The NFIP’s Risk Rating 2.0 is set to go into effect October 1st.

The Federal Emergency Management Agency (FEMA) is rolling out a new National Flood Insurance Program (NFIP) risk rating that will impact the pocketbooks of a majority of Mississippians with flood insurance. The rate increases and new rating system are to be effective tomorrow – October 1, 2021.

Mississippi U.S. Senator Cindy Hyde-Smith has cosponsored legislation (S.2869) to require the FEMA to delay its NFIP Risk Rating 2.0 rollout until Sept. 30, 2022. The new rates, which would apply to new policies immediately, are expected to raise premiums on nearly 80 percent of NFIP policyholders nationwide starting April 1, 2022.

“Right now, areas of the nation, including Mississippi, are dealing with hurricane recovery on top of economic stressors like inflation. There’s no question that more needs to be done to strengthen the solvency of the NFIP, but it would be a mistake for FEMA to rush the process and to push Risk Rating 2.0 on policyholders,” said Hyde-Smith in a release.

She serves on the Senate appropriations subcommittee with jurisdiction over FEMA.

“As the Biden administration does not wish to do the right thing and pause 2.0, we offer this legislation to delay implementation to provide time for full congressional oversight,” she said.

In addition to preventing premium hikes from going into effect for homeowners and other policyholders, the one-year delay would also give lawmakers time to develop meaningful, sustainable NFIP reforms.

Last week, Hyde-Smith was among a bipartisan group of Senators who signed a letter urging FEMA to delay Risk Rating 2.0. The lawmakers warned that the projected premium hikes could prompt a significant number of policyholders to drop their NFIP coverage, further weakening the solvency of the program.

U.S. Senator Marco Rubio (R-Fla.) introduced the NFIP Risk Rating 2.0 Delay Act, which is also cosponsored by Senators Bill Cassidy, M.D. (R-La.) and John Cornyn (R-Texas).

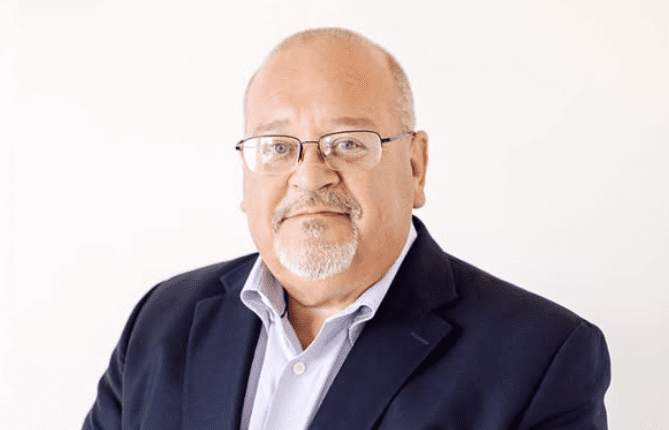

Y’all Politics spoke with attorney Jimmy Heidelberg, counsel for the Mississippi Windstorm Underwriting Association, earlier this month, outlining the impact the rate increases will have on Mississippians. Watch the interview below for more information.