Mississippi House of Representatives chamber, Monday, Feb. 26, 2024, at the state Capitol in Jackson, Miss. (AP Photo/Rogelio V. Solis)

- The adopted revenue estimate of $7.627 billion represents an increase of 0.4 percent or $26.9 million above the current fiscal year.

The Joint Legislative Budget Committee met Wednesday to adopt its recommendation for Fiscal Year 2026 which includes a revenue estimate of $7.627 billion.

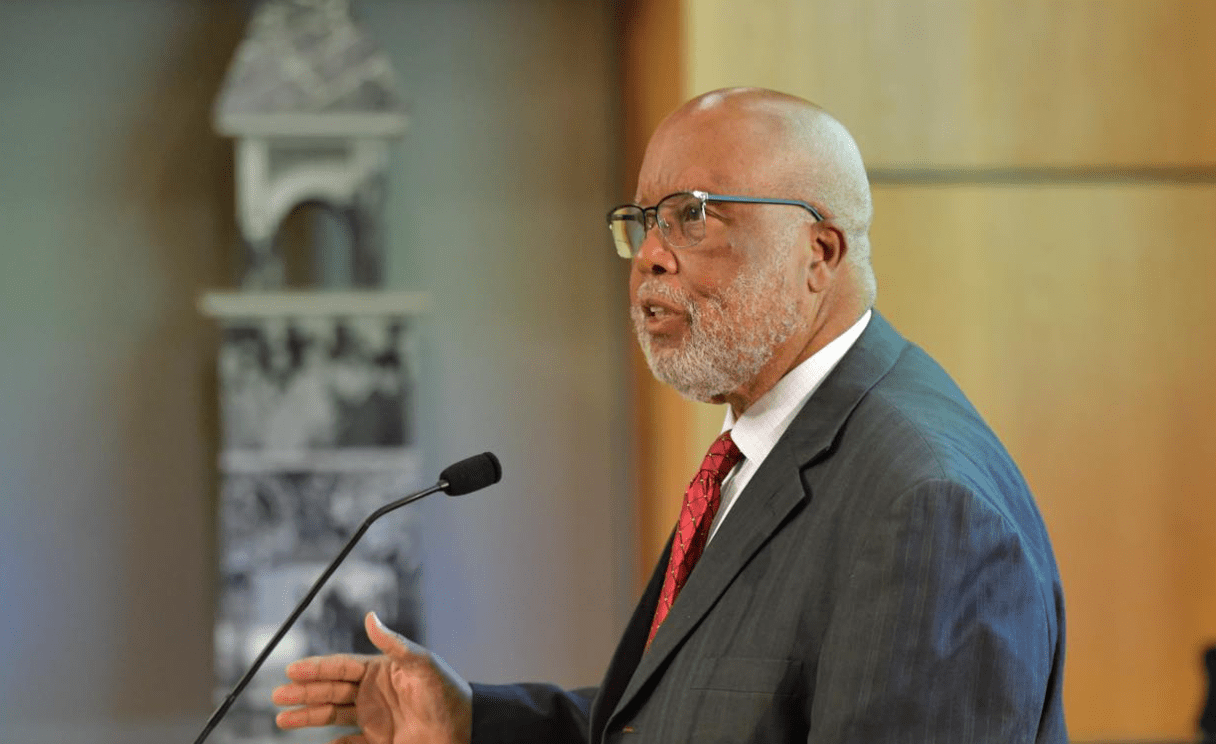

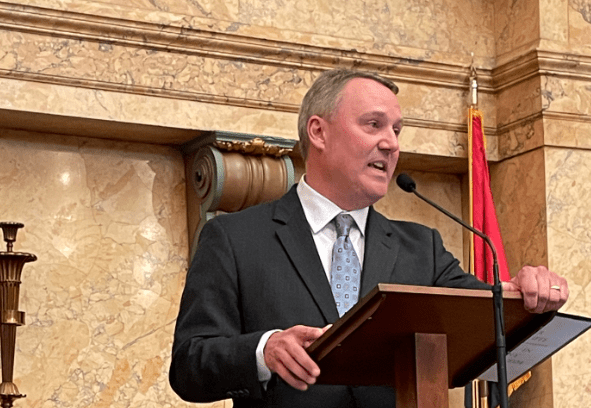

House Speaker Jason White (R), who chaired the group this year, said the committee’s work, in conjunction with the backing pf Governor Tate Reeves (R), is a good starting point for the 2025 legislative session which begins January 7th.

“The committee is recommending a conservative budget. This balanced budget includes a 2 percent set aside of $152 million,” White said. “The committee’s built the budget using only recurring funds again, strengthening the state’s reserves.”

JLBC recommends $2.749 billion in state reserves or unallocated funds, with $1.08 billion in capital expense funds, $667 million in working cash stabilization or “rainy day” funds, and $449 million in General Funds.

The adopted revenue estimate represents an increase of 0.4 percent or $26.9 million above the current fiscal year sine die legislative estimate. It leaves $7.474 billion available for lawmakers to appropriate after the 2 percent set aside. Of that, JLBC’s recommendation for the state’s General Fund budget is $7.024 billion, leaving $449.7 million up for appropriation during the session.

While the total state support budget recommendation of $7.699 billion is $16.7 million less than the current fiscal year’s appropriations, JLBC is supporting funding increases for the following:

- State agency health insurance – $21 million

- State agency PERS 0.5 percent increase – $15 million

- Department of Education (Chickasaw Interest) – $4.3 million

- Homestead exemption reimbursements – $2 million

Ten budget lines account for over 82 percent of the state support in funding, with the top five being:

- Mississippi Student Funding Formula (public education) – $3 billion

- Medicaid – $909 million

- Institutions of Higher Learning – $451 million

- State’s debt service – $421 million

- Corrections – $419 million

JLBC also recommends $58.7 million in General Fund reductions. These cuts include deleting 1,722 vacant state positions, reducing travel and contractual services, and eliminating expenditures using one-time funds.

“I’m real pleased with the work of the committee this year. We have reduced our budget by over $16 million this year when, as you know, inflation is increased much more than that,” Lt. Governor Delbert Hosemann (R) said, noting the ability to recommend a reduction in the size of government.

Hosemann added that lawmakers are running state government like Mississippi runs its businesses – “lean and mean.”

The Lt. Governor noted that the use of interest on state funds has allowed the state budget to remain in the black in the current fiscal year.

Mississippi state revenues rebounded in November, after dipping below legislative estimates the prior month. The Magnolia State’s year-to-date revenue collections for the first three months of FY 2025 were $46 million above estimates, yet when factoring in the October decline in collections, Mississippi’s revenues remain above estimates by $18.5 million on the year.

“I believe the state is getting about 4.3 percent interest right now on its funds and so there’s a significant amount of money somewhere in the $300 million plus that has historically not been at that amount because interest rates were much smaller,” Hosemann said, asking the Legislative Budget Office to analyze where those interest accruals were coming from so lawmakers could determine it the monies should be placed in the General Fund.

During the November JLBC meeting, State Economist Corey Miller told the 14-member budget committee that the state is experiencing slower revenue growth than in recent years.