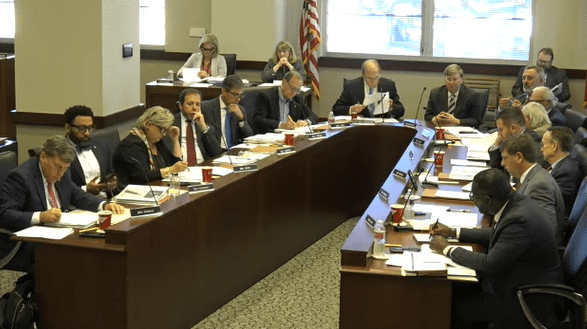

(Photo from JLBC livestream)

- JLBC unanimously adopted a 1 percent decrease to the revenue estimate for the current fiscal year. The lawmakers and governor also adopted the next year’s revenue estimate of $7.532 billion.

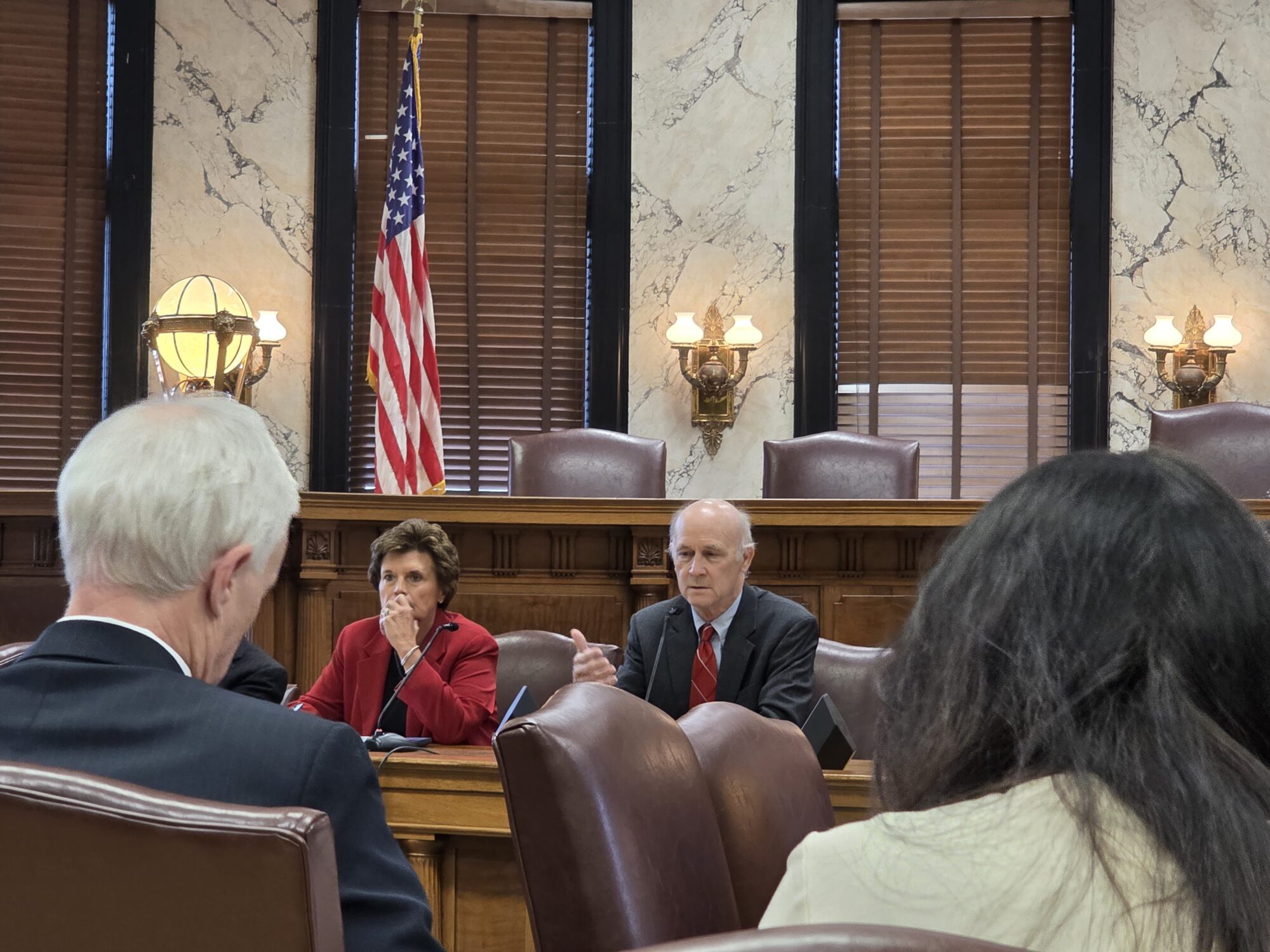

The Joint Legislative Budget Committee met Wednesday morning as Mississippi lawmakers begin setting the framework for the next state budget.

Lt. Governor Delbert Hosemann (R) gaveled in the meeting, which was quickly moved into an hourlong executive session. When lawmakers emerged, Governor Tate Reeves (R) had joined the gathering to hear from State Economist Corey Miller.

Miller reported that sales tax revenue in Mississippi continues to grow, coming in 2.7 percent higher in this current fiscal year’s first four months than in the prior year. Miller said individual income tax revenues were also up 3.3 percent for the same period “despite another reduction in the income tax rate that occurred last January.”

“Total residential employment in Mississippi in July and August was essentially the same as in July and August in 2024. However, average hourly wages in Mississippi for July and August as compared to one year ago were up 6.6 percent and 5.8 percent, respectively,” Miller said, noting that the higher wages explained the increased income tax revenue with the lowered income tax rate.

Mississippi is on a path to fully eliminate its individual income tax over the decade.

Miller said corporate income tax revenues continue to trend down, with revenues coming in 0.5 percent lower in July to October this year compared to the same period in 2024. He attributes the decline to full expensing and lowered corporate profits.

The Legislative Budget Office reported Tuesday that Mississippi’s revenue collections for the fourth month of the current fiscal year were up 6.83 percent above the sine die revenue estimate for the month. Fiscal year-to-date total revenue collections through October 2025 were $69.9 million, or 2.8 percent above estimates. In addition, the first four months of this fiscal year surpassed the prior year’s collections by $79 million, or 3.18 percent.

READ MORE: Mississippi’s October revenue collections exceed estimates by $45.7 million

Using these numbers and forecasting economic trends for the next year, Miller told lawmakers that the Revenue Estimating Group recommends the current 2026 Fiscal Year state General Fund revenue estimate be changed to $7.552 billion, a decrease of 1 percent or $75 million from the approved sine die estimate.

Without public discussion, the JLBC unanimously adopted the revised revenue estimate for the current fiscal year.

Miller went to say the group’s recommended revenue estimate for the 2027 Fiscal Year is $7.532 billion.

Governor Reeves said he agreed with the recommendation, adding that it is important to note that when more people are working with higher wages, even as income tax rates decline, state revenues see an increase.

“I think that revenues for this fiscal year are more likely to come in above $7.7 billion than they are to come in below $7.5 billion but anywhere between $7.5 billion and $7.7 billion is within the realm of possibility in my mind,” Reeves said.

Without further discussion, the JLBC along with the governor then unanimously adopted the Fiscal Year 2027 revenue estimate of $7.532 billion.

This procedural move sets the stage for lawmakers to begin work on the state budget when they return to the Capitol in January.