Lt. Gov. Phil Bryant says he supports a proposal to increase the homestead exemption for persons over 65 or the totally disabled from the current $75,000 level to $100,000.

Bryant’s proposal would also adjust the homestead exemption that applies to all other homeowners.

Under homestead exemptions, the state encourages people to own homes by exempting the houses from some property taxes. The state reimburses the counties and cities for lost tax revenues.

Under state law, for homeowners 65 years of age or totally disabled, there is an exemption on the first $75,000 true value.

About the Author(s)

Magnolia Tribune

This article was produced by Magnolia Tribune staff.

More Like This

More From This Author

Previous Story

News

|

Lisa Mascaro, Associated Press

, Mary Clare Jalonick, Associated Press

, Matt Brown, Associated Press

•

July 1, 2025

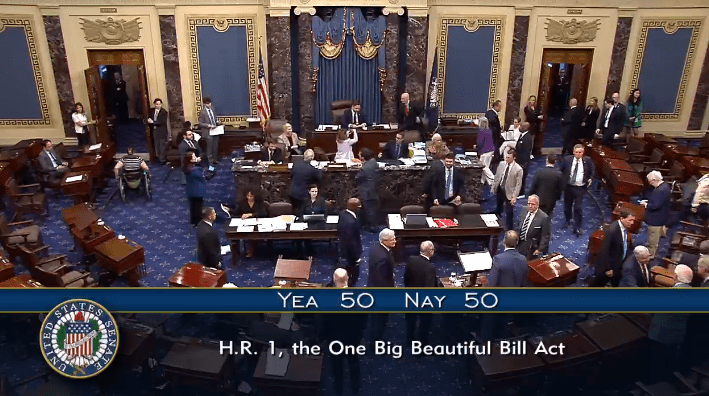

Senate passes Trump’s big tax breaks and spending cuts bill as Vance breaks 50-50 tie

The bill next goes back to the House, where Speaker Mike Johnson of Louisiana warned off big revisions from his chamber’s version.