Revenues continue to climb two months into FY2023, nearly 15% over estimates in August alone.

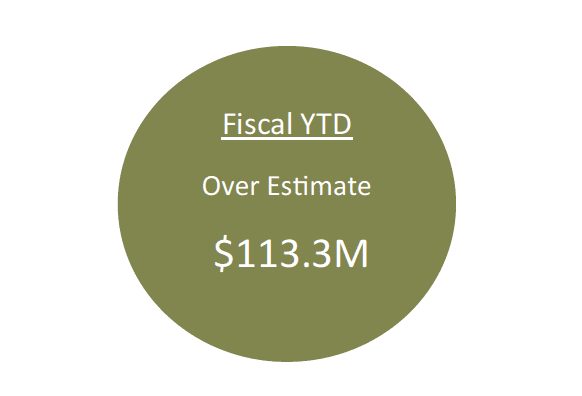

Total revenue collections for the month of August FY 2023 are $68,604,272 or 14.25% above the sine die revenue estimate. Fiscal YTD revenue collections through August 2022 are $113,279,985 or 11.19% above the sine die revenue estimate. Fiscal YTD total revenue collection through August 2022 are $90,531,440 or 8.74% above the prior year’s collections. The FY 2023 Sine Die Revenue Estimate is $6,987,400,000.

As of August 31, 2022, total revenue collections for FY 2022 were $7,386,706,687. When compared to the total General Fund appropriations for FY 2022 of $5,818,968,025, the General Fund will end the fiscal year with an estimated excess of $1,578 million including re-appropriations.

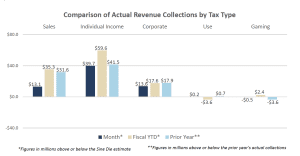

The graph above compares the actual revenue collections to the sine die revenue estimate for each of the main tax revenue sources. The figures reflect the amount the actual collections for Sales, Individual, Corporate, Use and Gaming taxes were above or below the estimate for the month and fiscal year-to-date. The graph also compares fiscal year-to-date actual collections to prior year actual collections, as of August 31, 2022.

August FY 2023 General Fund collections were $48,019,332 or 9.57% over August FY 2022 actual collections. Sales tax collections for the month of August were above the prior year by $12.5M. Individual income tax collections for the month of August were above the prior year by $23.7M. Corporate income tax collections for the month of August were above the prior year by $12.3M.