- Kelley Williams says the inflation Reduction Act “boondoggles” seem to be irresistible to some elected officials.

In the 4th century St. Augustine, the Bishop of Hippo, famously prayed: “Lord, make me chaste – but not yet.” His prayer still resonates after 2000 years. Today some conservatives say: “I’m against President Biden’s inflationary Inflation Reduction Act boondoggles – except for my pet projects.” It’s hard to be virtuous when sinning is profitable and politicians encourage it.

That may be why conservative senators and congresspeople in other states are reported to be torn between supporting President Trump’s Department of Government Efficiency or their constituents’ pet Inflation Reduction Act boondoggles. This made me wonder about IRA boondoggles in Mississippi. So, I did some research with help from several Large Language Artificial Intelligence Models. I learned that there’s Inflation Reduction Act trouble right here in River City Mississippi. Its boondoggles seem to be irresistible.

A boondoggle can be defined as wasteful or impractical spending. The IRA seems designed with that in mind. It passed the Senate 51-50 on a tiebreaker by the VP and the House 220-207 on a party line vote. President Biden actually signed it into law (no auto pen) August 16, 2022. It earmarked some $370 billion for climate, energy, healthcare, and tax reform initiatives. Many Mississippi politicians were vocal skeptics and critics.

State Treasurer David McRae said the IRA wouldn’t curb inflation and would funnel money to “liberal elite pet projects” like solar power and electric vehicles. Senators Roger Wicker and Cindy Hyde-Smith voted against it. So did most Mississippi Congresspeople. They said it was a boondoggle that would burden taxpayers. This made IRA funded projects suspect – but nevertheless hard to resist when they deliver benefits for some Mississippi constituents. Almost all do. Let’s take a look.

The IRA includes the Rural Energy for America Program (REAP). It provides grants and loans to pay farmers for solar farms in soybean fields. Solar leases are more profitable than soybeans and are irresistible temptations for struggling farmers. Who will pay for abandoned solar farms 15 years from now promoted by bankrupt shell companies? As Scarlet O’Hara famously said in Gone with the Wind: “I’ll worry about that tomorrow.”

The IRA backs the Empowering Rural America (New ERA) program too. It hands out $9.7 billion to rural electric co-ops for clean energy projects. Mississippi has 26 co-ops serving over 800,000 customers. Clean energy projects include wind turbines, solar farms, heat pumps, etc. Critics say the projects are climate scold rat holes that don’t benefit most customers and can disrupt the grid. But they do provide benefits for a lucky few.

The IRA also offers $7,500 tax credits to buyers of electric vehicles and funding for charging stations. There were153 electric vehicle registrations in Mississippi in 2023.

There are 480 public charging stations in Mississippi including an Entergy Mississippi pilot project in Ridgeland to study the effects of charging stations on the electric grid.

Charging stations disruptive intermittent demand effects on the grid are already well known. Intermittent (unpredictable, variable) electric demands from charging stations have the same destabilizing effects on the grid as intermittent electric supplies from solar and wind. Variable electric demand and variable electric supply both cause power interruptions. Both increase the need for reliable backups from fossil fuels or nuclear – which increases electric rates.

All of these boondoggles are small and still in their early stages. Their future IRA funding is uncertain due to Department of Government Efficiency (DOGE) investigations. Their effects are harmful for many. But beneficiaries don’t want their funding cut. A few vocal beneficiaries speak louder than a majority that suffers in silence.

However, there is a big IRA project in Mississippi that’s further along and has support from Mississippi politicians – even though it may be a boondoggle on the scale of the Kemper County Lignite Plant. That’s the Amplify Cell Technologies battery plant in Byhalia, Mississippi (near Oxford). It too is driven by and is dependent on IRA clean energy incentives.

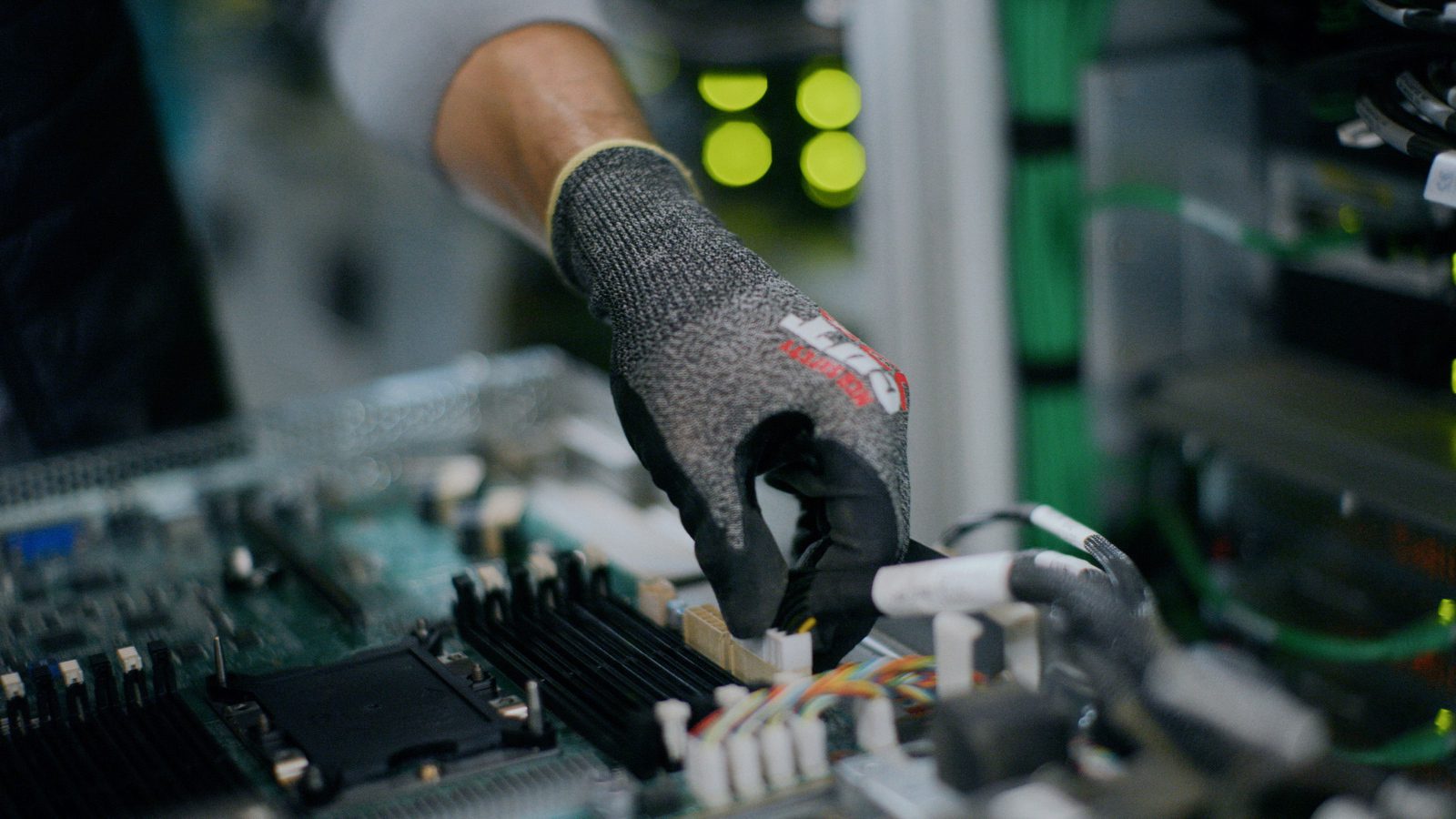

The project was announced in January 2024 with the promise of 2000 permanent jobs (average salary $66,000 per year) in 2027 when the plant is supposed to be producing lithium-iron-phosphate (LFP) batteries. Construction started last July. There are thousands of construction workers on site including many Mississippians. They are building a 2 million square foot factory to manufacture batteries for electric trucks.

In addition to the IRA incentives, the project has $1.9 billion of private investment from a consortium of private companies (Cummins, Daimler Trucks, and PACCAR) and a $365 million package of state goodies. Governor Reeves says the projected $130 million annual payroll will be the largest in Mississippi history. Will it become reality? What could go wrong? What are the risks?

The most obvious risk is that the President and DOGE pull the plug on IRA incentives. These include manufacturing tax credits of up to 10% of production costs and Electric Vehicle credits tied to domestic battery production. There’s also market risk that electric trucks can’t compete with diesel trucks. A diesel truck can haul 80,000 lbs. over 1000 miles on a single tank. Refueling takes 15 minutes at thousands of truck stops. A more expensive electric truck can run 300-500 miles on a single charge. Recharging takes an hour if you can find a charging station.

There’s an even bigger risk looming. It threatens IRA legislation, executive orders, and regulatory rulings based on the premise that carbon dioxide is a pollutant. The risk is that the EPA’s 2009 endangerment finding (i.e., carbon dioxide is a pollutant) will be overturned. That finding was an Obama era ruling. It’s in President Trump’s cross hairs. It’s a subject for another day that’s potentially a big-time game changer.

Meantime, there are probably more Inflation Reduction Act boondoggles in Mississippi in addition to those above. Many conservative Mississippians instinctively oppose them. Others may – but not yet.