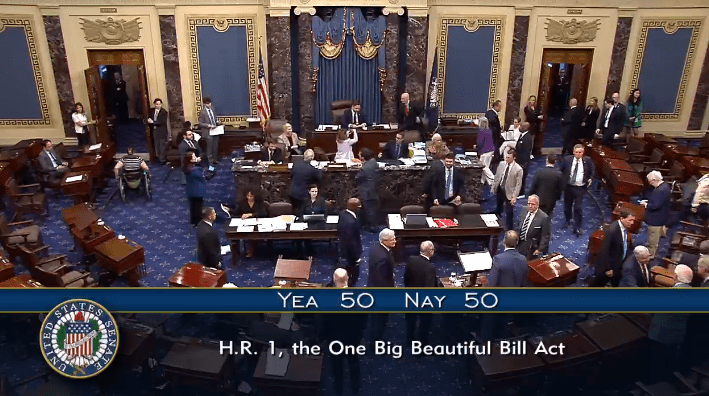

Congressman Travis Childers (D-MS) today voted to create and save thousands of jobs for hard working Mississippians and help get the economy back on track. The American Economic Recovery and Reinvestment Act (H.R. 1) will provide billions of dollars in funding for Mississippi to put people back to work and restore the economy through investments in education, infrastructure, health care, and one of the largest tax cuts in American history. The legislation passed in the House by a vote of 246 to 183.

“Right now, North Mississippians are fighting to stay employed in the face of constant plant closures, layoffs, and reductions in hours,” said Congressman Childers. “The American Reinvestment and Recovery Act will help get us moving in a new direction. The recovery package will create and save 3.5 million jobs nationwide, invest quickly in our troubled economy, give nearly every American worker an immediate tax cut, and invest in important infrastructure projects to jumpstart the economy.”

“We cannot lose sight of the fact that this plan is about creating jobs. While it is not a perfect piece of legislation, it is necessary for uplifting hard working families and getting our faltering economy back on track by putting Americans back to work. Since December 2007, when this recession first began, our country has lost a staggering 3.6 million jobs. Mississippi and the First Congressional District are struggling especially hard under these conditions. There are currently 22 counties throughout our state that have double digit unemployment rates, and the First District is just a few tenths of a percentage point away from holding the highest jobless rate in all of Mississippi. The recovery package is estimated to directly impact 30,000 jobs statewide, including nearly 9,000 jobs in the First District.

“This recovery act does not negate fiscal discipline. While we need to do what is necessary to protect our country and our economy right now, I remain committed to the long-term goals of restoring government fiscal responsibility and accountability.”

Job Creation and Unemployment Relief

The American Economic Recovery and Reinvestment Act will create and save 3.5 million jobs. In December, there were an estimated 104,400 unemployed workers in Mississippi. The act will impact an estimated 30,000 jobs throughout Mississippi, and nearly 9,000 jobs in the First Congressional District.

The recovery package would extend unemployment insurance benefits through the end of 2009 and increase benefits by $25 per week. The extension would provide critical assistance to an additional 3.5 million jobless workers, while the benefit increase will help nearly 20 million jobless workers.

The package temporarily suspends the taxation of some unemployment benefits.

The package provides funding to help workers find jobs, including $4 billion for job training, $500 million for Vocational Rehabilitation State Grants to help persons with disabilities prepare for gainful employment, and $500 million to match unemployed individuals to job openings through state employment agencies.

The recovery plan provides a payment of $250 to Social Security beneficiaries, SSI recipients, and veterans receiving disability compensation and pension benefits from the VA.

Currently, laid-off workers, under the COBRA program, can buy into their former employer’s health insurance, but the premiums are often prohibitively expensive. In order to help people maintain their health coverage, the recovery package provides a 60 percent subsidy for COBRA premiums for up to nine months.

Education

The legislation will provide the following education fund totals for the State of Mississippi for the next two years:

o State Fiscal Stabilization Fund to prevent teacher layoffs and other cutbacks in education and other key services – $484.1 million

o Title 1 (No Child Left Behind) – $132.7 million

o Title 1 School Improvement – $39.6 million

o Individuals with Disabilities Education Act (IDEA) – $118.2 million

o IDEA Part C funding to provide early intervention for infants and toddlers with disabilities – $3.6 million

o Educational Technology State Grants used to integrate technology into curricula in order to improve teaching and learning – $8.3 million

The plan increases the Pell Grant scholarship by $500 for the next school year. An estimated 96,824 Mississippi students will benefit from this increase.

The plan includes a new, partially refundable $2,500 college tax credit for families, which will benefit an estimated 63,000 students in Mississippi.

Infrastructure

The plan provides $27.5 billion to modernize roads and bridges, and requires states to obligate at least half of this funding within 120 days. States have over 6,100 projects totaling over $64 billion that could be under contract within 180 days. The Mississippi Department of Transportation (MDOT) will receive $415.3 million in infrastructure investments from the recovery act. Of this amount, $354.6 million will go towards roads and bridges.

Prioritizing clean water, flood control, and environmental restoration will create hundreds of thousands of jobs. The package provides $19 billion for these investments. There are currently $16 billion in water projects that could be quickly obligated.

The plan provides $8.4 billion for investments in transit. States have 787 ready-to-go transit projects totaling about $16 billion.

Health Care

The package protects health care coverage for millions of Americans by providing an estimated $87 billion over the next two years in additional federal matching funds to help states like Mississippi maintain their Medicaid programs in the face of massive state budget shortfalls.

The package provides $19 billion to accelerate adoption of Health Information Technology (HIT) systems by doctors and hospitals, in order to modernize the health care system, save billions of dollars, reduce medical errors, and improve quality. Promoting the adoption of HIT will create hundreds of thousands of jobs. The legislation also contains strong language to protect patients’ privacy and ensure that doctors are in charge of patients’ medical care without government interference.

Tax Relief

More than 35 percent of the package will provide direct tax relief to 95 percent of American workers.

The “Making Work Pay” Tax Credit will provide an immediate, direct refund to families through a reduction in the amount of income tax that is withheld from their paychecks, or through claiming the credit on tax returns. The tax credit will benefit an estimated one million Mississippi taxpayers.

The package will provide critical tax relief to hardworking families by expanding the Earned Income Tax Credit (EITC) for working families with three or more children and increasing the EITC marriage penalty relief, allowing these families to take home a little more from their paycheck each month.

The package will temporarily increase the eligibility for the refundable child tax credit, allowing the families of millions of children to get tax relief.

The package will help first-time homebuyers and strengthen the housing market by enhancing the current credit for first-time home purchases with the removal of the repayment requirement.

The package provides incentives to buy new cars with a tax deduction for state and local sales taxes paid on the purchase.

The recovery act will provide important tax relief for state and local governments, as well as businesses, to spur investment and job creation.

The plan includes a variety of provisions to help small businesses, including a cut in the capital gains tax for investors in small businesses who hold stock for more than five years. Congressman Childers wrote a letter urging House leadership to include this provision that originally appeared in the Senate version of the recovery package. This provision enacts a capital gains tax cut similar to that outlined in the Congressman’s Invest in Small Business Act.

The plan includes provisions to enhance the marketability for state and local government bonds, which will reduce the costs they incur in financing state and local infrastructure projects. It also includes a new bond-financing program for school construction, rehabilitation, and repair.

Accountability

The package contains no earmarks or pet projects.

How funds are spent, all announcements of contract and grant competitions and awards, and formula grant allocations must be posted on a special website created by the President. It must also include the names of agency personnel to contact with concerns about infrastructure projects.

Public notice of funding must include a description of the investment funded, the purpose, the total cost, and why recovery dollars should be used. Governors, mayors, or others making funding decisions must personally certify that the investment has been fully vetted and is an appropriate use of taxpayer dollars. This information will also be placed on the internet.

The Council of Economic Advisors must report quarterly on the results for the American economy.

A Recovery Act Accountability and Transparency Board will be created to review management of recovery dollars and provide early warning of problems. The board is made up largely of Inspectors General.

US Rep. Travis Childers (D-MS) Press Release

2/13/9