(Photo from Shutterstock)

- A year after approving $5 million to help Coast residents fortify their homes in hopes of lowering insurance rates, lawmakers suspended the program. Why? It depends on who you ask.

The Comprehensive Hurricane Damage Mitigation Program was established in 2007 within the Mississippi Insurance Department following Hurricane Katrina in 2005. However, legislative appropriations were never made to fund the program until the 2024 legislative session.

A year later, amid a tense budget battle between the House and Senate, funding for the program was suspended when the Legislature did not include it in the final appropriation bills. Much of the initial funds, Insurance Commissioner Mike Chaney (R) told Magnolia Tribune, have been placed in a trust fund “to ensure it does not end up in the state’s general fund.”

Now, with the Mississippi windpool facing a 16 percent increase come January 1, 2026, and the 20th anniversary of Hurricane Katrina bringing the issue back to the forefront for those on the Coast, the Mississippi mitigation program is in limbo.

Other states impacted by Katrina, as well as those that have faced storm losses in areas along the eastern U.S., have implemented robust mitigation programs aimed at strengthening and fortifying existing structures while raising building standards on the local level for new construction.

The goal is to show insurance companies that state and local governments are taking risk mitigation seriously in an effort to keep costs down for home and property owners seeking coverage.

Yet, Mississippi residents are left with officials pointing fingers as their insurance rates are on the rise.

How we got here

In a February 2024 op-ed, Insurance Commissioner Chaney pushed for the mitigation program to be statewide, saying that all Mississippians have the potential to be impacted by hurricanes, high winds and tornadoes.

READ MORE: Mississippi Home Mitigation Program Would Save Money, Property and Lives

“For every one dollar spent on mitigation, the average payback on the investment happens within 2.7 years. Mitigation makes communities more resilient following catastrophic events as it can lessen loss severity and allow homeowners to get back on their feet quicker,” Chaney wrote. “Research shows that fortified roofs reduce insurer loss severity by as much as 60 percent. Mississippi state law requires insurance companies to give discounts to people who mitigate their home to the Insurance Institute for Business and Home Safety (IBHS) standards, and insurers have filed discounts with MID ranging from 15 percent to 30 percent for those fortified homes.”

He noted that similar grants were available in Alabama, North Carolina, South Carolina and Louisiana.

When HB 1705 was passed and signed into law by Governor Tate Reeves (R) late in the 2024 session, the program was limited to the lower six counties. The bill appropriated $5 million to be transferred from the Mississippi Surplus Lines Association to the Comprehensive Hurricane Damage Mitigation Program Fund. Allowable uses for the funding included financial grants to retrofit properties.

Retrofit grants of up to $10,000 per approved applicant were to be used to encourage single-family, site-built, owner-occupied, residential property owners or commercial property owners to fortify their properties, making them less vulnerable to hurricane damage, the legislation outlined.

After nearly six months of training and program development within the Mississippi Insurance Department, the agency launched a “testing phase” to mitigate approximately 30 homes, far fewer than what lawmakers had hoped given the interest from residents.

The Insurance Department’s testing phase was to use the Insurance IBHS FORTIFIED standard for those homes in the program, which was to begin October 1, 2024. The homes selected during the testing phase were to be those whose owners had previously applied for roof mitigation through other mitigation grant programs but that were never mitigated due to the expiration of funding under those programs.

If successful in the testing phase, the agency anticipated a full rollout of the program during the first quarter of 2025, except it was halted given the failed re-appropriation process.

Coast senators express frustration

The Coast delegation at the state Capitol has pushed for years for a dedicated mitigation program, seeing firsthand the adverse impact insurance rates have had on residents and economic development prospects.

Yet, Coast lawmakers have also expressed concerns of having the Mississippi Insurance Department run the program, given that the agency’s mission is to regulate the insurance industry, not oversee construction projects, particularly in multiple parts of the state at once.

The lawmakers point to a previous attempt at having the Mississippi Emergency Management Agency (MEMA) oversee a similar effort nearly a decade after Katrina which largely proved unsuccessful. FEMA suspended federal reimbursements in 2016 for the $30 million program citing lax state oversight. The program was aimed at benefitting up to 2,000 homes but only 945 saw work, with cost overruns doubling estimates.

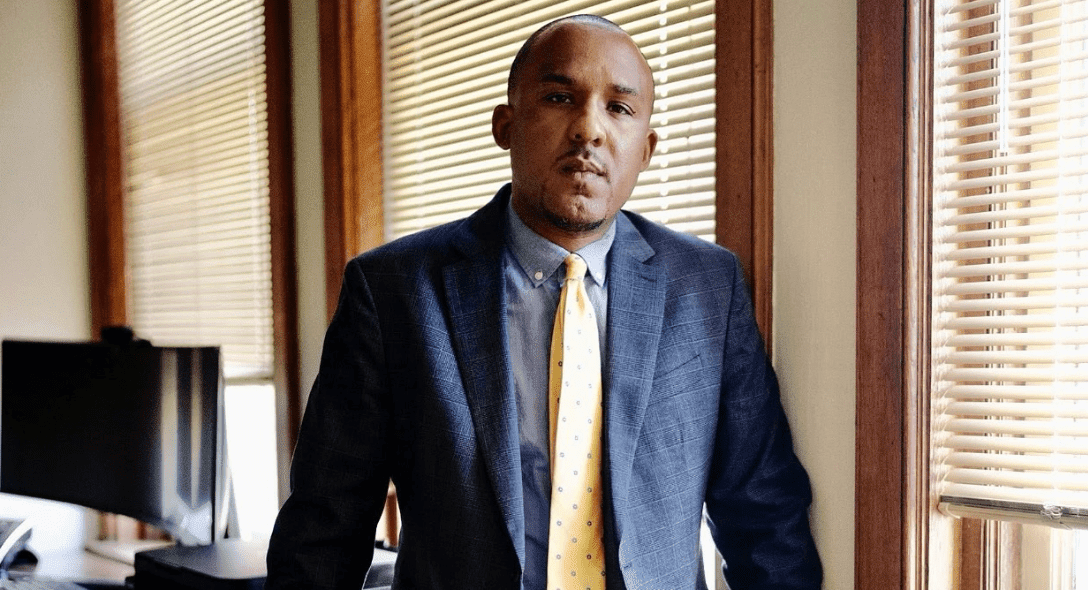

State Senator Scott DeLano (R) says the longtime Insurance Commissioner has provided very little tangible accomplishments to help South Mississippi mitigate against the rising costs of homeowner’s insurance. DeLano’s comments came on Friday as the state commemorated the 20th anniversary of Hurricane Katrina.

“I will not attend any Katrina services today,” DeLano wrote on Facebook Friday. “I have lived that event every single day for the last 20 years. Homeowner’s insurance issues were significant impediments to redevelopment then as they still are today.”

Fellow Coast State Senator Jeremy England (R) agreed with DeLano. England wrote on Facebook Friday that Mississippi is “lagging so far behind what other states have done to mitigate the rising costs of insurance.”

“Meanwhile, the one statewide elected official that could and should have been pounding the table with us on the Coast to address the insurance coverage problem is only interested in going on the radio and speaking to groups playing the blame game. Leaders don’t look to place blame; failures do that,” England wrote. “The Coast deserves better.”

In an interview on Tuesday, DeLano told Magnolia Tribune that mitigation “is the only way to see increased competition for homeowner’s insurance in our state.”

“What other states have done to be more competitive is to support a mitigation program, and the mitigation program is a balance between increased code standards so homes are built and rebuilt in a more resilient manner, and there is a function of monies provided by the state or insurance companies or someone to help offset the costs of the mitigation measures,” DeLano said.

He called the funding a “carrot” for homeowners to consider the upgrades while providing a push for local governments to buy into the effort by updating building codes.

Only the Legislature can require municipalities and counties to adopt IBHS Standards. Lawmakers have been reluctant to do so, at least at this point.

DeLano said the Insurance Commissioner could be making the case for local governments to take that step on their own, similar to what was done in Alabama. He said Alabama’s mitigation efforts have impacted roughly 70,000 homes with their Insurance Commissioner leading the charge.

Legislative wrangling

It appears legislative wrangling between the two chambers this year coupled with frustration with Insurance Commissioner Chaney ultimately resulted in the mitigation program approved in 2024 being suspended in 2025.

Commissioner Chaney, who was elected to lead the Insurance Department in 2007, told Magnolia Tribune on Tuesday that 28 houses were mitigated during the testing phase of the mitigation program before it was suspended.

Chaney said the authorization for the Insurance Department to spend the $5 million for the next fiscal year was in legislation initially vetoed by the governor, which was then brought back to the Legislature when they reconvened for the special session.

The Commissioner recalled that his office received a copy of the updated appropriation bill two hours before the special session started. That is when his staff noticed their ability to expend the funds was removed.

Chaney contends that he informed lawmakers of where he was on the program in January despite comments to the contrary from some lawmakers who have expressed frustration with the Commissioner over his handling of the effort. He said it was members of the Coast delegation that had a hand in suspending the funding, specifically Senator DeLano.

DeLano told Magnolia Tribune that the initial funding of $5 million in 2024 was “one time money” for Chaney to start the mitigation program, with the understanding that if the program was up and running in short order, lawmakers would discuss how to provide a sustainable funding source.

When the Legislature convened in January, DeLano said lawmakers saw the program was not meeting their expectations, especially after being told 1,000 homes could be mitigated in the fiscal year but learning that less than 30 were in process.

Frustration boiling over

Commissioner Chaney said the issue ultimately became “a spitting contest” and he set it aside to see what could be done to salvage the program for next year.

“Bottom line is, we had to tell a thousand people we can’t mitigate your homes,” Chaney said. “The Attorney General gave us an opinion that said you can’t spend the $5 million that’s in the trust fund… A thousand people who did not get their roofs mitigated are mad at the people on the Coast who voted to defund the program, and they’re calling their legislators.”

Senator DeLano said Chaney “wants to point the finger at everyone else for his failures,” adding that “the only solace that I can find is that [Chaney] is retiring in two years.”

In his social media post, Senator England went on to add, “Thankfully, we’ll have a new Insurance Commissioner in two years – and maybe then we can start to address the problem we’ve all had for so long. We need someone that works for US!”

Commissioner Chaney, now in his fifth term, has flirted with not seeking re-election and even asked lawmakers to make his position appointed. But when the Legislature balked at the proposal, Chaney told Magnolia Tribune at the Neshoba County Fair in July that he is considering another run in 2027.

What’s next?

The Mississippi Windstorm Underwriting Association board, who has not wanted to do mitigation over the last eight years, is now at the table as windpool rates are increasing, the Commissioner noted.

“The problem is, they got a cut of about $9 million [last session],” Chaney said, a reference to appropriation reductions.

The windpool relies on fees and unless specifically funded by the Legislature, has no reliable source of outside funding to attempt a mitigation program on its own. A large reason for the coming rate increase is a rollback of state subsidies that have kept rates low in coastal counties.

Chaney worries about the negative impact of the mitigation program drama, knowing insurance companies as well as reinsurers are watching the saga unfold.

“It’s a screwed-up mess,” he said.

“The odds of trying to get something passed now with everybody pointing the finger at the whodunits are pretty slim,” Chaney said. “The only thing we can do is hope the Legislature will give us the authority to spend the $5 million back in January.”

For lawmakers, some want to see a more concrete plan, even possibly the outsourcing of the operation of the mitigation program to a third party as has been done in other states.

Yet, until cooler heads prevail and state leaders agree to sit down to hammer out a way forward, the multi-million-dollar mitigation program nearly 20 years in the making sits on a shelf collecting dust.