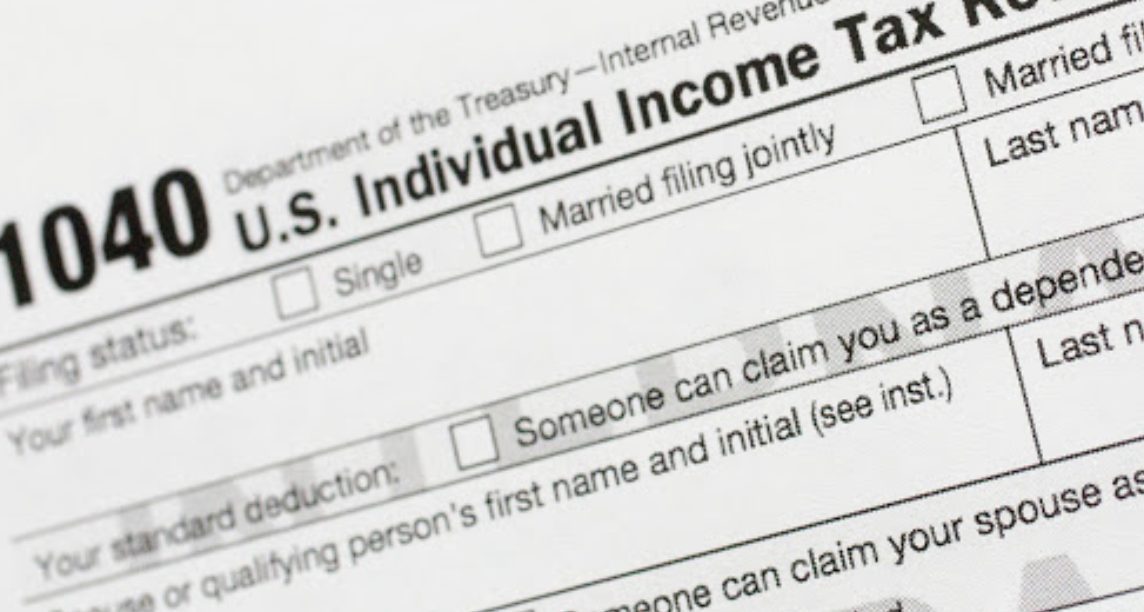

Individuals and businesses in Carroll, Humphreys, Monroe and Sharkey counties now have until July 31 to file their taxes instead of April 18.

The Internal Revenue Service (IRS) announced on Tuesday that those Mississippians impacted by the tornadoes and severe weather that ripped through the state on March 23 and 24 will have until July 31, 2023, to file various individual and business tax returns and make tax payments.

Given the federal disaster declaration issued by the Federal Emergency Management Agency (FEMA) approved by President Joe Biden, individuals who reside or have a business in Carroll, Humphreys, Monroe, and Sharkey counties qualify for the extended tax relief.

According to the IRS, affected individuals and businesses will have until July 31 to file returns and pay any taxes that were originally due during this period. This includes 2022 individual income tax returns which are due on April 18, as well as various 2022 business returns normally due on April 18.

The July 31 deadline also applies to any payment normally due during this period, including quarterly estimated tax payments, quarterly payroll and excise tax returns. In addition, penalties on payroll and excise tax deposits due on or after March 24, 2023, and before April 10, 2023, will be abated as long as the tax deposits are made by April 10, 2023.

The IRS notes in their announcement that if an affected taxpayer receives a late filing or late payment penalty notice from the IRS that has an original or extended filing, payment or deposit due date that falls within the postponement period, the taxpayer should call the telephone number on the notice to have the IRS abate the penalty.

However, the IRS does encourage affected taxpayers to file for an extension electronically by April 18 if the taxpayer feels more time is needed to complete the tax return before the July 31 deadline.