Washington Post – Bennie Thompson faces ethics scrutiny after credit card hearing

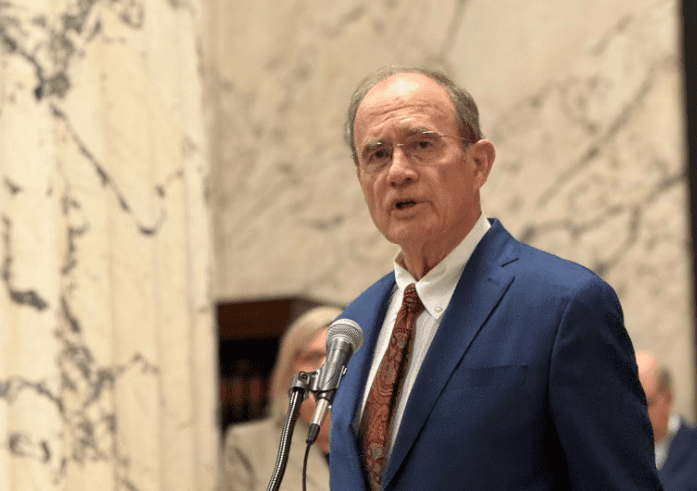

At a hearing in late March, the nation’s credit card companies faced the threat of expensive new rules from an unlikely regulator: the House Committee on Homeland Security, chaired by Rep. Bennie Thompson (D-Miss.).

The committee had never before dealt with credit card issues, but Thompson warned Visa, MasterCard and others that Congress might need to impose tighter security standards costing millions of dollars to protect customers from identity theft.

Behind the scenes, some of Thompson’s staffers sensed a different motive — an attempt to pressure the companies into making political donations to the chairman, according to several former committee staffers.

Now the House ethics committee is investigating the propriety of the committee’s operations, and whether its members’ interactions with companies compromised its work. Within a few weeks of the hearing, Thompson collected $15,000 in donations from the credit card industry and its Washington-based lobbyists, a Washington Post analysis shows. No legislation on card security has been introduced.

Several former committee staffers, speaking on the condition of anonymity, have told The Post that the credit card hearing was one of several committee actions that caused staff concerns because of their consideration of potential donors and contractors friendly to Thompson. The current ethics inquiry was prompted this summer, according to an ethics document obtained by The Post, when a former committee aide alleged she was fired after complaining to her bosses that a lobbyist made improper requests of staff members.

Thompson — who made headlines separately this week by calling a committee hearing to investigate Tareq and Michaele Salahi’s ability to get past Secret Service and into a White House state dinner without invitation — said he did not arrange a hearing to generate campaign donations.

“That’s incorrect,” he said of the suspicion. “We do hearings all the time — sometimes we are able to generate legislation earlier, and sometimes we have to [build] a public record.”

Committee staff director Lanier Avant, who also serves as the congressman’s chief of staff, said the credit card hearing was prompted by a data breach at a payment company, Heartland Payment Systems, that compromised the credit information of millions of customers.

Several congressional ethics experts said it could be an ethics violation if a lawmaker or senior staff member arranged a hearing for the express purpose of collecting campaign contributions. Proving such a case would be difficult, they said.

Sarah Dufendach, a vice president at Common Cause, said the House ethics committee should take the staffer’s allegation against her former boss seriously, especially because Thompson’s office has had a number of staff departures. She questioned whether credit card security was a top committee priority, given terrorism threats and the need to plan for pandemic flu.

“You have to wonder: Did this take precedence over everything else that was on your committee’s plate?” she said. “Homeland Security is not a committee that should be wanting for things to have hearings on.”

Joshua Levy, an attorney for the fired staffer, Veronique Pluviose-Fenton, declined to comment.

Numerous credit card lobbyists, asked about their donations, would not comment for the record.

Thompson’s committee has been roiled by turnover this year, with at least 10 staff members resigning or being fired, according to congressional payroll records. Former and current staffers said many departures came after employees objected to committee operations. Many blame the staff turmoil on Avant, a 30-year-old Thompson confidant. Avant played a role in planning the March 31 credit card hearing, hosted by the subcommittee on cyber-threats.

Avant said politics have not guided his committee decisions. “I’ve never asked anything that they would be uncomfortable with,” he said. “I ask people to come to work and work hard, to help our members do the best they can to oversee the department.”

Thompson and his subcommittee chairman suggested the industry should use better data encryption and new technologies to prevent identity theft, such as microchips in credit cards.

“I’m concerned that as long as the payment-card industry is writing the standards, we’ll never see a more secure system,” Thompson warned then, calling credit card security an “ongoing threat.”

Legislation never surfaced. Avant said that the hearing helped inform lawmakers and the public about the issue, and that the committee might consider legislation at a later date.

In April and May, donations of $250 to $1,500 came in from lobbyists registered to represent Visa, American Express, MasterCard, Heartland and the National Installment Lenders, among others, as well as from the American Bankers Association political action committee.

Washington Post

12/4/9