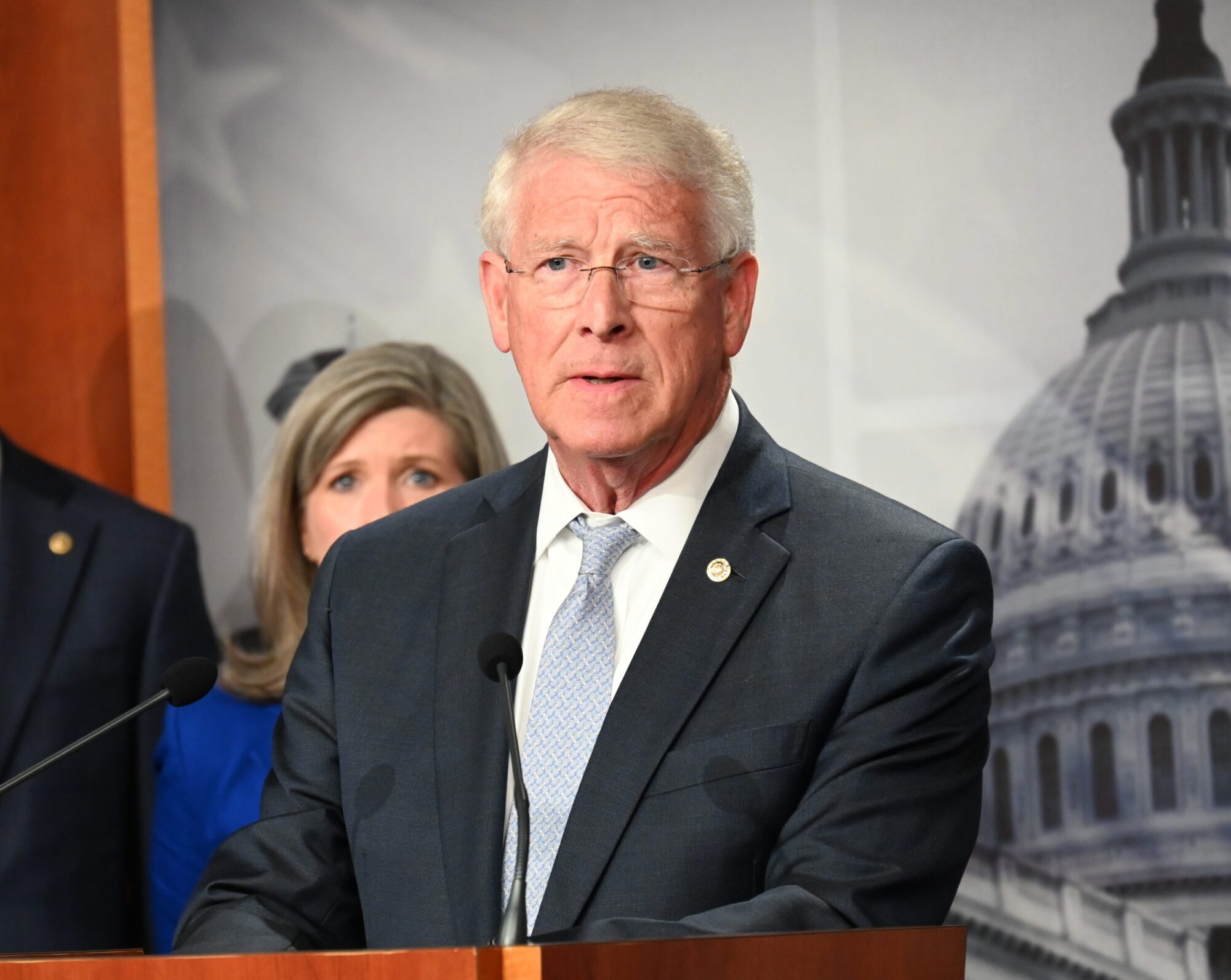

Submitted by Senator Roger Wicker

Mississippi Senator urges Democrats to abandon tax hikes, keep Trump-era tax cuts in place.

President Biden’s tax-and-spend bill is regrettably back on the table. Last December, the President’s plan seemed all but defeated when two Democrat Senators, Joe Manchin and Kyrsten Sinema, joined all Republicans in opposing the bill – with Senator Manchin declaring it “dead.” Yet today, Senator Manchin is once again engaging Democrats on a plan to revive the Biden bill, even as our economy suffers under the weight of Biden-caused inflation. If Democrats pass this tax-and-spend proposal, we can expect even more inflation and economic pain to come.

A Recipe for Recession

Details on the Democrat bill are still emerging, but Senator Manchin has signaled his desire to roll back the Republican-passed tax cuts of 2017, which led to massive economic growth. The West Virginia Senator wants to raise taxes on job creators from 21 percent to 25 percent, making American companies less globally competitive and hurting job creation. He also wants to expand IRS audits on taxpayers, even as millions of Americans are still waiting for their tax refunds. On spending, Democrats are seeking at least $300 billion in taxpayer dollars for their climate agenda while doing nothing to address soaring gas prices.

Given the economic pain we are all feeling, this tax-and-spend bill is an insult to the American people that ignores our most pressing needs. The price of gasoline has doubled under President Biden, with experts predicting we will be paying $6 per gallon by August. Inflation is costing the average family an extra $5,000 per year. Employers are still struggling to find workers. And supply chain problems continue to result in empty shelves. Instead of addressing these problems, Democrats are fixated on tax hikes and socialist spending that would upend any hopes of a recovery. No wonder the President’s approval rating is underwater and 83 percent of Americans rate him poorly on the economy.

2017 Tax Cuts Created Jobs

It is now widely acknowledged that the President’s massive and unnecessary “stimulus” bill last year sparked our current inflation crisis. The results have been felt across our economy. More than 60 percent of small businesses now fear that inflation will drive them out of business, and economic confidence has reached its lowest level since 2009. Indeed, our economy shrank by 1.4 percent in the first quarter of this year, prompting fears of a recession. The last thing we need now is a tax increase.

Despite the President’s missteps, the Republican tax cuts of 2017 remain our biggest economic advantage. These policies, which I helped negotiate, unleashed an economic boom that lasted up until the pandemic. In the first two years of lower tax rates, business investment surged by 9.4 percent. Unemployment dropped to 3.5 percent, the lowest in 50 years. Incomes grew, especially among low-income earners and those without high school diplomas. On the whole, 90 percent of workers kept a larger share of their money.

We cannot afford to lose these highly successful tax cuts if we want a real recovery. I hope Senator Manchin takes a step back from these Democrat talks and remembers why he rejected the Biden tax-and-spend plan in the first place. Republicans are committed to protecting tax relief as a bedrock of our post-pandemic economy.

###

Submitted by Senator Roger Wicker.