Mississippi Gov. Tate Reeves (AP Photo/Rogelio V. Solis - Copyright 2023 The Associated Press. All rights reserved.)

- Reeves says cutting taxes and letting Mississippians keep more of their money – when combined with fiscal restraint – works.

On Tuesday, Governor Tate Reeves (R) celebrated the start of the state’s new fiscal year by saying in a social media post that Mississippi is in the best fiscal and financial shape in its history.

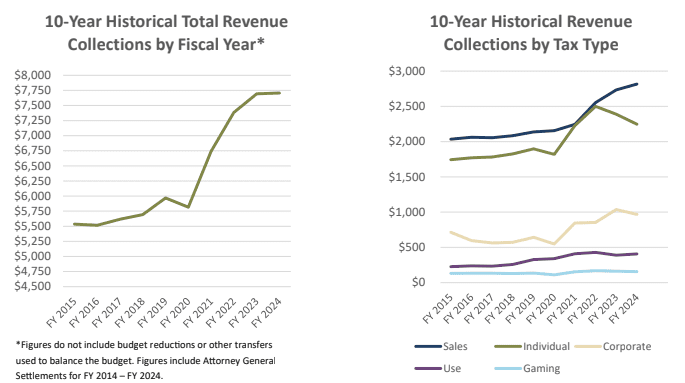

Reeves highlighted the fiscal success Mississippi saw in the 2025 fiscal year, noting that total revenue collections will exceed $7.6 billion – nearly half a billion more than the prior year’s $7.035 billion budget and above the legislative revenue estimates.

While the Legislative Budget Office has not yet released its end of year report, Reeves shared that revenue collections for June, the last month in the 2025 fiscal year, were almost $33 million above the monthly estimate.

The May revenue report showed collections $5 million above total year estimates.

“Mississippi is #2 in the country in economic growth in Q4 2024. Mississippi is #4 in the country in per capita income growth in Q4 2024,” Reeves said. “Because cutting taxes and letting you keep more of your money – when combined with fiscal restraint – WORKS.”

The new 2026 fiscal year began July 1, complete with a $7.135 billion state budget after legislative wrangling caused the need for a special session to finalize this year’s appropriations bills.

Over the past two years, Mississippi revenue collections have leveled off since seeing a major spike in the wake of the COVID pandemic even with the reduction in the state’s individual income tax through the 2022 tax cuts passed by lawmakers and signed into law by Governor Reeves.

Another round of tax cuts were approved this year, aiming to fully phase out the individual income tax over the next decade while also reducing the sales tax on groceries from 7 percent to 5 percent.

“REMEMBER….in Mississippi: If you are married filing jointly the first $36,000 of income you earn is taxed at 0%. We eliminated the 3% individual Income Tax bracket. We eliminated the 4% individual Income Tax bracket. We eliminated the Corporate Franchise Tax. We eliminated the Corporate Inventory Tax. And we reduced the 5% bracket to 4.4% in 2025 and 4% in 2026. (earnings OVER $36k),” Reeves added.

The Mississippi governor also urged Congress to pass move forward with passing President Donald Trump’s “One Big Beautiful Bill” to “unleash the American economy to grow like Mississippi’s economy next year.”

That legislation, among other provisions, would extend and make permanent tax cuts from the first Trump administration, while also allowing deductions for tips and overtime pay.