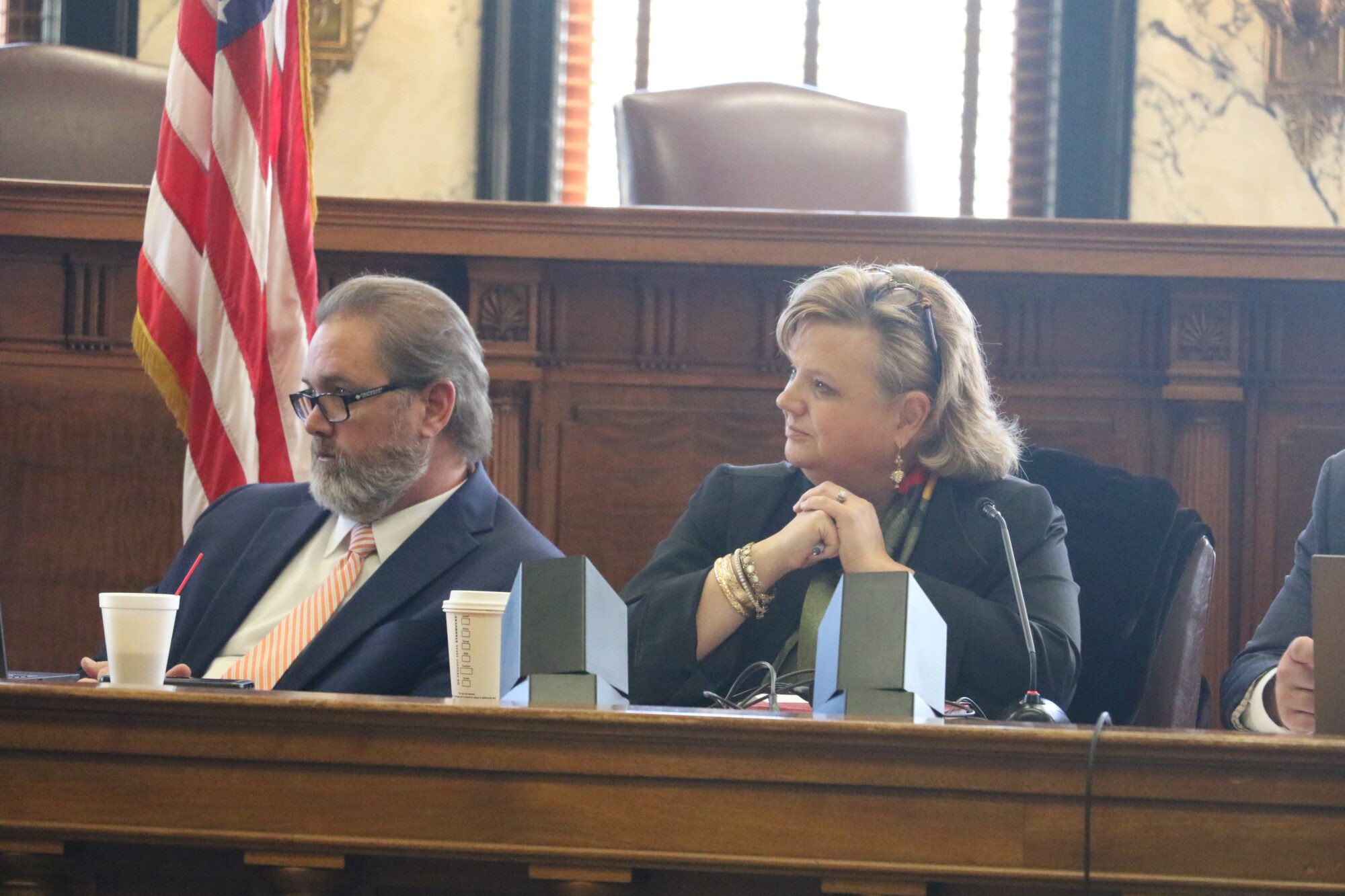

Lt. Governor Delbert Hosemann presents the Senate tax plan - February 12, 2025 (Photo: Daniel Tyson | Magnolia Tribune)

- Unlike the House’s tax reform package, the Senate proposal stops short of full income tax elimination, harkening back to the 2022 tax cut debate.

The Mississippi Senate released its long-awaited tax bill Wednesday, a scaled-down version of the House’s proposal, but that still includes reductions in the state income and sales tax on groceries as well as an increase on gas taxes to fund road projects.

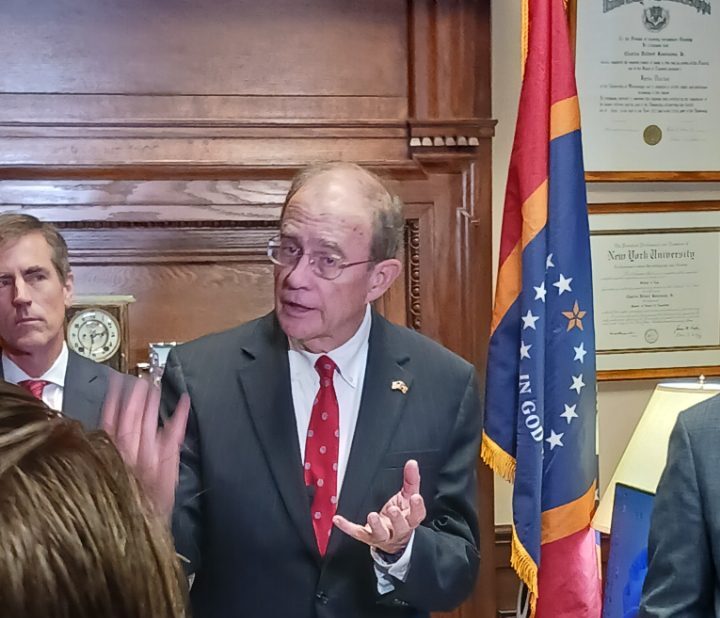

Lt. Governor Delbert Hoseman (R) described the bill as “a sustainable, conservative approach to tax cuts.”

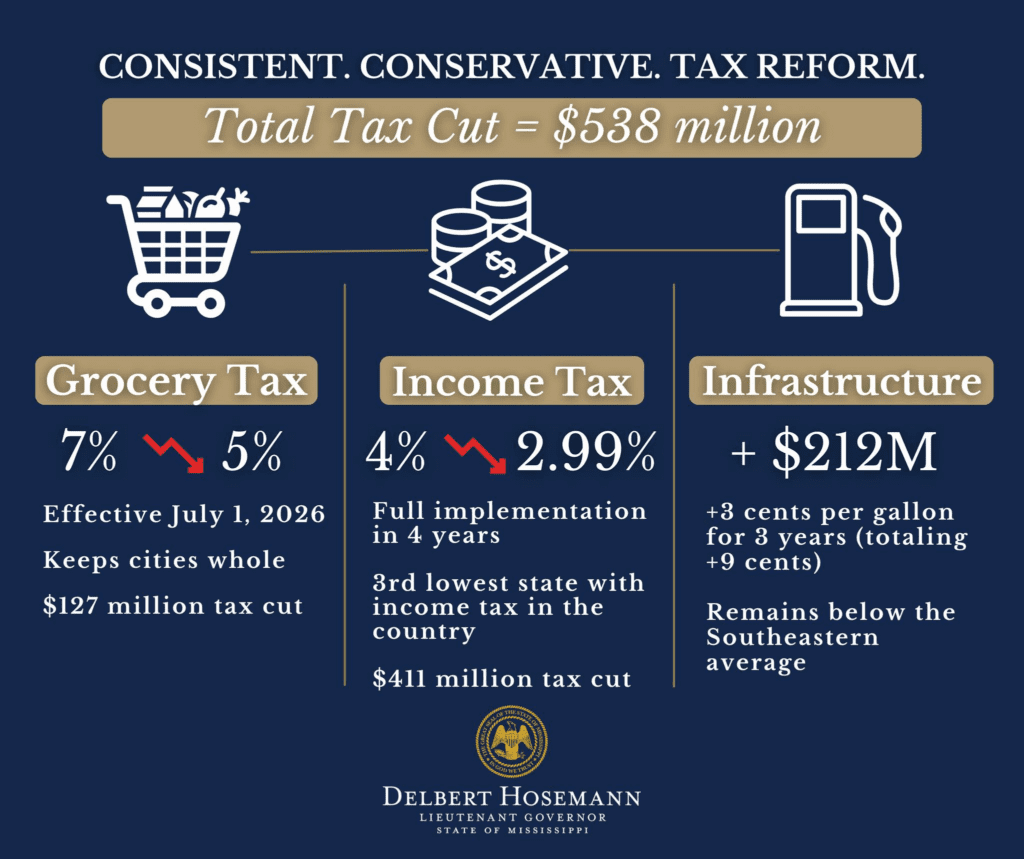

Total tax cuts equal $538 million over three years under the Senate plan.

“The Senate’s tax plan is simple but effective,” Hosemann said.

When asked why the projections are seven years shorter than the 10-year House forecast, he said, after three years, “you enter never, never land.”

The House bill cuts $1.1 billion in taxes over a decade.

READ MORE: Mississippi Senate’s tax reform proposal is here

Hosemann, flanked by senators, said the legislation is a continuation of the Senate’s 2022 tax reform, which cut taxes by nearly $600 million, adding that with this proposal the chamber will have slashed taxes by more than $1 billion.

In 2022, like this year, the House sought to fully eliminate the state income tax with the support of Governor Tate Reeves (R). However, the Senate wanted to take a more cautious approach which resulted in lower the income tax rate to a flat 4 percent instead of full elimination.

The Senate now proposes to lower the income tax rate from its current 4 percent to 2.99 by 2030.

“This will make Mississippi the third lowest state with income tax in the country,” Hosemann told reporters.

This could be a contentious point during conference between the two chambers. The House tax bill, HB 1, eliminates the income tax within a decade and again has the support of Governor Reeves, who has praised the House legislation as a “serious effort.”

The Senate plan also includes cutting the sales tax on groceries from seven percent to five percent, saving Mississippians $127 million, starting July 1.

“Our first goal is to cut the grocery tax,” Hosemann said.

The Senate version would add $212 million to infrastructure, which Hosemann said is a serious need. Part of paying for that increase would be a 9 cent per gallon gas tax over three years. It would be indexed from there. He said the people who travel Mississippi’s roads should pay for their maintenance and upkeep, also noting the investment is a safety issue.

“It’s the way we get our kids to school,” he said.

The Lt. Governor said that even with the 9-cent increase, Mississippi would still have the lowest gas prices in the southeast. Mississippi currently charges an excise tax of 18.4 cents per gallon of fuel but exempts fuel purchases from sales tax.

Notably, Transportation Commission Chairman Willie Simmons (D) and Mississippi Department of Transportation Executive Director Brad White have released a statement of support for the House plan.

“Not since 1987 have we had a real conversation on properly funding transportation with recurring revenue. HB1 grants us this opportunity, and, for that, we are very grateful to Speaker Jason White, Chairman Trey Lamar and Chairman Steve Massengill. HB1 accomplishes a significant net tax cut for the people of Mississippi while still taking strides to make our transportation dollars both reliable and adequate,” the joint statement reads. “We look forward to working with our partners in the transportation arena to help see this legislation through the process, hopefully culminating with a positive outcome for the people of Mississippi.”

Several members in both chambers expressed concern at the speed with which the House passed its tax bill, a process that bypassed the Legislative Budget Office. When asked if the LBO had looked at the Senate bill, Hosemann gave a small smile before replying, “Yes.” He did not elaborate on his one-word answer.

The Senate bill does not include aid to cities, a deviation from the House plan. HB 1 calls for dropping the sales tax on groceries to 4.5 percent in year one but then adds a 1.5 local sales tax option allowing municipalities to make up the difference. Mayors interviewed by Magnolia Tribune expressed concern that the Senate bill would not include such a provision.

READ MORE: Mayors express support for House tax reform package

Hoseman said cities would be fine under the Senate bill but did not go further when questioned.

While House leaders said their bill will “totally reform the state’s tax system” and called HB 1 “a transformational piece of legislation,” Hosemann was more sedate.

“We intend to run this state like a business,” he said, adding the Senate wants to be prudent in its legislation because the Magnolia State is in the best financial shape “that it’s ever been.”

House Speaker Jason White (R), who posted several letters in support of HB 1 on his X account hours before the Senate unveiled its bill from business organizations and even MDOT, said he is pleased the upper chamber has a plan.

“I am glad they have a plan. I hope we can start moving down the road comparing their ideas and the House ideas and seeing where the common ground is and where the differences are,” he said. “I haven’t seen their legislation. I don’t know if they have the votes to pass their legislation.”