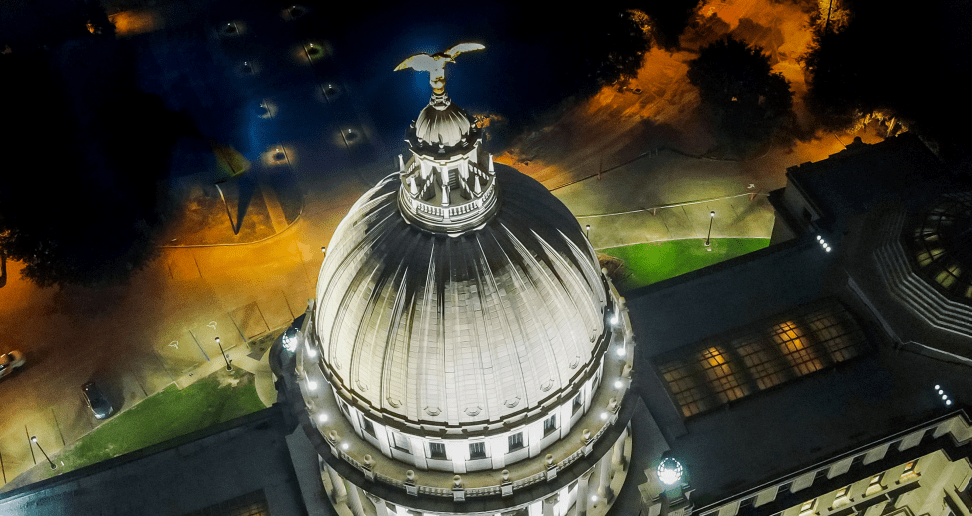

(Photo from Shutterstock)

- The IRS said the One Big Beautiful Bill Act could impact federal taxes, credits and deductions. Taxpayers in Mississippi have until April 15 to file both their federal and state income taxes.

The Internal Revenue Service has set Monday, January 26 as the opening of the 2026 federal filing season.

Several new tax law provisions of the One, Big, Beautiful Bill become effective, which the IRS said could impact federal taxes, credits and deductions. Taxpayers will use the new Schedule 1-A to claim recently enacted tax deductions, such as no tax on tips, no tax on overtime, no tax on car loan interest and/or the enhanced deduction for seniors.

Taxpayers will have until Wednesday, April 15 to file their 2025 tax returns and pay any taxes that are due.

The IRS expects to receive about 164 million individual income tax returns this year, with most taxpayers filing electronically.

Treasury Secretary and Acting IRS Commissioner Scott Bessent said in a statement that President Donald Trump is committed to the taxpayers of this country and improving upon the successful tax filing season in 2025.

“Prior to the passage of the One, Big, Beautiful Bill, which delivered working families tax cuts, Treasury and IRS were diligently preparing to update forms and processes for the benefit of hardworking Americans, and I am confident in our ability to deliver results and drive growth for businesses and consumers alike,” Bessent said.

The IRS directed filers to their online tools and resources, a website for taxpayers to use before, during and after filing their federal tax return. Another site, One, Big, Beautiful Provisions, provides information the IRS said could help lower tax bills and potentially increase refund amounts.

What About Mississippi?

In Mississippi, taxpayers must also file their state income tax by April 15.

The state is currently in the process of phasing out its individual income tax over the next decade or so, assuming certain economic triggers are met to allow for the continued reduction in tax rates.

The Mississippi Department of Revenue said there is no tax schedule for Mississippi income taxes.

In 2026, the graduated Mississippi 2025 tax year income tax rate is:

- 0% on the first $10,000 of taxable income.

- 4.4% on the remaining taxable income in excess of $10,000.

Tax Rates for Mississippi tax years 2026 and 2027 are set to be 4% and 3.75%, respectively, on taxable income in excess of $10,000.

For more information on Mississippi income tax filings, visit the Department of Revenue here.