- The Legislative Budget Office also notes that the Magnolia State’s General Fund ended the prior fiscal year with an estimated excess of $979.4 million including reappropriations.

According to the Legislative Budget Office, Mississippi started the new fiscal year surpassing revenue estimates for month one in FY 2025 by $5.2 million.

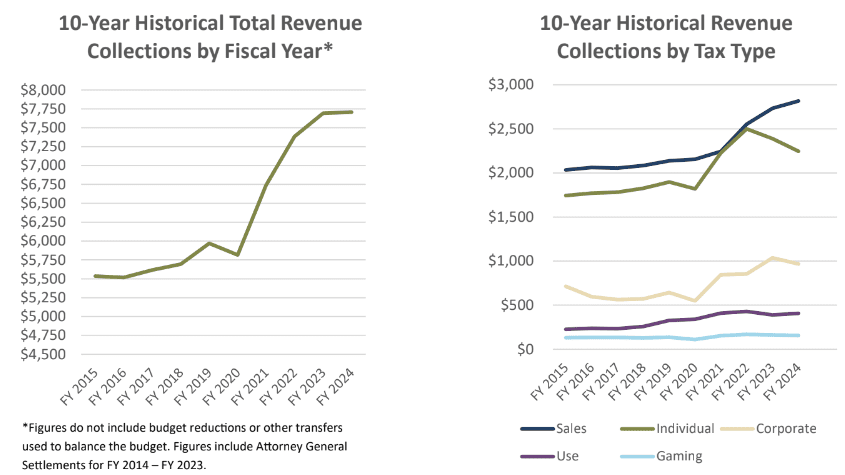

The July report for the Mississippi budget revenue released on Monday shows that the state collected nearly 1% more than the legislative estimate for the first month in the fiscal year which began on July 1. The total FY 2025 revenue estimate is $7.6 billion.

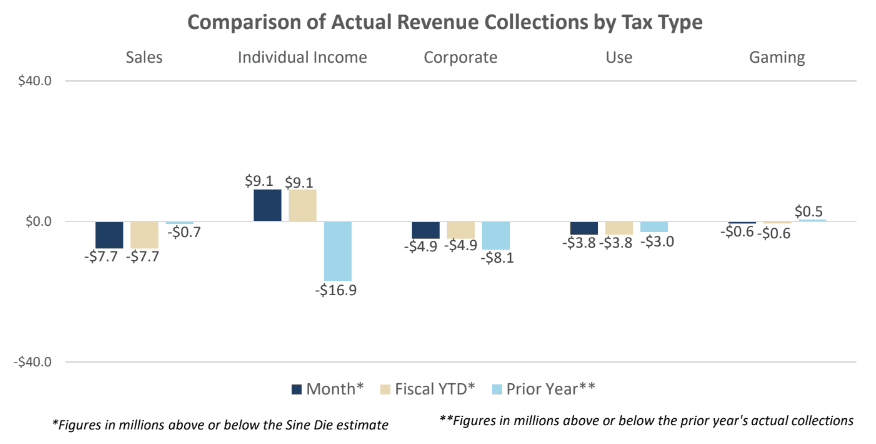

In comparison to prior year collections, the July 2024 numbers are down from July 2023 by over $18.6 million, largely due to the continued phase in of the 2022 income tax cut. Year-over-year income tax collections for the month of July showed July 2024 down by $16.9 million.

Most of the other revenue lines were also down in a year-over-year comparison, with sales tax down $718,000, corporate income tax down $8.1 million, and the use tax down $3 million. The revenue lines showing an increase were in insurance premium taxes, gaming taxes and other revenues.

The Legislative Budget Office also provided updated numbers for the prior fiscal year’s collection for FY 2024 which ended June 30.

According to the report, total revenue collections for FY 2024 were $7,706,816,068. When compared to the total General Fund appropriations for FY 2024 of $6,730,763,551, the General Fund will end the fiscal year with an estimated excess of $979.4 million including reappropriations.

As LBO notes, additional revenues may be recorded, and subsequent adjustments could be necessary as the fiscal year close-out is completed.