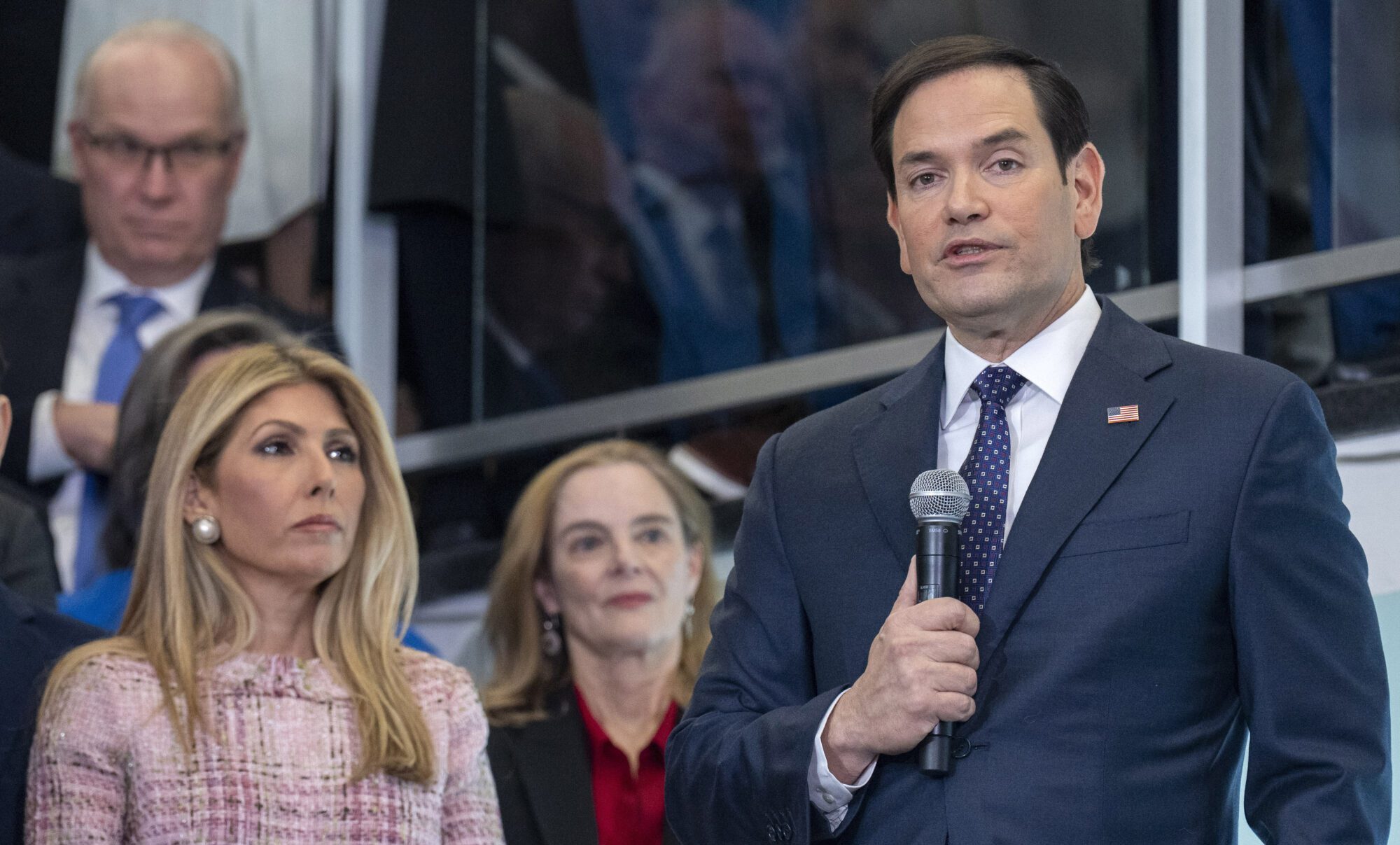

Mississippi House Ways and Means Committee Chairman Trey Lamar, R-Senatobia (AP Photo/Rogelio V. Solis, File - Copyright 2022 The Associated Press. All rights reserved.)

Rep. Lamar said the bill clarifies that going forward the city would spend the money on water and sewer needs.

On Thursday, the Mississippi House passed House Bill 1168 which would revise the use of revenue from the City of Jackson’s municipal option special sales tax. After heavy debate on the House floor, Representatives passed the bill by a vote of 76-41, with two amendments failing by a voice vote.

Under the legislation, the money from the city’s 1% local sales tax would be solely used to pay the cost of repairs, upgrades and improvements to the municipality’s water system and related infrastructure.

During the 2011 Regular Session of the Mississippi Legislature, a bill was passed to authorize the City of Jackson to impose a Special Sales Tax of 1% on any person engaging in business in the city for the purpose of funding water, sewer, road, and bridge repair. The tax applies to those activities taxed at the rate of 7% or more under the Mississippi Sales Tax Law. The Mayor and the City Council of Jackson adopted, by resolution, their intent to levy the tax as the result of the city wide election held Tuesday, January 14, 2014. This tax became effective March 1, 2014.

The Jackson, Mississippi sales tax is 8%, consisting of 7% Mississippi state sales tax and 1% Jackson local sales taxes.

State Representative Trey Lamar (R), House Ways and Means Committee Chairman, said that from 2014-2022, the tax has generated about $120 million.

Representative Lamar, who represents Lafayette and Tate counties, is the author of the legislation. He said the bill simply clarifies that going forward the city would “strictly” spend that money on water and sewer needs.

He explained that no money would be taken away from the City of Jackson, saying, “We’re just simply prioritizing where it’s going to be spent and I hear Jackson’s got a water problem.”

The bill summary is as follows:

“An act to amend Section 27-65-241, Mississippi Code of 1972, which authorizes the levy of a municipal special sales tax in certain municipalities, to provide that for a municipality that is levying a tax under this section on July 1, 2023, all revenue collected by the municipality after July 1, 2023, shall be used solely to pay the cost of repairs, upgrades and improvements to the municipality’s water system and related infrastructure; to provide that if a municipality levying a tax under this section fails to comply with certain audit or reporting requirements and does not remedy the noncompliance within thirty days after receiving written notice of noncompliance, the department of revenue shall withhold payments otherwise payable to the municipality under this section until the department receives written notice that the municipality has complied with such requirements; and for related purposes.”

While many lawmakers, including those who represent the capital city and metro area, expressed concerns about other matters that need attention as well, including roads and infrastructure, Lamar maintained that the city’s water crisis should be a priority.

“I feel like ability to have fresh, clean drinking water, and not have sewage running on top of the roads, at this point in time, is a higher priority than paving potholes,” Rep. Lamar said.

State Representative Zakiya Summers (D), who represents Hinds County, offered the first amendment to HB 1168. The amendment would change the language to say, “Once the federal money is received by the city of Jackson, then revenue will be redirected back and used.” The amendment failed by a vote of 45-70.

A second amendment was introduced by State Representative Robert Johnson (D), the House Minority Leader. His amendment sought to amend line 119 to 125 of the bill by striking certain language. That amendment also failed by a vote of 40-74.

Though the bill has passed the House, it now heads to the Senate for consideration where it will receive more debate.

You can watch the debate on the House floor below: