The Mississippi House is willing to move toward full elimination, the Senate shows caution with a bracket elimination.

Both chambers of the Mississippi Legislature have proposed plans to cut the state’s individual income tax.

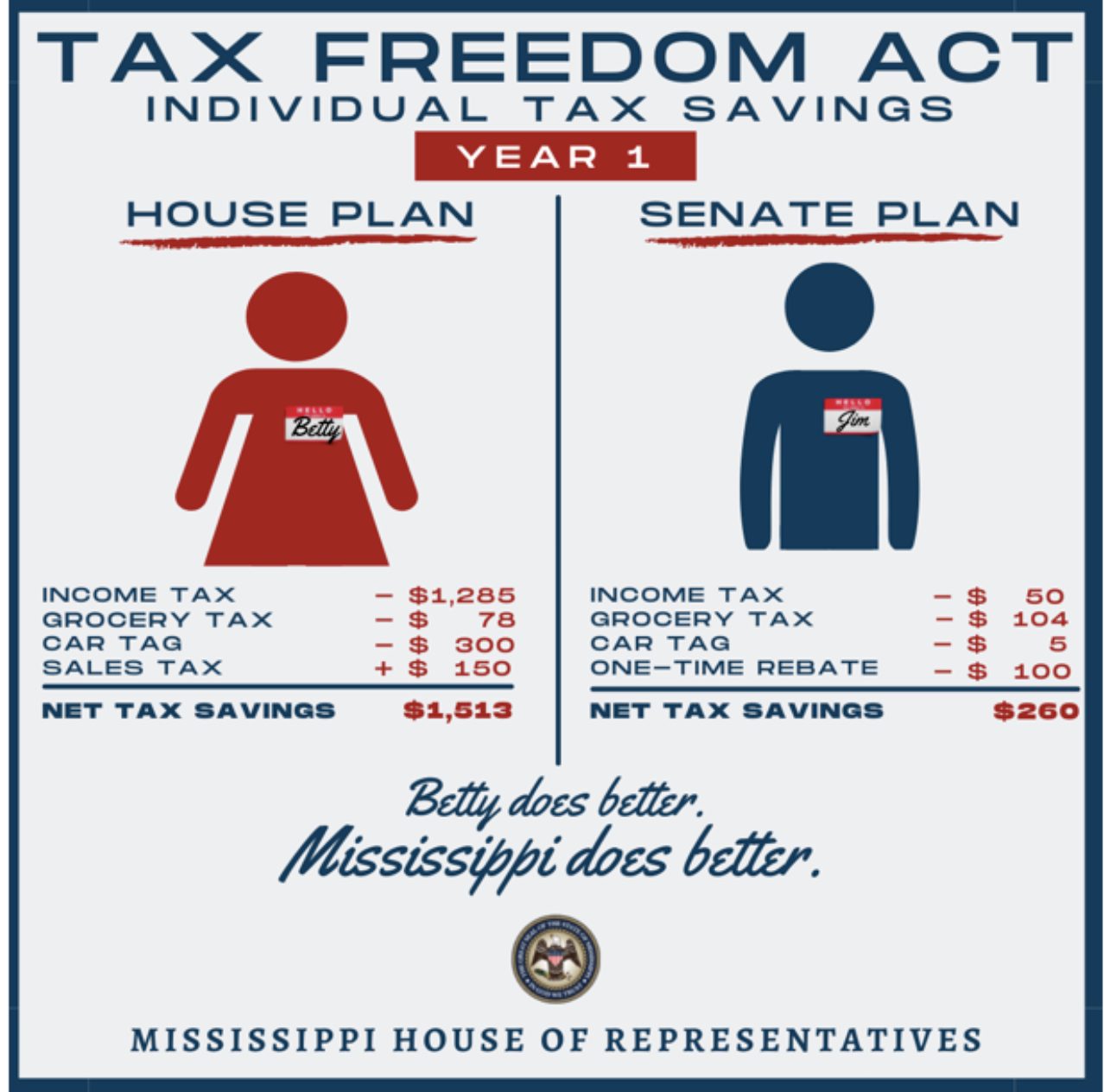

On Tuesday, Speaker of the House Philip Gunn (R) released graphics that depicted the House’s comparison of the two chambers’ proposals featuring “Betty and Jim.” In the graphics, “Betty” represents a taxpayer under the House plan and “Jim” represents a taxpayer under the Senate plan.

“The graphics highlight the radical differences between the two plans,” Gunn said. “The House plan offers significant tax relief for Mississippians. The Senate plan does not. We believe the numbers speak for themselves as to which plan would benefit the people of our state. And they speak loudly.”

As indicated in the graphics, the Speaker believes the House plan is more substantial and therefore, “Betty does better. Mississippi does better.”

Mississippians do better under the @MSHouseOfRep Tax Freedom Act. Ask your Senator to work with the House to eliminate the income tax, cut the grocery tax and provide real relief on car tags. pic.twitter.com/OI2IMh82Zz

— Philip Gunn (@PhilipGunnMS) February 8, 2022

The plans have stark differences.

House Plan:

The House recommends cutting the entirety of the income tax as well as decreasing the sales tax on groceries from 7 percent to 4 percent. This plan does include raising the overall sales tax to 8.5 percent from its current 7 percent, largely in order to offset the lost revenue. It also proposes cutting the cost of car tags. This plan can only come to fruition in the event triggers are met within the state budget to protect the integrity of the state’s finances.

RELATED: Mississippi House set to pass its version of Income Tax Elimination

Senate Plan:

The Senate recommends cutting the 4 percent income tax bracket over four years, thus it is not a complete income tax elimination. It cuts the sales tax on groceries from 7 percent to 5 percent, but the plan does not have an increase in general sales tax. It also cuts the state’s $5 car tag fee. The plan does not operate on any necessary triggers.

“The tax plan the Senate has put forward is a true tax cut—no growth triggers which may delay cuts for years and no tax increases,” said Lt. Governor Delbert Hosemann. “Taxpayers expect conservatives to be responsible, not use one-time funds on recurring expenses. The most important thing we can do when it comes to tax reform is get it right.”

RELATED: Mississippi Senate to drop tax reduction plan to eliminate 4% income tax bracket

The Senate’s bill has not yet been filed but is expected in the coming weeks.