- Governors are asking the President to put a stop to the new rule. Mississippi’s Senate Medicaid Chairman says he expects the change to be “costly” and “overly burdensome.“

A group of Republican governors are fighting to prevent a proposed Center for Medicaid and Medicare Services (CMS) rule change that would impact how states fund their Medicaid programs.

Under existing law, the federal government funds a percentage of the expense associated with Medicaid programs across the country. States are responsible for the remainder. For Mississippi, the federal government pays approximately 77 percent of the cost.

Forty-nine states, including Mississippi, generate funding toward their state portion of Medicaid expense through “provider taxes” on medical services, such as inpatient hospital visits.

States are allowed to use these taxes under current regulations as long as they are broad-based and uniformly imposed. There is increasing federal concern, however, that states are abusing provider taxes through “hold harmless” arrangements that effectively redirect federal Medicaid dollars to reimburse providers for the provider tax.

Michael Cannon, Director of Health Policy Studies with the Cato Institute, said states are using provider taxes to increase Medicaid spending, federal deficits, and the federal share of Medicaid spending beyond the statutory share. He quoted President Joe Biden by saying “provider taxes are a scam.”

In February of 2023, CMS issued an informational bulletin titled “Health Care-Related Taxes and Hold Harmless Arrangements Involving the Redistribution of Medicaid Payments.” The bulletin was followed by a proposed rule change that would place limits on the use of hold harmless arrangements for Medicaid and the Children’s Health Insurance Program (CHIP).

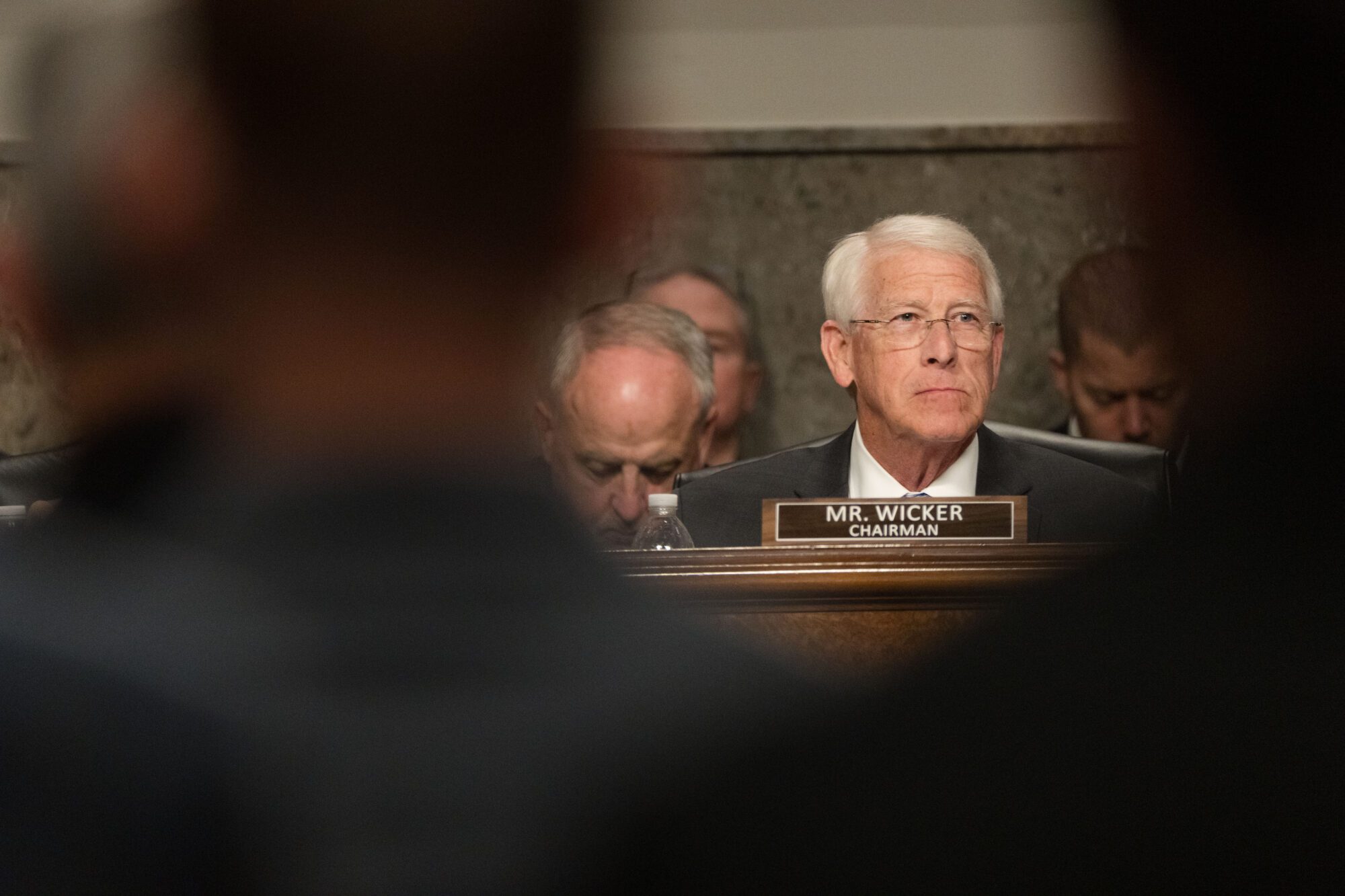

Mississippi State Senator Kevin Blackwell (R), chairman of the Senate Medicaid Committee, told Magnolia Tribune that President Joe Biden “wants changes on how states fund the non-federal share.”

“CMS wants more oversight on how we use provider taxes to fund our program,” Blackwell said. “Our [Mississippi’s] department of Medicaid is trying to figure out the impact of these changes.”

Senator Blackwell said he expects the change to be “costly” in terms of administration and “overly burdensome.” He also anticipated a reduction of funds that would be going to provide patient care.

In a letter signed by a group of Republican governors to President Biden, the state executives claim the changes are “overly prescriptive, administratively burdensome, and contrary to the interests of the Medicaid beneficiaries.”

The governors argued the change could reduce Medicaid funding by nearly $48 billion each year, directly impacting 49 states that utilize provider taxes in order to supplement their programs.

“Suffering most, would be states like Louisiana, Missouri, Texas, and Florida. Texas and Florida alone rely on provider taxes to support more than $8 billion and $2.6 billion, respectively, in critical Medicaid funding each year. Such reductions would harm critical healthcare systems serving our most vulnerable citizens, exacerbating disparities in care,” the letter states.

The letter was signed by the Governors of Georgia, Idaho, Iowa, Louisiana, Missouri, Oklahoma, Texas and Wyoming. Mississippi Governor Tate Reeves was not among them.

However, Cannon says provider taxes serve to push the burden of spending onto others, equating it to taxation without representation.

“There are neither any valid arguments for preserving provider taxes nor valid arguments against trying to eliminate them,” said Cannon. “Eight ostensibly conservative Republican governors are warning that the Biden administration’s efforts to restrict provider taxes would reduce Medicaid spending by $48 billion. That is a completely bogus argument.”

Cannon points to the fact that the federal government is already spending 32 percent above its collected revenue, and contends that if Medicaid is valuable to states, they should pay their portion of the expense.

“If these governors believe or know that they would not increase taxes to keep funding Medicaid at current levels, they are telling us that Medicaid is not popular enough to maintain at current spending levels,” said Cannon.

The balance between state and federal funding sources for Medicaid has been a frequent topic of conversation this session as the Legislature considers Medicaid expansion. Proponents have cited the economic impact of high levels of federal funding for states that expand, while opponents have argued that future changes to federal funding could leave states in a difficult fiscal position.

In both the House and Senate versions of Medicaid expansion, the funding mechanism for the state portion is a tax on managed care organizations (MCOs) that receive both state and federal Medicaid dollars in exchange for managing medical services to recipients.