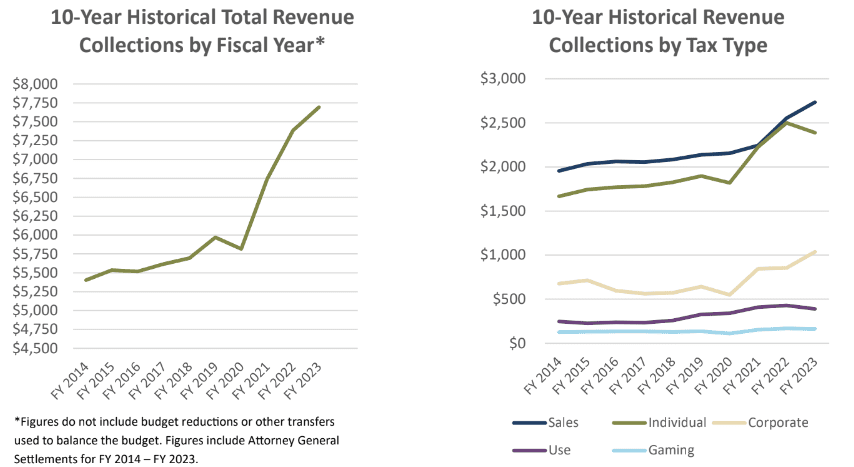

- With one month remaining in the fiscal year, tax collections are up $134.8 million above annual estimates. Sales tax continues to be a bright spot, while overall revenues continue to adjust to the income tax cut of 2022.

Revenues continue to adjust to new fiscal realities in Mississippi as the state phases in the largest tax cut in Magnolia State history.

The Legislative Budget Office released the May state revenue report on Wednesday showing Mississippi tax collections are up $134.8 million for the year with one month remaining in the fiscal year. A new fiscal year begins on July 1st.

However, the month of May came in $51 million below the sine die revenue estimate, a number that could without context give onlookers pause. Yet, as Lt. Governor Delbert Hosemann (R) told Magnolia Tribune, it’s one month out of a fiscal year.

“One month is not necessarily an indication of the entire year,” Hosemann said. “We continue to monitor revenues and stay prudent and cognizant of the state’s financial obligations.”

The Legislature passed and Governor Tate Reeves (R) signed into law a $525 million tax cut plan in 2022 which eliminated the 4% income tax bracket and phased down the 5% bracket to 4% over a three-year period. Most of the May decline is a result of reduced individual income tax collections from that tax cut.

General Fund collections for May this fiscal year were $42.7 million less than the previous fiscal year’s May numbers, with individual income tax collections down $24.5 million and corporate income tax collections down $12.9 million year-over-year for the same month.

With one month remaining in the fiscal year, individual income tax collections are down $155.7 million over the prior year as Mississippians are keeping more of their earned income.

Sales tax revenue continues to be a bright spot, with collections for the month of

May above the prior year by $6.5 million and up year-over-year by more than $78 million.

Overall fiscal year-to-date collections for eleven months into the current year are down $17.9 million over the prior year.

Governor Reeves and Speaker Jason White (R) have both expressed the desire to continue to phase out the state’s income tax, the goal being to eliminate it entirely. Reeves put forward an aggressive plan in his Fiscal Year 2025 Executive Budget Recommendation earlier this year, yet lawmakers did not act on the proposal during the 2024 session.

But all hope is not lost for those wishing to explore future cuts as Speaker White announced in late May that he was appointing a Select Committee on Tax Reform to study a path to eliminate the “tax on work.” He has said the idea is to provide a recommendation next session to “move away from personal income tax and moving more toward a consumption model.” White announced appointments to the House committee last week.