Submitted by Tom Gresham

“For business owners, swipe fees have become the most expensive operating cost after labor,” Gresham writes.

Small businesses owners in places such as Indianola, Pontotoc, and Brookhaven are struggling with skyrocketing prices and a shortage of labor. These local stores are the heart of our communities, but the big credit card companies make it increasingly difficult for them to make a profit.

Thankfully, Congress can provide real relief to these businesses by passing the Credit Card Competition (CCC) Act. This bipartisan measure would lower prices for merchants and consumers by bringing competition in the credit card marketplace.

Rural communities are in dire need of relief. The small businesses that stand as the cornerstone of these communities are doing everything they can to juggle supply chain issues and labor shortages while trying to limit the impact of rising prices on consumers.

Sen. Hyde-Smith has made a concerted effort to make sure rural communities have the best banking options to help entrepreneurs establish businesses. However, once these businesses are open, they face unexpected swipe fees that eat up a large portion of their discretionary budgets and ultimately lead to higher prices for their customers.

For business owners, swipe fees have become the most expensive operating cost after labor and force local merchants to raise prices in order to cover higher overhead costs. It’s worth noting that Visa and Mastercard, along with big banks, are paid a percentage of the total transaction, so higher consumer prices yield larger swipe fees for Wall Street.

While big banks have tried to scare consumers into thinking the CCC Act will hurt small community banks, that could not be further from the truth. A small number of big banks dominate credit card issuing, with the top 10 card-issuing banks controlling about 80% of the market. By leveraging their market control, these banks are able to lower average costs to issue cards and handle transactions, making the process for them much cheaper than it is for community banks.

We need to learn from the experience of debit card fees. Injecting competition to the debit card market has helped community banks gain market share by exempting banks with less than $10 billion in assets from regulation of debit fees. In doing so, these efforts have leveled the playing field for smaller banks. If passed, the Credit Card Competition Act will do the same for all but the largest of the large banks in the nation.

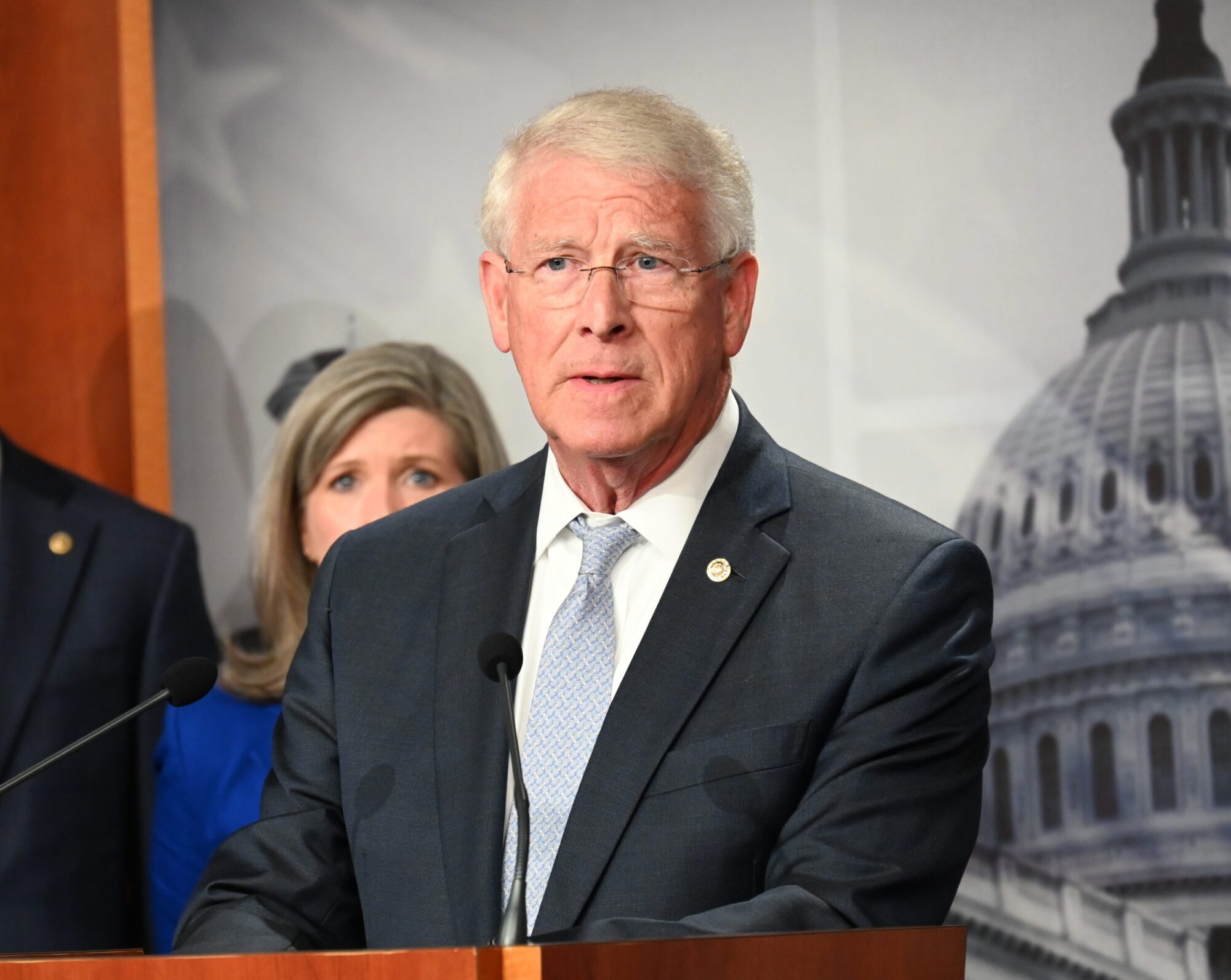

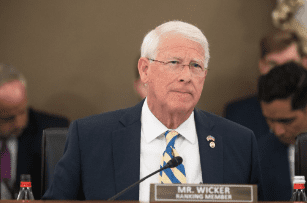

The small businesses and banks throughout rural America need competition in the payments marketplace. Visa, Mastercard and the big banks have too many advantages. Mississippi has two great U.S. Senators in Senator Cindy Hyde-Smith and Senator Roger Wicker who listen to the voters, so we need to urge them to join the bipartisan effort and support the CCC Act to force the Wall Street banks to compete for our dollars.

###

Submitted by Tom Gresham. He is Secretary-Treasurer of Gresham Petroleum Co. and former President & CEO of Double Quick, Inc. He lives with his wife, Louise, in Indianola, MS.