Total revenue collection for May 2023 were $15.7 million, or 2.65% above the estimate for the month.

Mississippi tax revenue collection have been robust over the last few years, exceeding estimates by over half a billion dollars or more. This current fiscal year is no different.

The latest report from the Joint Legislative Budget Committee shows that as of the end of May 2023 revenue collections have exceeded estimates by over $650 million with one month remaining in the fiscal year. The new fiscal year begins July 1st.

See the full report here

Total revenue collections for the month of May 2023 were $15,655,162, or 2.65% above the sine die revenue estimate for the month.

Fiscal year-to-date revenue collections through May 2023 were $652,669,829, or 10.40% above the sine die revenue estimate.

Fiscal year-to-date total revenue collections through May 2023 were $315,522,605, or 4.77% above the prior year’s collections.

The FY 2023 Sine Die Revenue Estimate was $6,987,400,000.

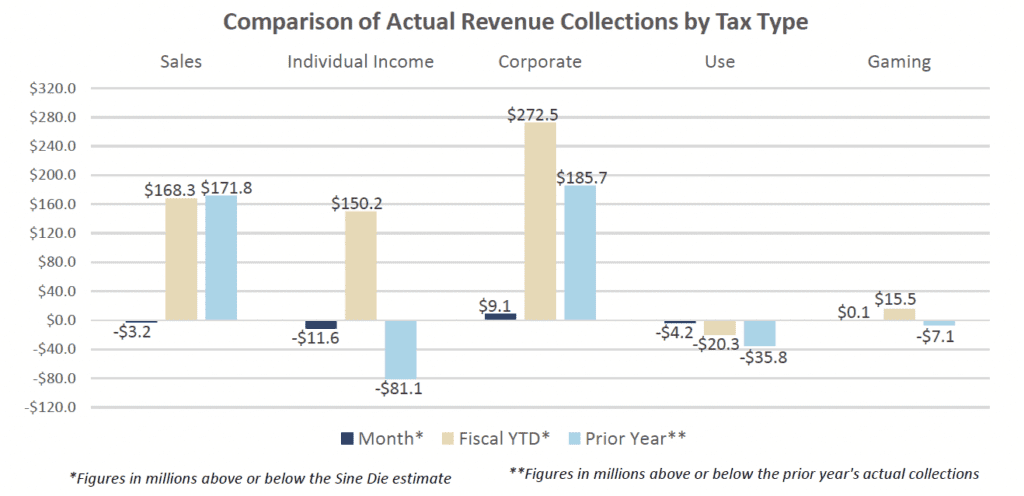

The graph above compares the actual revenue collections to the sine die revenue estimate for each of the main tax revenue sources. The figures reflect the amount the actual collections for Sales, Individual, Corporate, Use and Gaming taxes were above or below the estimate for the month and fiscal year-to-date.

The graph also compares fiscal year-to-date actual collections to prior year actual collections, as of May 31, 2023.

RELATED: Revenue collections stay high in Mississippi, 3.5% over April estimate

May 2023 General Fund collections were down $68,826,468, or -10.20% below May 2022 actual collections.

Sales tax collections for the month of May were above the prior year by $2.0 million.

Individual income tax collections for the month of May 2023 were below the prior year by $106.3 million, while Corporate income tax collections for the month of May 2023 were above the prior year by $13.1 million.