Inflation, federal policies are impacting oil and gas prices and consumer wallets across the Magnolia State with no end in sight.

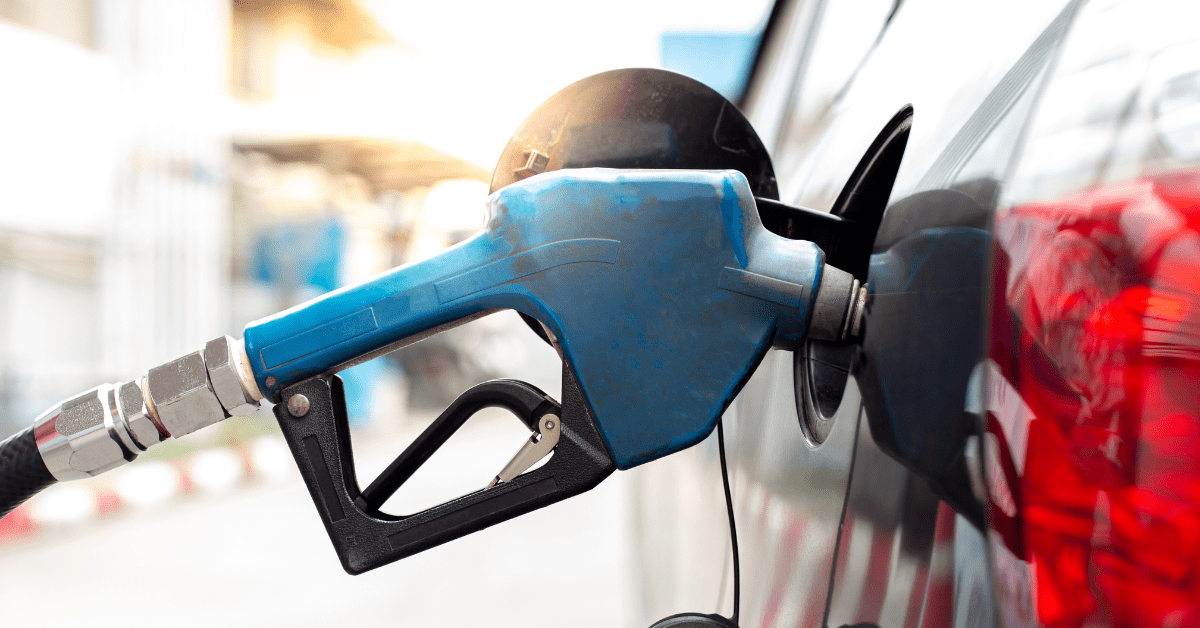

Whether at the pump or paying your home’s utility bill, Mississippians are feeling the strain on their wallets due to rising energy costs.

According to the recent U.S. Energy Information Administration (EIA) short-term energy outlook, oil prices are up from June.

While gas prices are still lower during this quarter than they were at the same time in 2022, customers have seen an increase. The third quarter of 2023 had gas prices averaging at $3.69 per gallon with an average season price of $3.63. Diesel fuel retail price is averaging $3.99 for the season. The Brent Crude Oil spot price averaged $85 a barrel in August.

Industry leaders say the increase in prices has been impacted primarily by extended voluntary cuts from Saudi Arabia on their crude oil production.

On Wednesday, the Biden Administration announced that it was canceling all remaining oil and gas leases issued under the Trump Administration in the Arctic Refuge. The White House says it is being done to protect more than 13 million acres in the Western Arctic.

It’s anticipated that these factors, along with others, will continue to reduce global oil inventory and put pressure to raise oil prices in the coming months.

James Heidelberg, Vice Chairman of the Mississippi State Oil and Gas Board, says the expectation in the state is that energy and gasoline costs will not be moderating anytime soon. He pinpoints the issue on bad federal government policy in an attempt to force “green energy” initiatives.

“Our government has a policy of increasing costs in oil and gas because they believe it will drive us to make more electric vehicles. I think that is a terrible way to make policy,” said Heidelberg. “I don’t know anyone who doesn’t want clean air and clean water, but I think we’ve gone a little overboard.”

Heidelberg emphasized a need in the market to invest in an array of energy, instead of one focus. He said if those investments are made on practical terms, the technologies can be developed without causing a huge inflationary issue for consumers.

He anticipates gas prices to again reach $4.00 by the end of 2023.

In 2021, Congress passed a $4.7 billion fund that was aimed at cleaning up what are considered “orphaned oil wells.” Lawmakers estimated there were over 800,000 that existed across the U.S. Most recently, the Biden Administration has pushed for new bond rules on oil and gas leases. The draft legislation would change the minimum $10,000 in new bonds to $150,000. It also increases the current $25,000 for blanket bonds, which cover all drilling in a single state, to $500,000. The Administration is also proposing eliminating blanket bonds for drillers nationally.

Heidelberg said these increased regulations on oil production in the United States has forced the country to rely more heavily on foreign markets that are limiting their supply causing prices to increase.

Global production is expected to increase by 1.4 million barrels a day in 2023 and by 1.7 million in 2024. That includes an increase by 1.2 million for 2023 by non-OPEC countries, which includes the United States.

Natural gas production is also expected to average 104 billion cubic feet per day through the end of 2024, compared to 103 bcf/d last year. This is related to the increase in oil prices.

The need for energy has also increased during the summer of 2023. Hot temperatures have plagued Mississippi and other Southern states in July and August. Electricity sales across the U.S. totaled 388 billion kilowatt hours in July, which was roughly equal to July and August sales in 2022.

“Energy costs are involved in everything you do, every product you purchase is based on these resources. It is a ripple effect,” said Heidelberg. “Inflation is very real, but I think anyone that deals in the market understands that the cost of everything has increased dramatically.”

While solar power and wind energy initiatives are moving forward, Heidelberg said it is very unlikely that there will be a current generation that sees the removal of petroleum-based energy in their lifetime. He used the example of electric cars, which rely on charging stations (and some gasoline) to function. While those cars may not be plugged into a wall, they are getting that electricity from somewhere which has increased demand and raised costs. Adversely, the nation continues to shut off and shut down coal refineries.

Heidelberg says these methods are just an energy transfer.

Besides gas and energy, petroleum is a derivative found in nearly every material encountered on a daily basis like cement, plastic and lubricants.

“There are some very smart people working on alternative energy production. It sounds great, but it’s just not efficient enough right now,” he said. “We need more energy in the U.S. at a fair cost.”

Heidelberg believes that the free market will correct itself if given the opportunity.

While increased costs have impacted consumers, the state of Mississippi is rising to meet the demand. The increased cost of oil has allowed the state to produce more by utilizing more wells that were previously not utilized because it was not financially sound when gas prices were lower.

Mississippi is ranked as number 12 in the U.S. based on Barrels of Equivalent (BOE) produced through April of 2023. The state has a total of 34,807 wells which is up from last year, with 2,663 producing. In those, 1.2 million BBL of oil have been produced in the state as of April 2023. In comparison, the leader of oil production in the U.S. is Texas, at 126.8 million BBL this year.