- Important state and national stories, market and business news, sports and entertainment, delivered in quick-hit fashion to start your day informed.

In Mississippi

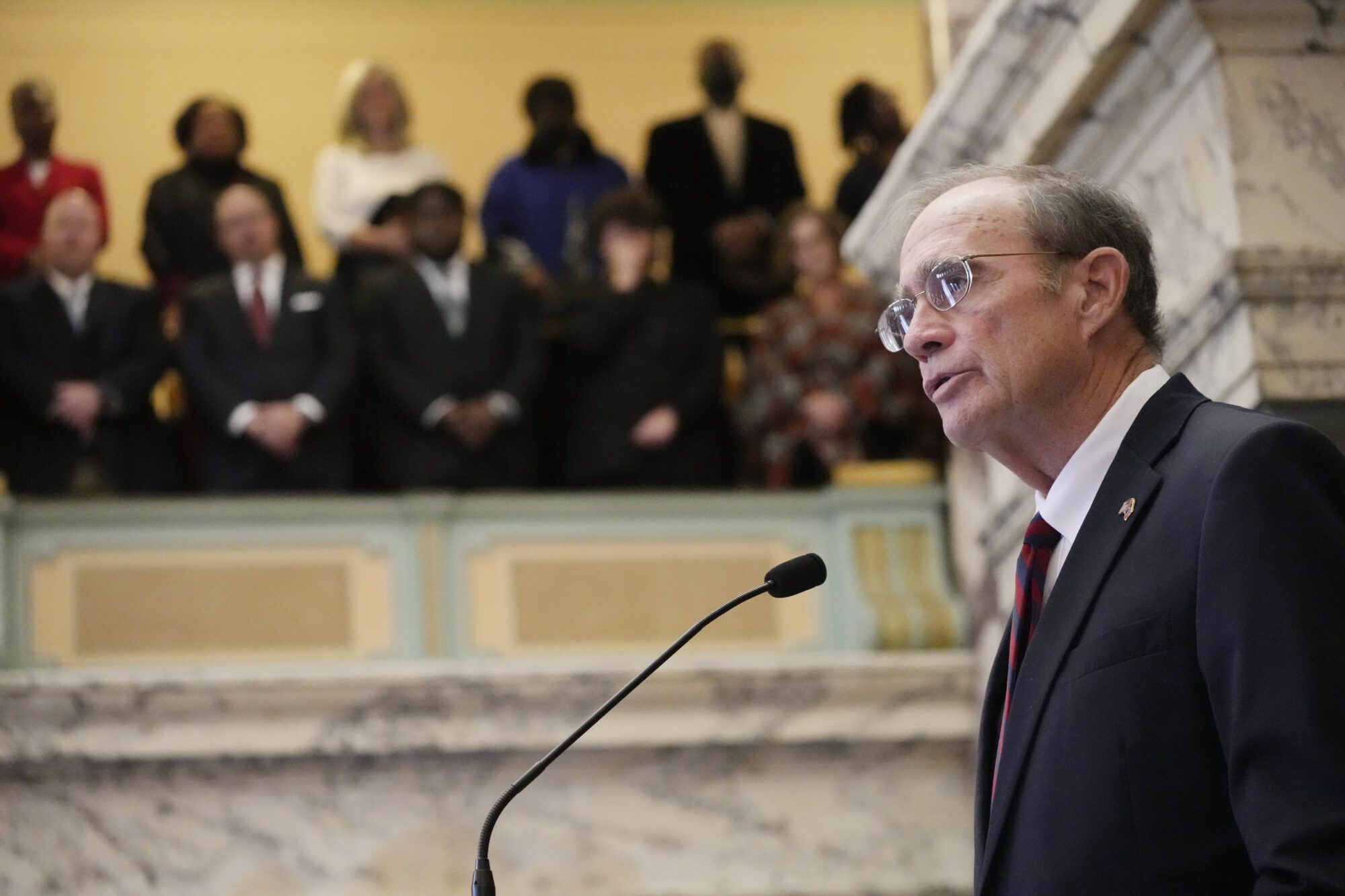

JXN water replacing undersized pipes

WJTV reports that JXN Water officials said the city has 100 miles of undersized pipes throughout the streets.

“During JXN Water’s quarterly meeting on Saturday, Interim Third-Party Manager Ted Henifin said they’re not replacing the whole system. However, two- and four-inch diameter pipes will be replaced with six-inch PVC pipes,” WJTV reported.

“Those small pipes have a lot of rust in them as the pressures change, and they get disturbed. They do become brown water. It has iron in it. Not hazardous, but certainly not something you love to have in your glass when you’re serving your friends,” said Henifin, as reported by WJTV.

National News & Foreign Policy

1. Trump declares Gulf of America Day

On his way to the Super Bowl on Sunday and becoming the first sitting President to attend the big game, President Donald Trump signed a proclamation declaring February 9, 2025, as Gulf of America Day.

“Today, I am making my first visit to the Gulf of America since its renaming. As my Administration restores American pride in the history of American greatness, it is fitting and appropriate for our great Nation to come together and commemorate this momentous occasion and the renaming of the Gulf of America,” the proclamation read.

2. Treasury to stop producing pennies?

The Hill reports that President Donald Trump on Sunday announced that he asked the Treasury Department to stop producing pennies, calling the one cent coin wasteful.

“For far too long the United States has minted pennies which literally cost us more than 2 cents. This is so wasteful! I have instructed my Secretary of the US Treasury to stop producing new pennies. Let’s rip the waste out of our great nations budget, even if it’s a penny at a time,” Trump said, as reported by The Hill.

The Hill also added, “The cost of making a penny was nearly 3.7 cents in Fiscal Year 2024 and the coin has cost above face value to make for 19 consecutive fiscal years, according to the U.S. Mint’s annual report.”

Sports

Three-peat denied as Eagles dominant Chiefs

The Philadelphia Eagles shocked the two-time Super Bowl champion Kansas City Chiefs on Sunday in Super Bowl LIX, rolling to a 40-22 rout that was far more dominant than the final score would indicate. The Eagles were up 34-0 late in the third quarter.

The win ensured that the Chiefs would not reach the coveted third consecutive Super Bowl victory, a feat no team in NFL history has achieved in the Super Bowl era.

The Eagles defense sacked Chiefs’ quarterback Patrick Mahomes six times and picked off two passes, one that was returned for a touchdown.

Eagles quarterback Jalen Hurts was named the game’s MVP. He finished with 221 passing and another 72 rushing with 3 total touchdowns.

Markets & Business

1. Chevron’s divorce from California

The Wall Street Journal reports on Chevron’s move out of California, as the company heads to Texas.

“Relations between [Chevron’s Mike] Wirth, CEO of the nation’s second-largest energy company, and [Gavin] Newsom, governor of America’s populous state, had soured over regulatory and legislative efforts intended to combat climate change—displacing internal-combustion engines with electric vehicles, for one,” WSJ reported, adding, “California has acted more aggressively than any other state to steer consumers from fossil fuels, including a state ban on the sale of gasoline-powered cars by 2035, as well as rules that oil companies blame for the state’s higher gas prices. EVs now account for more than a quarter of new car sales in California.”

WSJ went on to note, “California has more than Chevron headquarters at stake. The company, which operates two of the largest oil refineries in the state, has considered the possibility of ceasing production. That would raise gas prices further for California’s more than 27 million drivers. Chevron refineries make up a third of the state’s gasoline-production capacity. “

2. Investors bracing for week of data, tariff news

CNBC reports that stock futures rose early Monday, “as investors braced for a data-packed week ahead and eyed news that President Donald Trump may announce a new round of tariffs.”

“Futures tied to the Dow Jones Industrial Average gained 191 points, or 0.4%. S&P 500 futures ticked up 0.4%, while Nasdaq-100 futures advanced nearly 0.7%,” CNBC reported.

CNBC noted, “The threat of more tariffs comes ahead of a slew of economic data this week. The January consumer price index report is due out Wednesday at 8:30 a.m. ET, followed by initial weekly jobless claims and the producer price index on Thursday. Federal Reserve Chair Jerome Powell will also speak before Congress on Monday morning.”