Miss. Senators join colleagues to introduce legislation to boost economic development in rural, minority, & low-income communities.

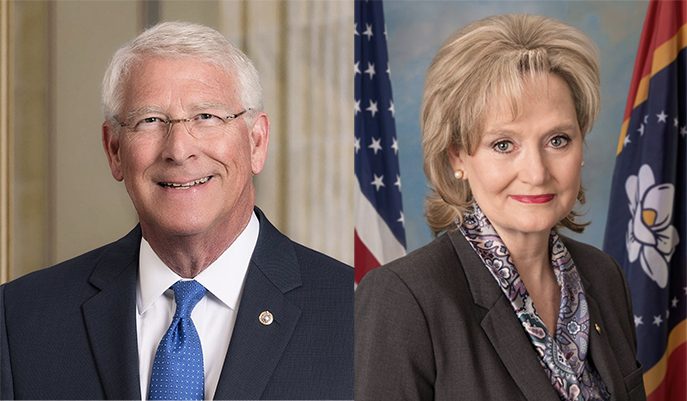

Last week, U.S. Senators Roger Wicker (R-MS) and Cindy Hyde-Smith (R-MS) joined Senators Mark Warner (D-VA) and Chris Van Hollen (D-MD), in introducing the Community Development Investment Tax Credit Act (S.4418).

The legislation would promote economic development in rural, minority, and low-income communities.

According to a one-page summary of the legislation, S.4418 would do the following:

- Credit: The bill would provide a 3% credit for the first 10 years of a qualified investment in a CDFI, 4% for the following years, up to a maximum of 10 years. There is a 1% increase in the credit for equity or equity equivalent investments.

- Qualified investments: The bill provides the tax credit for qualified investments in CDFIs including equity investments, loans with a minimum term of 10 years, and equity equivalent investments for CDFI loan funds. Institutions receiving the investment must be a qualified CDFI.

- Limitation: The total credit available is capped, starting at $1 billion for 2022, $1.5 billion for 2023, and $2 billion for 2024 and each year thereafter adjusted for inflation.

- Allocation: To receive an allocation, eligible CDFIs are required to apply through the Fund. The bill directs the fund to allocate the credit based a CDFIs’ past performance and ability to attract private capital. It also ensures small CDFIs and institutions and rural areas will benefit from the new resources.

Senator Wicker said that small businesses, including those in low-income and minority communities, are a pillar of the economy in Mississippi and across the nation.

“CDFIs support businesses, individuals, and entrepreneurs by providing access to capital and alternatives to predatory loans in low-access areas. I am glad to join my colleagues on this bipartisan measure to create an additional tax credit to support and expand this private-sector investment,” Wicker said.

Senator Hyde-Smith noted that CDFI investments are a critical source of capital for small business growth in many Mississippi communities and around the country.

“This bill would create a tax credit structure to attract greater private-sector investments in CDFIs, which would increase their ability to spur more long-term growth in disadvantaged areas,” Hyde-Smith said.

This legislation has the support of a number of organizations, including Community Development Bankers Association, National Association of Affordable Housing Lenders, Community Development Venture Capital Alliance, LISC, Opportunity Finance Network, CDFI Coalition, Inclusiv, and the Enterprise Community Loan Fund.

“OFN applauds Senators Warner and Wicker’s continued leadership in supporting community development financial institutions (CDFIs). The CDFI Tax Credit Investment Act will help drive more private capital to CDFIs offering affordable, responsible financing to low-wealth urban, rural, and Native communities across the country,” said Jennifer A. Vasiloff, Chief External Affairs Officer, Opportunity Finance Network.

“CDBA and its members strongly support the CDFI Tax Credit Investment Act. The credit will provide an invaluable tool for leveraging private investment into underserved markets. This will be a game changer,” said Jeannine Jacokes, Chief Executive Officer, Community Development Bankers Association.

“The CDFI Tax Credit Act is a practical, bipartisan way to marshal the long-term capital that struggling urban and rural communities need. It will create jobs, grow small businesses, and strengthen families by providing health services and child care. It’s a smart investment in America’s future,” said Buzz Roberts, President & CEO, National Association of Affordable Housing Lenders.

“Senators Warner and Wicker’s innovative proposal to drive more resources into our communities is forward-thinking and much needed. CDFIs, whose missions are to create economic opportunity for all, already leverage private capital sources to develop community-centered investments and sustain the communities they serve. Unfortunately, the community need is outpacing the resources available to CDFIs. Additional investment options like the CDFI Tax Credit will be a game-changer for the industry across the country. The VA CDFI Coalition is excited by the possibilities these investments could create across Virginia and hope to see this pass,” said Leah Fremouw, Board President, VA CDFI Coalition.

You can read the full copy of S.4418 below.

The Community Development Investment Tax Credit Act by yallpolitics on Scribd