Lawmakers will be deciding how best to appropriate the revenues when setting the FY 2023 state budget.

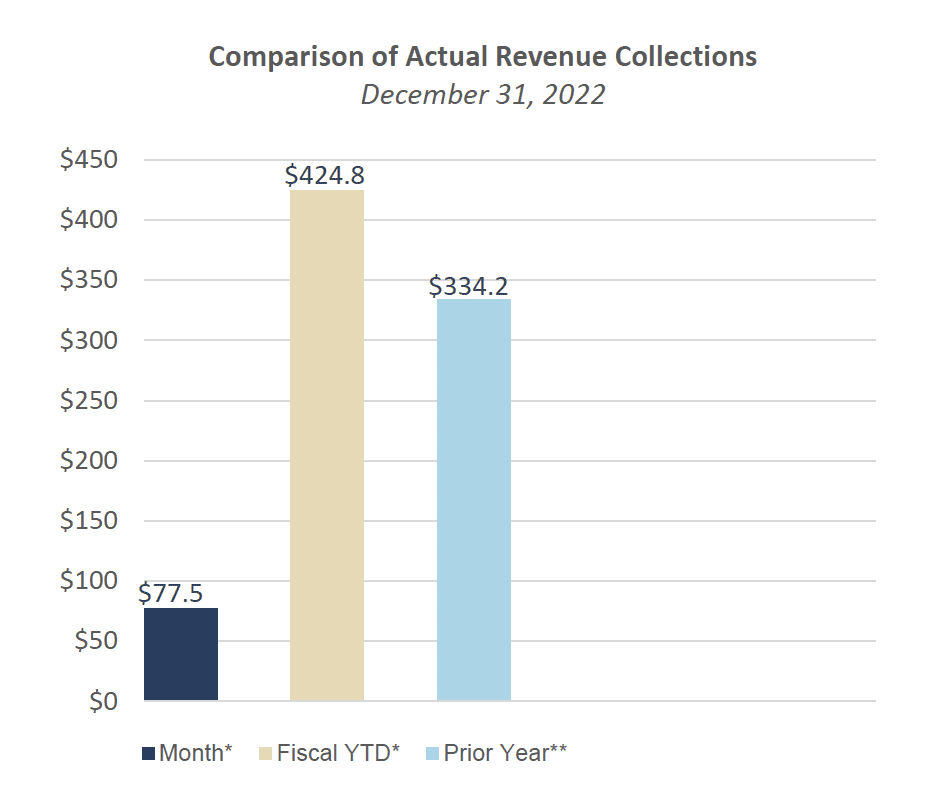

The Joint Legislative Budget Committee released the state revenue report for December 2022 showing tax collections continue to outpace budget estimates in Mississippi.

Total revenue collections for FY 2023 through the month of December 2022 are currently at $334,180,589, which is 9.92% over previous year collections and $424,812,437, or 12.96% over sine die estimates.

For the month of December, totals equaled $77,458,493, or 13.15% above the sine die revenue estimate the legislature used to set the budget. The total revenue estimate for FY 2023 is $6,987,400,000.

Lawmakers, now back in session, are set to determine how best to appropriate these dollars as well as set a new fiscal year budget by the end of March.

Sales tax collections were up for the month of December by $4.8 million. Individual income taxes were below the prior year by $6.8 million. Corporate income taxes were up by $57.6 million.

According to the 10-year Historical collections, Mississippi continues to grow in revenue collected, consistently since 2020.

General Fund collections were at $56,231,819 or 9.22% above December FY 2022 actual collections.

Lawmakers are back in session and will be considering how best to appropriate these excess dollars while setting a new fiscal year budget by the end of March.