January’s revenue alone was $77.2 million over legislative estimates.

As Mississippi lawmakers start the appropriations process in earnest this session, the question of what the state does with its extra revenue will be among the most hotly debated topics at the Capitol.

The talk has mostly centered around whether to give taxpayers a one-time rebate or fully eliminate the state individual income tax.

Today’s report from the Joint Legislative Budget Committee will surely fuel that debate.

The report says that Mississippi revenue collections for the month of January 2023 are $77,243,229 or 15.10% above the sine die revenue estimate.

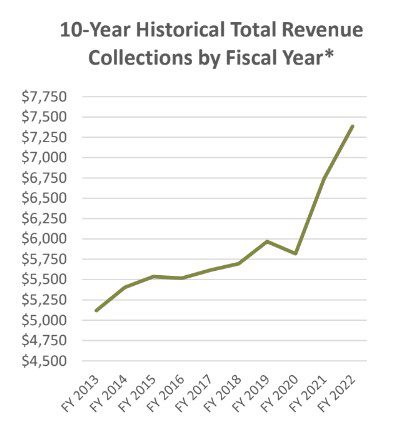

That brings the fiscal year-to-date revenue collections through January to over half a billion dollars – $502,055,666 or 13.25% – above the sine die revenue estimate.

Revenue collections through January 2023 are $363,604,438 or 9.25% above the prior year’s collections.

The total fiscal year 2023 sine die revenue estimate was $6,987,400,000.

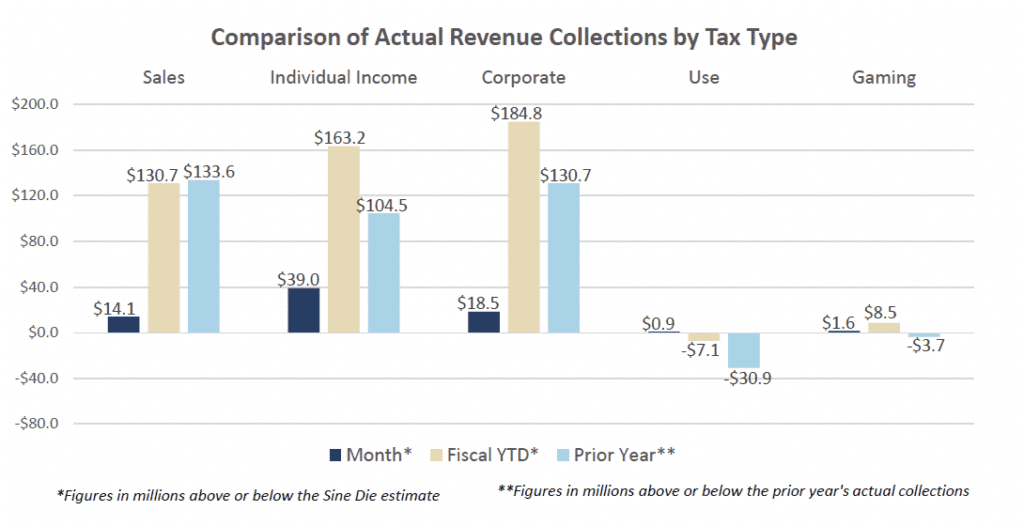

The graph above compares the actual revenue collections to the sine die revenue estimate for each of the main tax revenue sources. The figures reflect the amount the actual collections for sales, individual income, corporate, use and gaming taxes were above or below the estimate for the month and fiscal year-to-date. The graph also compares fiscal year-to-date actual collections to prior year actual collections, as of January 31, 2022.

Overall, January 2023 General Fund collections were $29,423,849 or 5.26% above January 2022 actual collections.

Sales tax collections for the month of January were above the prior year by $8.1 million. Individual income tax collections were above the prior year by $3.9 million and corporate income tax collections were above the prior year by $14.4 million.