ALA. PRESS REGISTER – Obama wisely rejects wind insurance plan

ALTHOUGH PRESIDENT Obama has been spending borrowed money at an unprecedented rate, his administration revealed a welcome streak of fiscal conservatism when confronted with the ominous possibility that Congress will add wind insurance to the federal flood insurance program.

Recently, Homeland Security Secretary Janet Napolitano wrote a letter to Rep. Barney Frank, who chairs the House Financial Services Committee, arguing that adding wind coverage to the flood insurance program would increase the program’s “exposure to catastrophic risks.” As Secretary Napolitano noted, the flood program is $19.2 billion in debt and unable to stabilize its financial situation with money from policyholders’ premiums.

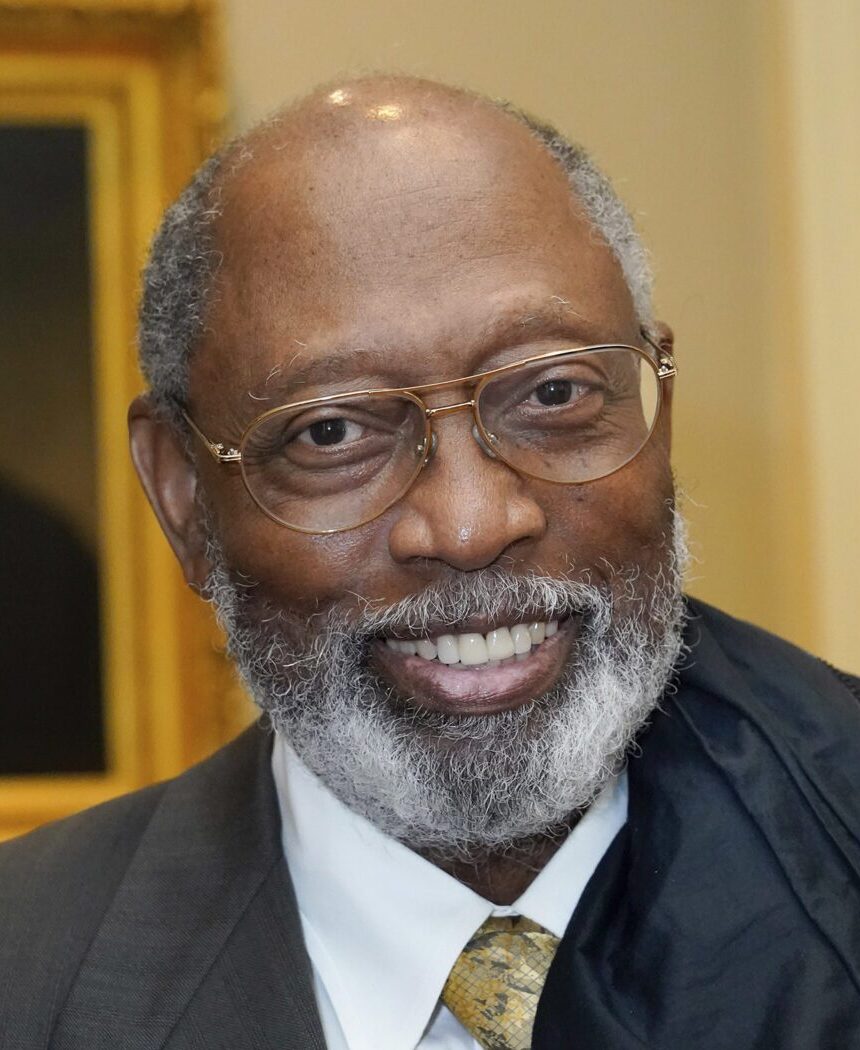

Despite the flood program’s financial plight, Mississippi Congressman Gene Taylor, D-Bay St. Louis, wants the federal government to add “multi-perils” coverage for homeowners in high-risk areas. Rep. Taylor and Sen. Roger Wicker, R-Miss., have sponsored bills to include wind insurance in the flood insurance program. The House passed the Taylor bill last year, but the Senate overwhelmingly rejected the expansion, which could put the taxpayers on the hook for even larger losses than the program has suffered issuing flood policies.

Press-Register

5/19/9

Most of flood insurance revenue is not going to pay claims

WASHINGTON — Across the country, federal flood insurance policyholders ponied up more than $3 billion in premiums to protect their homes and businesses in the last fiscal year. Less than half of that money was set aside to pay claims for actual flood losses, according to government figures.

Instead, the Federal Emergency Management Agency spent almost $1.5 billion to cover overhead in two areas: interest on the program’s debt to the federal treasury, and compensation to the insurance companies that largely run the program day to day. Other costs included taxes and grants.

About $1.4 billion went for claims, reserves and adjustment expenses, according to figures supplied by FEMA at the Press-Register’s request.

Three and a half years after Hurricane Katrina swamped the program with claims, the numbers offer a snapshot of its continuing struggle to recover.

Created in 1968 because private insurers were reluctant to cover water damage, the initiative, formally known as the National Flood Insurance Program (NFIP) was generally self-supporting for much of its history. Now, it is considered effectively bankrupt.

As Hurricane Ike and other recent storms have spawned more losses, the program’s borrowing from the treasury has crossed the $19 billion mark. Last month, President Barack Obama’s administration urged Congress to forgive that debt or face the possibility that interest payments will eventually consume every dime in premium revenue.

So far, lawmakers have deadlocked on the specifics of a remedy. The flood program formally expired last fall, and Congress has since approved only a stopgap measure to keep it going through this September.

In Alabama and Mississippi, the NFIP has more than 130,000 policies, the bulk of them in coastal counties. As elsewhere in the country, most are handled by private insurers under what is known as the “Write Your Own” arrangement, begun in 1983.

Those insurers sell policies and adjust claims on FEMA’s behalf.