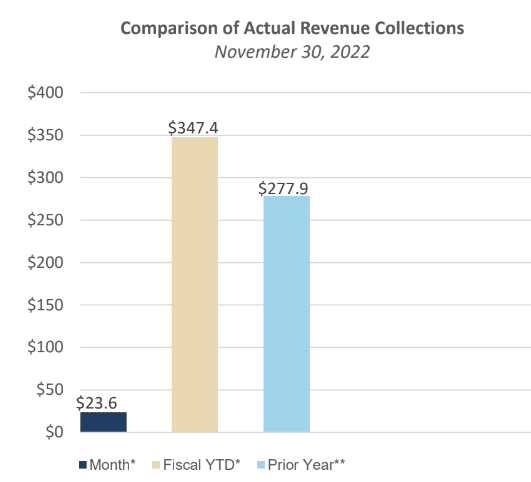

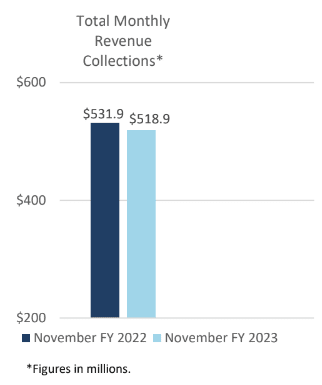

The state collected $13 million less than the same month last year, yet still remains $347.4 million above fiscal year-to-date estimates.

While Mississippi state revenue collections outpaced legislative estimates for the month of November in the current Fiscal Year 2023, there are signs that the economy is cooling.

The Joint Legislative Budget Committee reported on Wednesday that the total revenue collections for the month of November FY 2023 are $23,580,341 or 4.76% above the sine die revenue estimate.

Fiscal year-to-date revenue collections through November 2022 are $347,353,944 or 12.91% above the sine die revenue estimate.

Fiscal year-to-date total revenue collection through November 2022 is $277,948,770 or 10.07% above the prior year’s collections.

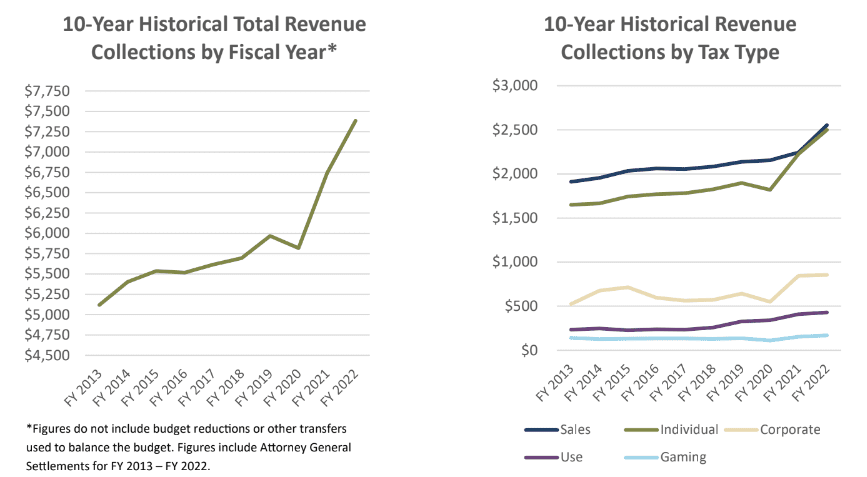

The FY 2023 Sine Die Revenue Estimate is $6,987,400,000.

However, the November FY 2023 General Fund collections were $13,081,704 or 2.46% below November FY 2022 actual collections.

In addition, individual income tax collections for the month of November were below the prior year by $14.9 million, and corporate income tax collections for the month of November were below the prior year by $9.7 million.

Even still, sales tax collections for the month of November outpaced the prior year by $7.3 million.

The U.S. economy continues to be plagued by a nearly 40-year high inflationary period driving up the cost of goods and services and making personal incomes not stretch as far as purchasing power is restricted and rates are increased by the Federal Reserve in an attempt to stave off a deepening recession.

Over the past 10 years, Mississippi has seen an unprecedented increase in its state revenues, largely fueled by sales and individual income tax collections.

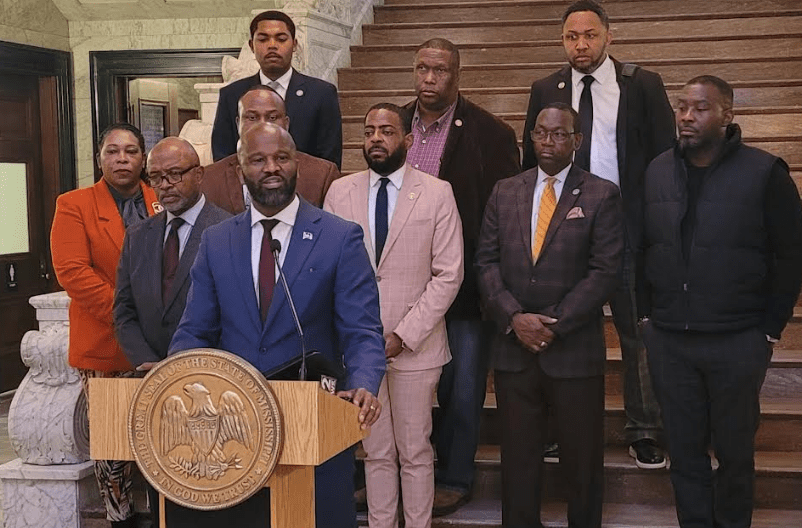

Lawmakers met earlier this week to adopt the FY 2024 state revenue estimate of $7.5 billion, outlining plans for state support funding that included maintaining the 2% set-aside in the General Fund, strengthening the state’s financial reserves, and building a budget using only recurring funds while increasing state support for many budget lines.

READ MORE: Joint Legislative Budget Committee sets FY 2024 revenue estimate at $7.5 billion, outlines state funding

Governor Tate Reeves and Speaker of the House Philip Gunn hope to find support in the 2023 legislative session to fully eliminate the personal income tax in Mississippi after having to compromise on a reduction in the income tax last session as opposition in the State Senate advised caution.