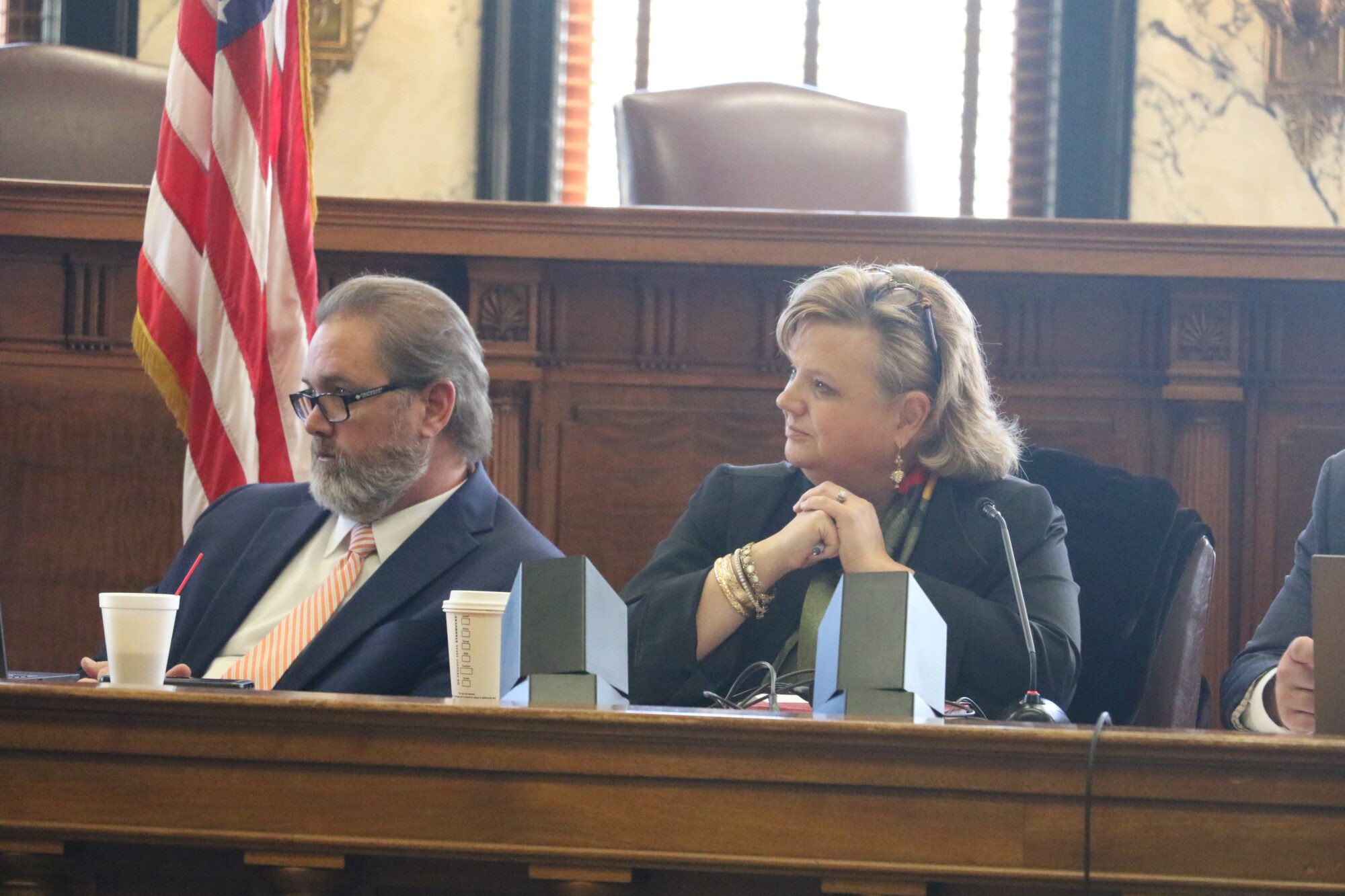

The state’s banking industry remains better positioned than counterparts in other states, but a University of Mississippi professor’s research shows some troubling areas.

Data suggest the foreclosure rate on prime-rate loans – those made to consumers with good credit – is higher than the national average, Ken Cyree, interim dean of the the University of Mississippi business school, said during a hearing Tuesday at the Capitol.

Cyree, who is also the school’s Mississippi Bankers Association chair of banking, told lawmakers and banking association members that Mississippi has an 11.95 percent foreclosure rate on subprime, adjustable-rate mortgages, compared with 17.09 percent nationally. The foreclosure rate on prime, adjustable-rate mortgages during the first quarter of the year was 5.17 percent, compared to the national average of 3.45 percent. During the same period, the foreclosure rate on prime, fixed-rate mortgages was 1.01 percent, compared to the national average of 0.67 percent.