While health insurance rates across the nation are rising, some Mississippians may be looking at level or lower rates in 2024.

Over the last several decades, healthcare costs have been on the rise across the nation. With another open enrollment season kicking off this month, Americans are wondering if those costs will continue to rise.

Experts point to the rising cost of healthcare, creation and utilization of programs like Medicare, Medicaid, and the Affordable Care Act (ACA) as reasons insurance costs continue to rise yearly.

According to Health Systems Tracker, it is estimated that 2024 will produce premium rate changes among 320 reviewed ACA marketplace insurers. The increases are anywhere from 2% to 10% higher than 2023’s rates with an increase of 6% being the median.

The American Medical Association (AMA) reported that healthcare costs are rising by 4.5% yearly and spending increased in 2019 by 4.6% or $3.8 trillion. This comes to roughly $11,583 per person.

On average, health insurance is costing an American family $22,463 annually and an individual $7,911. That is a 20% family premium increase since 2017 and 43% since 2012, according to the Kaiser Family Foundation. This amount does not account for potential employee contributions.

The data indicated 104 providers planned to increase up to 5% and 99 between 5% and 10%. These increases could result in higher federal spending on subsidies since most enrollees in the market receive such assistance.

However, for Mississippians, there could be some relief for rates moving into 2024.

“Rates appear to be neutral or even a little bit lower when you take all the rate requests in aggregate. Some small group rates will go up, but it appears to be nothing significant,” said Commissioner of Insurance Mike Chaney.

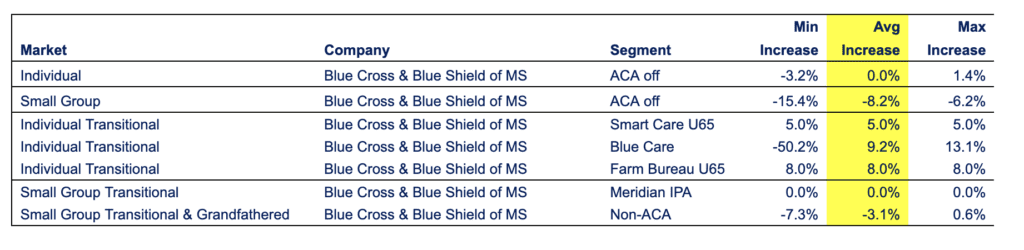

Blue Cross Blue Shield, which controls roughly 80% of the private market in Mississippi, will send out lower rates this year in select segments. Those are set to go into effect by October 15th.

Commissioner Chaney said Medicare rates have gone up slightly, based on who is and is not in someone’s network. For other companies like Magnolia, United, and Centene, rates are expected to stay roughly the same as last year.

“A couple of ACA (Affordable Care Act) folks had to lower their rates because of the medical loss ratio,” said Chaney.

Health insurance coverage typically includes preventative services, screenings, vaccinations and some check-ups. Customization to a plan can also include emergency services, maternity care, and prescription drugs.

Dental and vision coverage are separate from a standard health insurance comprehensive plan.

Many insurers indicated they are expecting broader economic inflation to put upward pressure on premiums. The COVID pandemic has left some lingering uncertainty as to what will happen with the future of healthcare. However, it is anticipated that more normal levels of usage to return since 2020’s drop in utilization.

Because Medicaid is unwinding policies from the pandemic, insurers do anticipate roughly 3.8 million people will be taken off of those rolls, leaving them to look for health insurance with other providers.