Will Mississippi conservatives finally get the job done?

Democrats, the media establishment and even some moderate Republicans are pulling out all the stops regarding the state income tax elimination proposal to stop it any way they can.

Flush with hundreds of millions of dollars of cash, minimal debt and a rebounding economic picture, conservatives see this as a once in a lifetime opportunity to make this initiative that the GOP regularly campaigns on a reality. While candidates try to win primaries in Mississippi on being “tax cutting conservatives”, this vote is where the rubber meets the road before facing voters again in 2023. And legislative Democrats and some moderate Republicans seem happy enough to kick the can down the road on making a sweeping policy change forgetting or obfuscating that you make changes when you have the votes and the money to do it. Deferring the big thing is often the same thing as denying it. (Exhibit A to that maxim was not reforming the MAEP formula in 2018).

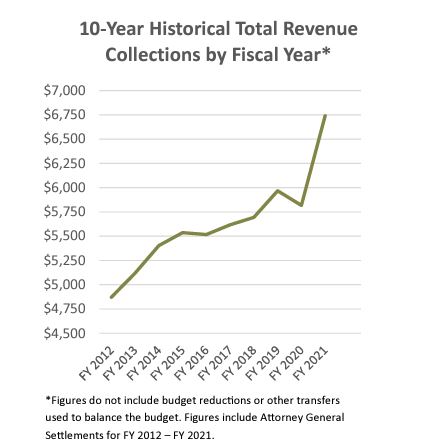

The central figures in the fight over what the future looks like is state economist Dr. Corey Miller and Legislative Budget office revenue analysts. Mississippi policymakers need to face a hard and incontrovertible truth. Lately our state has sucked at revenue projections. I mean, we have been truly incompetent. In FY2019, they missed by $300 million. FY2020 was actually the closest year to projections with Mississippi falling $43 million short of projections, but that was only due to a pandemic that literally shut our economy down for months on end. But for that, it would FY20 would have looked like the giant subsequent revenue misses in FY2021 (+$1.05 billion) and FY2022, which is well on its way to another billion dollar plus miss. The media will get to hear from Miller directly when he speaks at the Stennis press lunch on February 28th. Whether they remain as uncritical as they have remains to be seen.

So here’s the math. Mississippi’s tax revenues right now are about $7 billion. That’s the baseline. Historically, our tax receipts in the last 10 years have grown at about 2.5-3% annually. And pretty consistently. An income tax elimination will all but certainly spur the economy by putting more money in everyone’s pocket. The rate of growth assumptions and the revenue starting point are super important to the analysis. Starting at $7 billion, the difference in state collections between a 2.5% and a 3.5% growth assumption in the 5th year is over $300 million (and that’s without factoring in inflation). State budget forecasters are using a 2.6% rate of growth and starting at a $6.5 billion number to arrive at the errant conclusion that “we can’t afford it.” Coupling the higher growth that more cash in the economy tends to spur with the fact that Mississippi will see a huge amount of infrastructure spending which is supposed to spur even additional growth, the predicate conditions are there for a complete elimination of the tax cut without negative budget impact.

Given how fundamentally awful our revenue projecting has been in the last three years and the dynamics of a current 7+% inflation rate in our economy, it seems to not pass the straight face test not to really scrutinize the sources of these 5-10 year projections when we can’t seem to even get close on the one year projections. Of course, Mississippi media establishment has uncritically taken revenue estimates as gospel because (spoiler alert) it supports the narrative they’re being tasked with selling.

And we’ve seen this before. In the last major tax cut in 2016, there were all sorts of ill-informed doom and gloom articles about the fiscal mess that tax cut would leave. Media hacks were practically hyperventilating. When the corporate income and corporate franchise phase-outs begin starting Jan. 1, Mississippi stands to lose $46.5 million in fiscal year 2019. By fiscal year 2022, the tax cuts are projected to reduce state revenue by $70.8 million each fiscal year. By fiscal year 2028, the scheduled completion of the phase-out, the state will be losing $415 million per year in revenue from the tax cuts.

What was left of the Clarion Ledger op-ed page at the time gave an “oh boy” to the new law and called it “beating a broke horse.”

Here’s what then state economist Darrin Webb said about the tax cut that eliminated the 3% bracket and phased out the franchise tax. “I don’t think (the tax cut) will generate enough activity to fill the hole it will leave in revenue,” Webb said. “Other states didn’t have it and it may help (bring some business to Mississippi), but it’ll take an awful lot of companies coming here from other states to get close. It’s not going to create a boon for the economy.”

Here’s what actually happened.

We, of course, now subsequently spent way more on education, teacher pay, roads and bridges on an annual basis than we did back then. The Republican led legislature subsequently passed a lottery bill and the national economy from 2016-2020 kicked into overdrive. But back in 2016 when Democrats and the media were losing their minds about the tax cut, everyone just took their words as gospel. And like we’ve found out in the last couple of years about so many of our “experts” in society – they just turned out to be flat wrong.

Folks, the media elites and economists who both secretly pine for more taxes and government spending for special interest groups have a TERRIBLE track record. It’s time for voters, the media (yeah right) and more importantly legislators, to start looking back at the history of who said what when. What jumps to the forefront is that they will say or do ANYTHING to scare legislators away from doing something (dare I say) progressive like implementing meaningful tax reform for the masses, and that there seems to be little if any penalty for them being as wrong as they have been historically. And lest anyone forget, Mississippi has a fully funded $500 million+ “Rainy Day Fund” in addition to current cash reserves that can be used if needed to offset any shortfalls (if there even are any).

My grandfather used to say that if you want to be rich, do the things that rich people do. Same goes for the state. If Mississippi wants to be a prosperous state, it should generally try and emulate what prosperous states do. Tennessee, Texas and Florida are all glaring examples in our backyard of states that have prospered by eliminating income tax. That’s not the only reason, but clearly it hasn’t hurt them. People respond to incentives and having the incentive to make and keep more of your money is probably as admirable a public policy goal as there can possibly be. Wealth that grows and gets invested in communities will flow to states with good tax policy. Mississippi should be on that list.

With coffers full, this is a once in a generation opportunity to do something big . . . exactly the thing that a Republican supermajority was put in place over a couple of decades to do. Now is not the time for conservative legislators (or those that at the very least campaign as such) to get weak kneed.