The $6.4 billion budget recommendation includes state employee pay raises, deletes 2500 vacant positions. Education remains top budget item.

The Mississippi Joint Legislative Budget Committee has released its Fiscal Year 2023 state budget recommendations.

The committee met on Tuesday and adopted the recommendations ahead of the start of the 2022 legislative session in January.

The Committee built the FY 2023 only on recurring funds, Lt. Governor Delbert Hosemann said. One-time monies, such as those received from the federal government for pandemic assistance, was not used to buoy budgets and support recurring expenses.

Here is a breakdown of their recommendation:

- FY 2023 General Fund revenue estimate: $6,493,500,000. This reflects an increase in anticipated revenue of 9.56% above the Fiscal Year 2022 revenue estimate.

- General Funds available for Fiscal Year 2023: $544.7 million more than General Funds appropriated for Fiscal Year 2022.

- Fiscal Year 2023 General Funds available for expenditure (excluding the 2% Set-Aside): $6,363,630,000.

- Fiscal Year 2023 General Fund Budget Recommendation total: $5,824,812,943. The proposed Fiscal Year 2023 General Fund budget is $5.8 million more than was appropriated for the Fiscal Year 2022 budget.

- Total State Support, which includes General Funds, Capital Expense Funds, Education Enhancement Funds, Health Care Expendable Funds, and Tobacco Control Funds: $6,386,672,653. This is $573.9 million, or $5.64%, less than the Fiscal Year 2022 budget. This decrease is due to one-time COVID-19 funds, non-recurring Capital Expense Funds and Gulf Coast Restoration Funds being reduced.

Noted Proposed Increases

The Committee recommends select targeted budget increases to agencies, some of which include:

- State Personnel Board for the SEC2 salary schedule: This amount totaled $25 million for salaries to raise the salary of eligible state employees to the minimum salary as determined by the State Personnel Board. Due to this increase, many state agencies will show an increased level of funding over Fiscal Year 2022.

- Department of Revenue for the Homestead Exemption Reimbursement: This request of $90.6 million, which is an increase of $11.6 million over Fiscal Year 2022, fully funds the program. These funds go back to the counties where the reimbursement is filed.

- Department of Public Safety: This increase of $624,020 is to fund the cost to annualize the statutorily required sworn officer salary increases. In addition to these salary increases, $3.25 million in General Funds was provided for the Capitol Police, which includes thirty-seven new positions and funding for equipment in order to increase their presence within the Capitol Complex Improvement District.

- Department of Mental Health: $1 million was set aside for the Utilization Review Process and $4.9 million in Capital Expense Funds be provided for the Forensic Unit at Mississippi State Hospital.

- District Attorneys and Staff budget for the new District 23.

The following actions were recommended by the Committee:

- Defund most vacant state positions

- Delete 2,539 vacant state positions

- Reduce funding for travel and contractual services

- Spending down of agency cash balances where possible

- Eliminate funds for one-time expenditures, like capital improvement

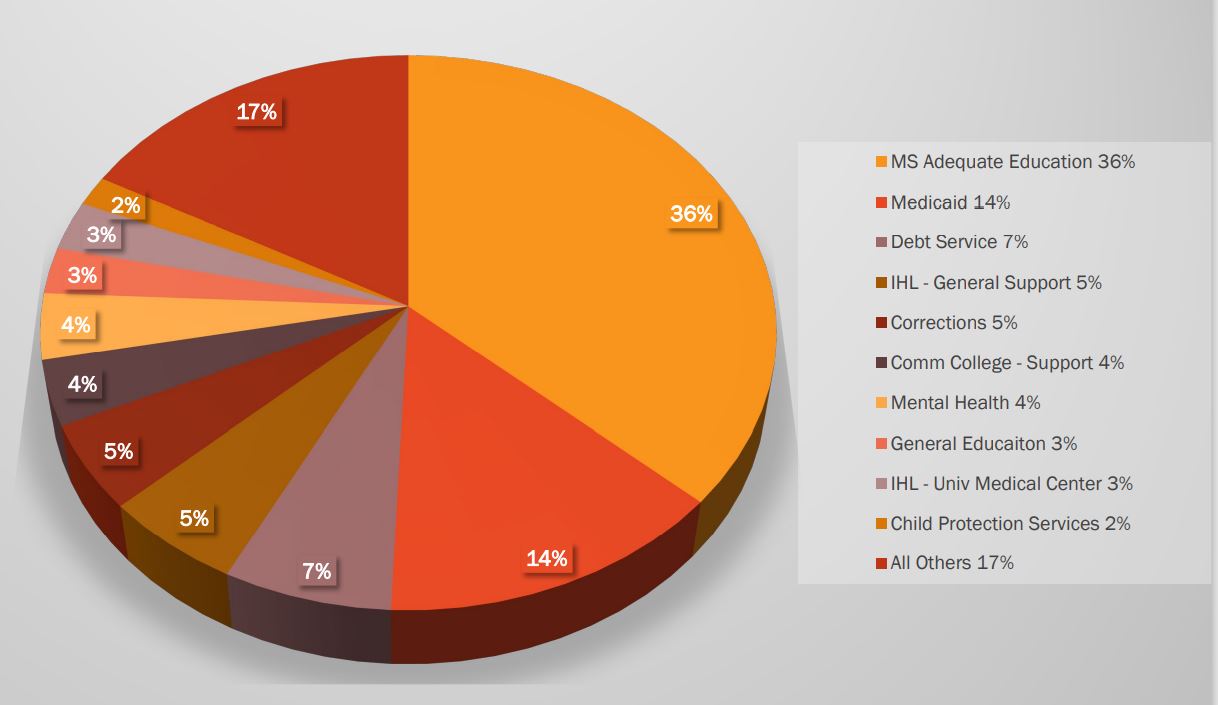

The Top 10 largest budget items for the state of Mississippi are:

- MS Adequate Education Program – $2,366.9M

- Medicaid – $900.3M

- Debt Service – $433.9M

- IHL – General Support – $360.9M

- Corrections – $318.9M

- Community College – Support – $242.4M

- Mental Health – $244.4M

- IHL – University Medical Center – $171.5M

- General Education – $184.2M

- Child Protection Services – $112.1M

The Committee recommendation maintains state reserve funds of nearly $4.4 billion. The Rainy Day fund has $556 million along with $129.9 million in the 2% set-aside.

Mississippi has $1.8 billion in the Coronavirus State Fiscal Recovery Fund which will be debated an appropriated during the upcoming session.

There remains $30.7 million in the Gulf Coast Restoration Fund and $23.1 million in the BP Settlement Fund.

Of note, the budget recommendation did not include a teacher pay raise. However, with Governor Tate Reeves and a majority of lawmakers expressing the desire to raise teachers pay that is likely to change as the process continues. A $1,000 raise for teachers would equate into a nearly $50 million hit to the budget.

Also, recommendations on how to eliminate the state income tax were not part of this publication by the Committee. Those discussions will be left to the appropriate committees in the two chambers during the session, meaning this recommendation is just that – a recommendation. Should lawmakers take up the income tax elimination, these numbers will surely change.

Lt. Governor Hosemann and Speaker Gunn thanked the Committee for their work, and also the Legislative Budget Office staff. The recommendations now go to the House and Senate for consideration.