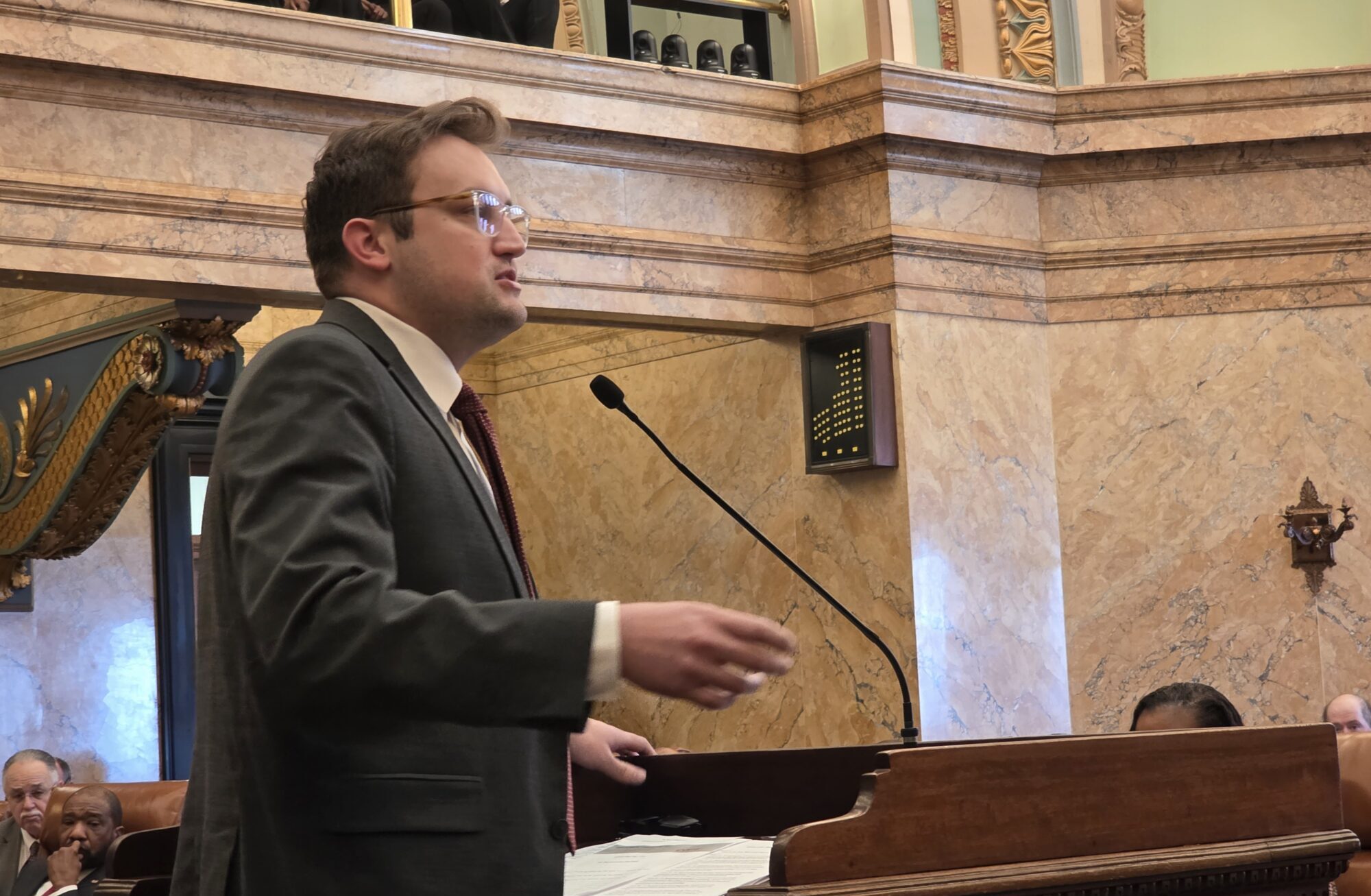

(Photo from Governor's 2024 EBR)

- Corporate tax collections came in over $146 million below estimates in December, sending year-to-date collections $80 million behind pace six months into the fiscal year.

Mississippi’s December tax receipts were 16 percent below projection, hindered mainly by corporate income tax collections that came in $146.6 million under legislative estimates. The December report sparked mixed reactions from state leaders.

During a news conference on Wednesday, Governor Tate Reeves (R) said the figures do not concern him.

“I don’t ever get concerned about one month of anything … it doesn’t make a trend,” the Governor said.

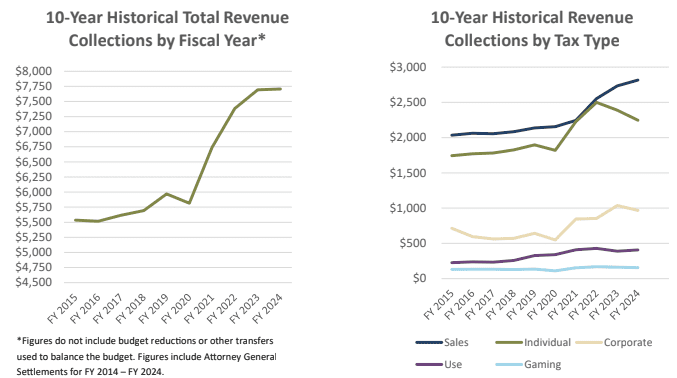

A committee of elected officials and economists annually estimate the revenue the state is projected to receive to plan a budget. The revenue estimate for the fiscal year that began on July 1 was for $7.61 billion in general fund revenue, or approximately $80 million more than the previous fiscal year estimate. With December’s decline, year-to-date collections are $80 million behind pace six months into the current fiscal year.

Governor Reeves questioned the reported corporate tax collection.

“Corporations have the ability to maneuver more so than most of us in terms of payment schedule,” he said, adding that “there’s nothing in our economy that suggests corporate income should be $100 million short.”

Other taxes, Reeves said, are meeting expectations.

House Speaker Jason White (R) told Magnolia Tribune that two recent changes in law, one that allowed certain limited liability companies to report “pass through” income as personal, instead of as corporate profit, and another that allows companies to fully deduct equipment expenses that in the past were subject to a depreciation schedule, could be impacting corporate tax collections.”

Overall, Speaker White said “folks are making money and we see sales tax trending up … because folks are spending money.” He noted that the state is “only $80 million off, six months in on a $7 billion-plus budget, and that’s a budget that’s got almost three-quarters of a billion dollars that’s not spent.”

The Department of Revenue’s annual reports show total tax transfers in FY 2019 were $8.340 billion for both general fund and special funds. Last fiscal year, in 2024, total transfers were $10.973 billion – a 32% increase. General fund transfers went from $5.774 billion in FY 2019 to $7.342 billion in FY 2024 – a 27% increase. Sales and use tax revenue transfers went from $3.621 billion to $5.070 billion – a 40% increase.

According to State Economist Corey Miller, two factors are primarily responsible for the stark decline in corporate taxes. One is that corporate profits were down in the third quarter of 2024, and the other is the changes in the state’s depreciation law as alluded to by Speaker White.

Mississippi was part of the national trend when corporate profits dipped during the third quarter of last year. Corporate profits, according to the U.S. Bureau of Economic Analysis, dipped by 0.04 percent during the third quarter. In Mississippi, corporate tax returns are not public records, according to the Department of Revenue.

Miller explained that several corporations opted to use a state law change, allowing companies to fully expense equipment rather than spreading the deduction over multiple years. The law, passed in 2023, enabled companies that make certain capital investments to immediately count the full cost as a business expense instead of using a depreciation schedule on the equipment purchased.

Still, some state leaders are advising fiscal restraint as lawmakers prepare to craft the next state budget.

The office of Lt. Governor Delbert Hosemann (R) said December’s revenue numbers should serve as a “yellow light” for lawmakers to cautiously make fiscally responsible, conservative decisions with the state’s expenditures or tax cuts.

While December’s reported revenues was $106,743,940 or 15.92% below estimates, there were areas that beat projections. The individual income tax came in $15.6 million above the prior year’s collection even with the 2022 income tax cut. Slight jumps were seen in use tax and gaming tax, both at $600,000. Sales tax receipts were $4.7 million below the forecast during the month but exceeded the prior year’s collections by $3.2 million.