS) will vote to pass this legislation and stand up to Visa and Mastercard on behalf of Main Street businesses and American consumers.