Homeowners’ group: High South Mississippi insurance premiums unjustified

Property insurance policies are costlier in coastal counties because hurricanes create higher losses, insurance companies and state regulators maintain, but a grassroots homeowners’ group in Alabama says the actual cost is greatly exaggerated.

The group won passage of a law in Alabama — the Clarity Act — that requires insurance companies to report losses by ZIP code. Those numbers, reported since November, show losses in coastal Mobile and Baldwin counties averaged $622 per policy over 10 years, compared with $722 per policy for the rest of the state, the Homeowners Hurricane Insurance Initiative estimates. The losses include hurricanes Ivan, a direct hit in the two counties in 2004, and Katrina in 2005.

HHII helped get a similar law passed this year in Louisiana, but it failed in the Mississippi Legislature. HHII will be back in January to push for the law in Mississippi.

The group also hopes to use numbers already generated to push for lower coastal insurance rates in Alabama.

The Alabama Department of Insurance and insurance industry dispute the reliability of the statistics.

Anti-consumer stance?

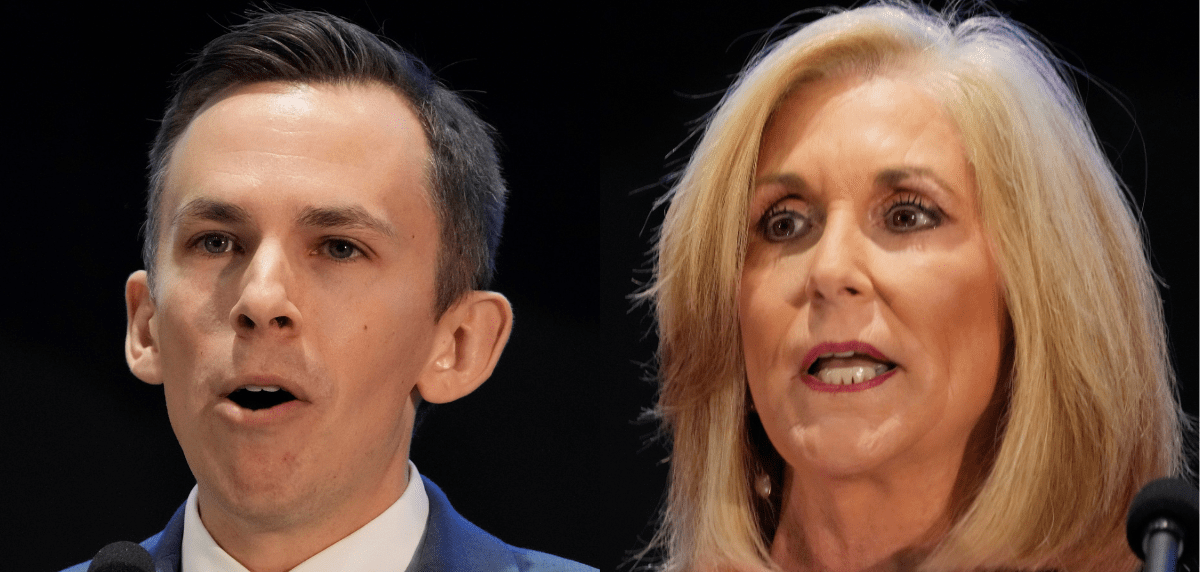

“They basically adopted that strategy when the data came out and have really strained to attack the credibility of that data,” said Dan Hanson, an HHII organizer. “The Department of Insurance has done everything they can to discredit this. Not one single pro-consumer thought.”…

….The pricing, HHII contends, fails to follow state laws that prohibit inadequate and excessive premiums and discrimination. HHII is looking to Gov. Robert J. Bentley for action because the state insurance commissioner is appointed.

“The law’s there,” Hanson said. “It’s just a matter of getting the governor to say, ‘Enforce the law.'”

Trying for both sides

Mississippi Insurance Commissioner Mike Chaney said he plans to talk with some legislators on the Coast next week about the Clarity Act. He believes Mississippi should have a law to collect loss data for comparison of coastal and upstate losses. But he thinks loss calculations should include insurer expenses. The biggest expense, according to the Alabama DOI, is the cost of reinsurance, polices insurers buy to help cover catastrophic losses. Chaney also believes the data should be collected by zone rather than ZIP code because ZIP codes can run from the waterfront too far inland, while zones are based on exposure to catastrophe.

“It can be modified,” Chaney said. “It should be modified to be meaningful and helpful not only to the regulators but to the consumers.”

Sunherald

6/15/14