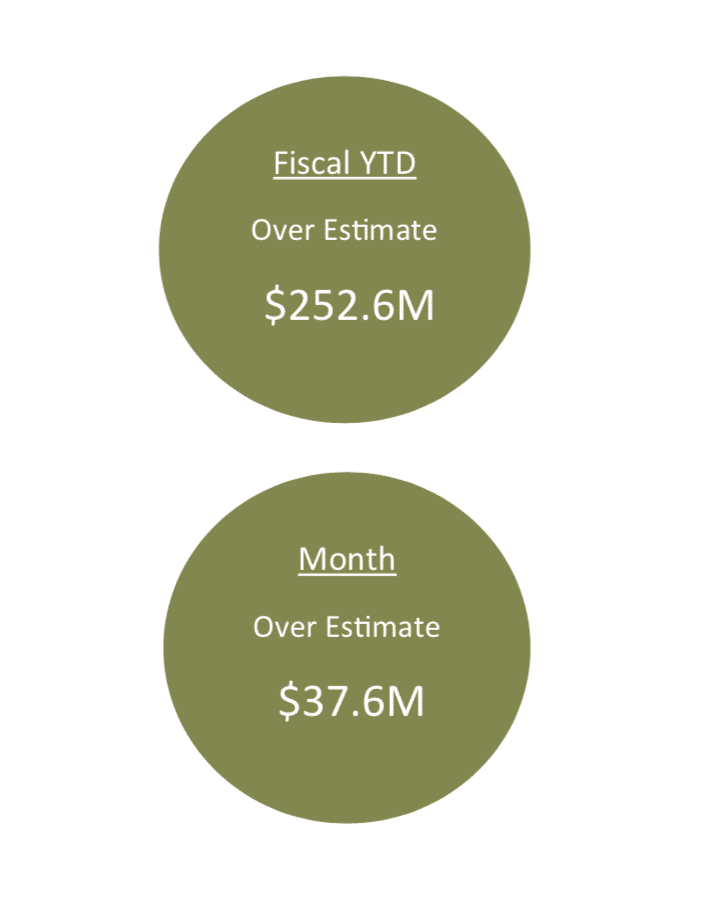

Total revenue collections for the month of May FY 2019 are $37,568,626 or 8.41% above the sine die revenue estimate. Fiscal YTD revenue collections through May are $252,559,226 or 5.12% above the sine die estimate. Fiscal YTD total revenue collections through May 2019 are $224,657,646 or 4.53% above the prior year’s collections.

On March 25, 2019, the Joint Legislative Budget Committee revised the revenue estimate upward by $125.3M. FY 2019 year-to-date actual collections are $162,146,226 above the year-to-date FY 2019 revised revenue estimate as of May 2019.

The graph above compares the actual revenue collections to the sine die revenue estimate for each of the main tax revenue sources. The figures reflect the amount the actual collections for Sales, Individual, Corporate, Use and Gaming taxes were above or below the estimate for the month and fiscal year-to-date. The graph also compares fiscal year-to- date actual collections to prior year actual collections, as of May 31, 2019.

May FY 2019 General Fund collections were $3,157,497 or 0.65% below May FY 2018 actual collections. Sales tax collections for the month of May were above the prior year by $13.5M. Individual income tax collections for the month of May were below the prior year by $29.8M. Corporate income tax collections for the month of May were above the prior year by $8.3M.

FY 2019_ Revenue Report_05-31-2019 by yallpolitics on Scribd