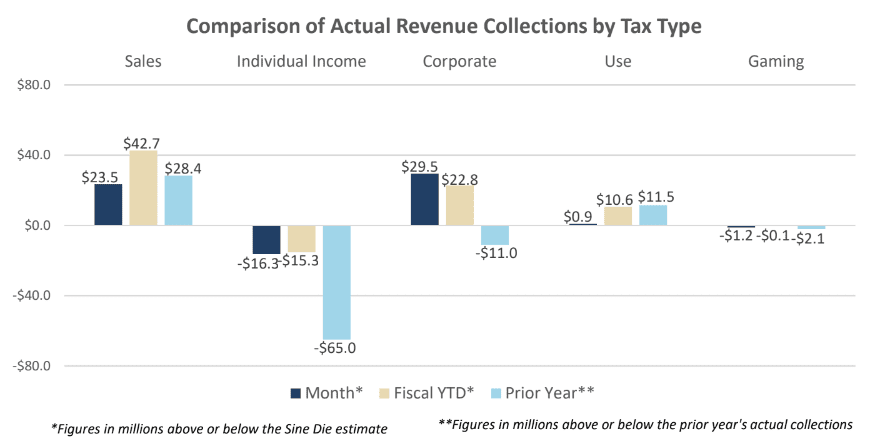

The impact of the 2022 individual income tax cut is being felt in Mississippi revenue collections, with income tax collections down nearly $38 million year over year. However, overall state revenue continues to exceed estimates.

Mississippi revenues rebounded in September after coming in below legislative estimates in the month of August.

According to the latest revenue collections report from the Mississippi Legislative Budget Office, state revenue collections for the month of September were $43,700,240, or 6.63% above the sine die revenue estimate for Fiscal Year 2024.

In August, the second month of the fiscal year, revenue collections came in $3 million below estimates. It was the first time monthly collections did not meet estimates since May 2020, according to LBO staff.

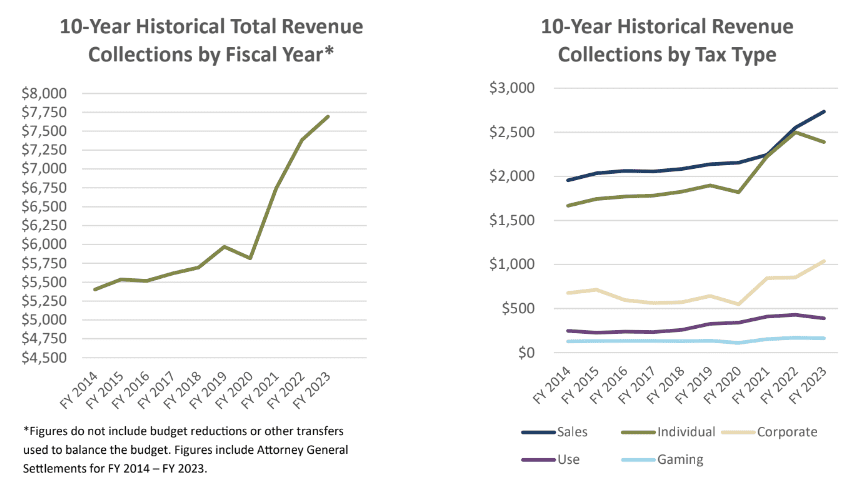

September’s revenue report shows Fiscal Year-to-Date revenue collections through September 2023 are $85,802,005, or 4.93% above the sine die revenue estimate. The total revenue estimate for the 2024 Fiscal Year is $7,523,800,000.

However, for the first three months of the current fiscal year, total collections are nearly $19 million, or just over 1% below the prior year’s collections for the same period.

The September report shows sales tax collections up year over year by $11.6 million. Corporate income tax collections were also up for the same month in the prior year by $2.3 million.

But individual income tax collections for the month were down $37.6 million from the prior year. Lawmakers who spoke with Magnolia Tribune last month said this is by design, attributing the reduction in individual income tax collections to the cut in income taxes for Mississippi taxpayers approved by the Legislature and signed by Governor Tate Reeves in 2022.

State Senator Briggs Hopson, Senate Appropriations Chairman, said in August that the reduction in income tax collections is certainly no surprise as the 2022 tax cuts are beginning to be implemented.

Overall, Fiscal Year 2024 General Fund collections were $17,954,050, or 2.49% below the prior year’s actual collections.