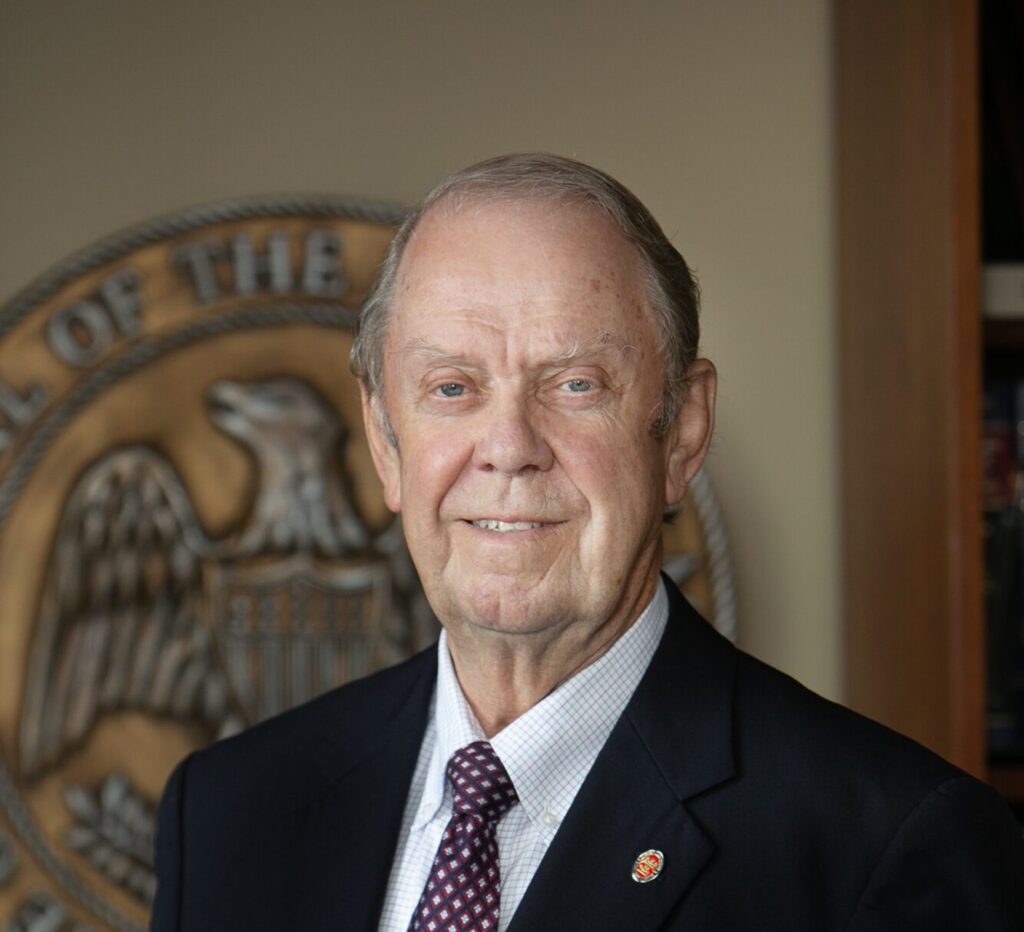

- Commissioner Mike Chaney says increases are mostly due to inflation and the rising cost to replace a home if substantial damage occurs.

Many homeowners in Mississippi have seen increases in their insurance rates recently, but the reasons are not as simple as some may assume.

Insurance Commissioner Mike Chaney (R) said the increases are mostly due to inflation and the rising cost to replace a home if substantial damage occurs. However, this year his office did approve a roughly 16 percent increase for those that operate under his umbrella, which includes admitted companies.

Chaney explained that admitted companies are controlled to a limited degree by the Mississippi Insurance Department, while non-admitted and surplus line companies can set any rate they wish. He added that the number of non-admitted companies writing policies for businesses in Mississippi increased after Hurricane Katrina in 2005.

What may surprise most Mississippi residents is that the highest rate increases are being seen in areas that are not along the Gulf Coast.

“The largest increases are occurring above the lower six counties and most of them are occurring in the areas where you have hail damage by zones,” Chaney described.

That area includes the areas north of Hattiesburg and across central Mississippi through Jackson and up to Madison over to Meridian, among other areas.

For those policies with surplus lines, at least a 3 percent fee is collected that is provided to the state’s wind pool.

“Most of those fees are sent to the wind pool to keep rates artificially low on the Gulf Coast,” Chaney said.

The fees and taxes collected last fiscal year totaled about $30 million, of which about $23 million was provided to the Mississippi Wind Pool. Another portion is used to help bring fire insurance rates down by providing equipment and trucks to fire departments, a move that lowers an area’s fire rating and subsequently insurance rates, Chaney said.

Whatever is not used to cover losses or purchase re-insurance is put into a surplus account. Commissioner Chaney said that account totals about $400 million at present. The idea is to have enough to cover a third of the insurance companies’ probable maximum losses for a one in 250-year storm.

Due to the previously mentioned surplus lines fee, Chaney said about 60 percent of the fees paid into the wind pool come from outside of the Gulf Coast.

“The bottom line is the Gulf Coast has been subsidized since 2008 by residents of the northern part of the state that pay surplus lines and fees,” Chaney elaborated.

At some point the subsidization needs to end, Chaney believes, but he said that is up to the Legislature.

Admitted companies under the Mississippi Insurance Department have not been granted a major rate increase since 2008, but three years ago Chaney’s office allowed for a 3 percent increase in zones A and B as well as a decrease in zones C and D along the six coastal counties, effectively equating to a flat rate across the area.

This past year another rate increase was approved as an inflation guard. Commissioner Chaney said the insurance companies asked for a 50 percent increase for businesses and a 33 percent increase for homeowners, but he approved an average of a 16 percent increase, which people would have noticed over the past 2 to 4 months.

Chaney added that it was the first increase he has approved since he took office in 2008, not counting the increases that occurred for the cost to replace a home. However, there have been larger increases from companies the Mississippi Insurance Department does not control.

“This is important to understand because you always hear, ‘Rates have gone out of sight on the coast,'” Chaney said. “They have if you have been buying from surplus lines, but that is the agent’s job, who you buy your insurance from. They may need to put you in the wind pool instead of into a surplus lines company.”

As such, Chaney’s office suggests shopping around and considering a higher deductible to help lower the cost of home insurance.

Other suggestions include making improvements to the home, including the installation of hurricane straps from the roof to the walls, hurricane shutters, and even building homes at a higher elevation. According to a recent release from Chaney’s office, state law mandates insurance companies provide discounts to homeowners who make mitigation efforts that meet the standards under the Insurance Institute for Business and Home Safety.

To help bring rates down, Chaney said his office has been trying to implement a mitigation program that could help homeowners get those discounts. The Commissioner pointed to the Legislature providing about $5 million for the Comprehensive Hurricane Damage Mitigation Program during this year’s legislative session. The grant-based program is expected to start in August of this year but is limited to the six coastal counties, Chaney added. For more information on that program, visit here.

Other ways to reduce insurance costs is to bundle home and automobile insurance policies with the same insurance company.

“However, you should make sure that the premiums with the discount do not total more than if you bought policies from different companies,” the Insurance Department cautions.

For other tips to decrease insurance policy costs, visit the Mississippi Insurance Department.

Editor’s note – This story has been updated to reflect the increases have been seen over the past four months, not 24 months and the surplus account for the Wind Pool is to cover losses for a 250 year storm, not 50 year storm.