Mississippi State Capitol

- Five months into the fiscal year, Magnolia State revenues exceed estimates by over $26 million.

Mississippi state revenues rebounded in November, after dipping below legislative estimates the prior month.

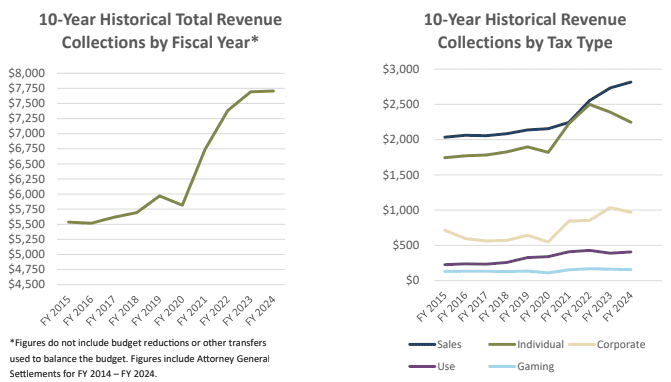

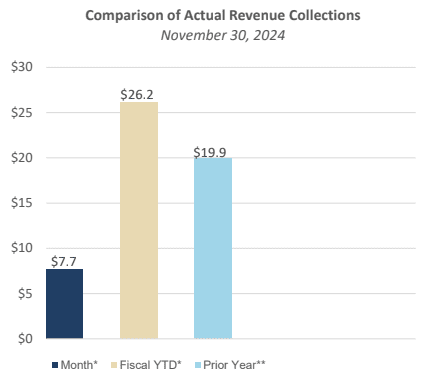

The Legislative Budget Office reported Tuesday that the total revenue collections for November were $7,704,685, or 1.48 percent above the sine die revenue estimate. This means revenue collections have exceeded estimates four out of five months so far this fiscal year.

When comparing the November General Fund collections with the prior year, revenue was down $227,313, or 0.05 percent. Sales tax collections and corporate income tax collections for the month were also down compared to the prior year, coming in at $5.9 million and $24.2 million, respectively, below November 2023.

However, despite the continued phase in of the 2022 state income tax cut, individual income tax collections for November were above the prior year by $9.6 million.

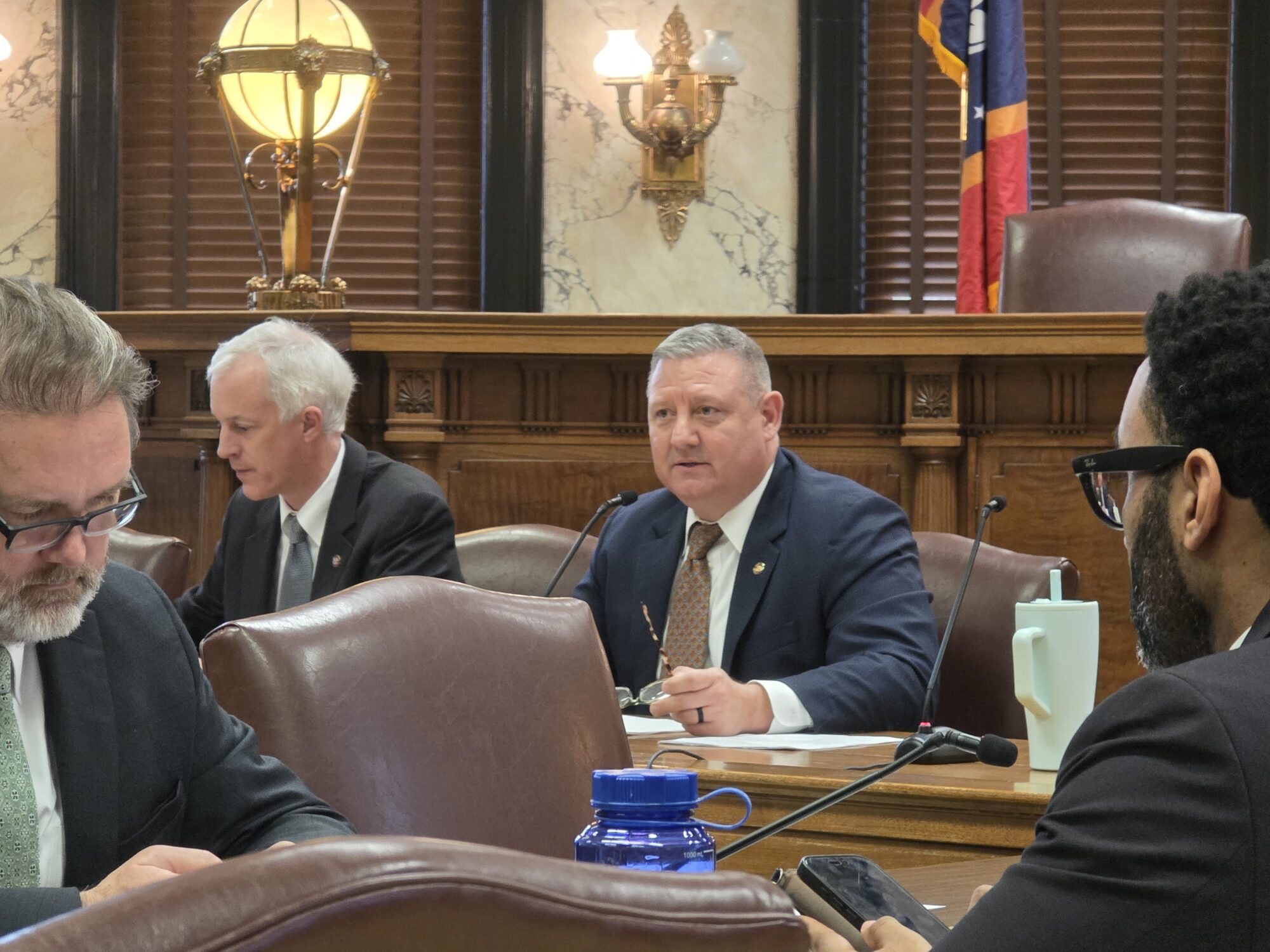

State Economist Corey Miller told lawmakers at a Joint Legislative Budget Committee meeting in mid-November that individual income tax revenues are up 1.6 percent through the first four month of this fiscal year compared to the same period last year. He attributed the increase to an 0.8 percent increase in the state’s labor force participation rate as of April. Miller also noted that residential employment is up 1.7 percent in the last six months.

Governor Tate Reeves and lawmakers in the House of Representatives continue to discuss the potential for a full income tax elimination, phased out over a period of years. The current tax cut would leave the state income tax at a flat 4 percent when fully implemented by 2026.

Year-to-date revenue collections through November came in at $26,219,410, or 0.88 percent above the legislative revenue estimate. Total revenue collections through November are

$19,897,043, or 0.66 percent above the prior fiscal year’s collections.

Miller told the Joint Legislative Budget Committee last month that the state is experiencing slower revenue growth than in recent years. Comparing the first four months of the current fiscal year to the same period in the prior year, sales tax collections are flat and individual income tax revenues are up.

The total FY 2025 revenue estimate is $7.6 billion.