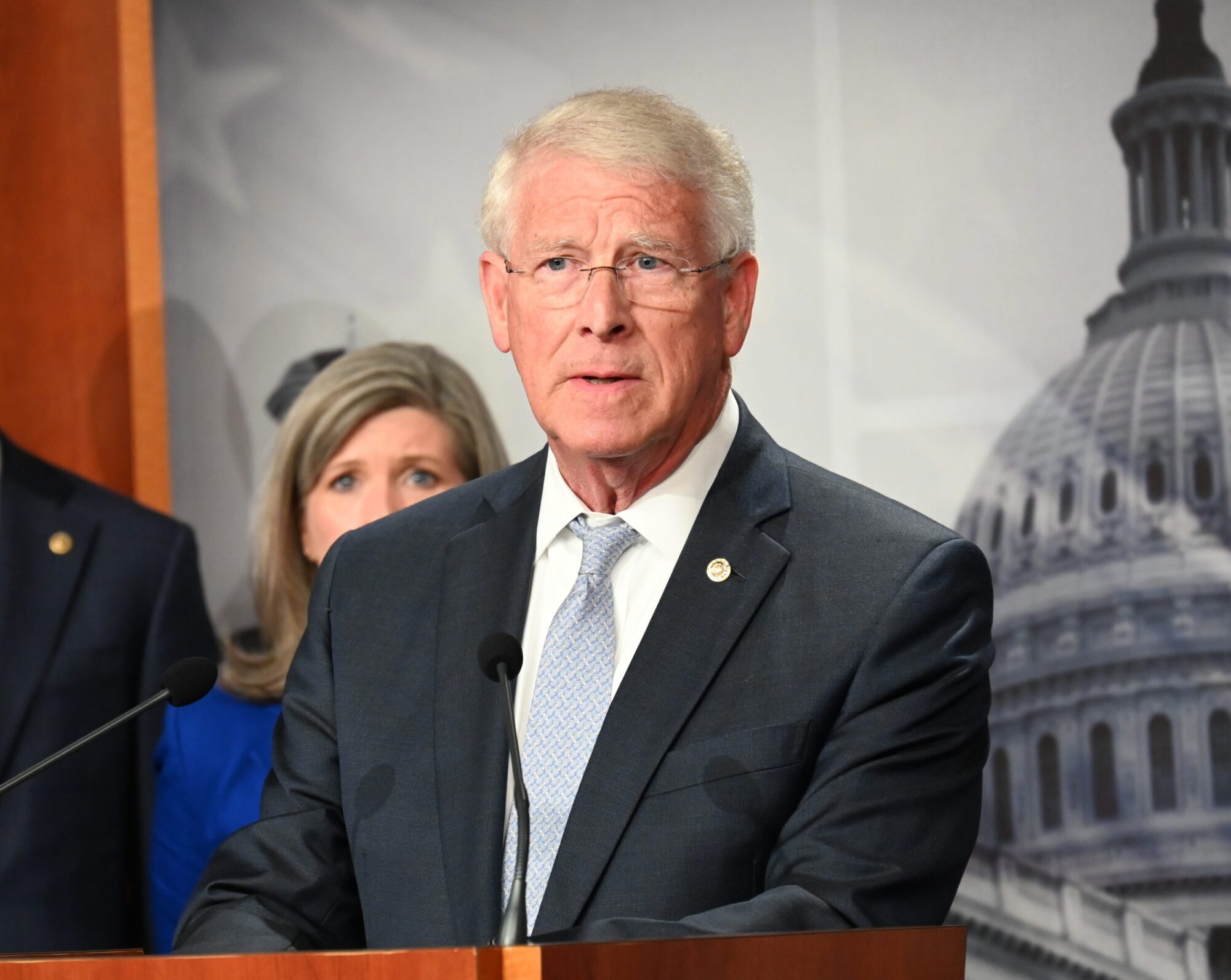

Submitted by John Caldwell, Northern District Transportation Commissioner

“The challenge is clear! Fix our highways. That costs money. Additional and alternative revenues must be considered,” Caldwell writes.

Hold on to your coffee. Whether it’s a rough stretch along your favorite highway, or random potholes on our interstates, there’s no need to go looking for trouble. You can find examples in every direction. Our state highway infrastructure is in serious need and has been for some time now.

We were way behind and losing ground. We are still behind and still losing ground. Funding is well short of need and more than a decade behind the pace of inflation. High costs and increased demands of basic maintenance leaves little capacity for making substantial improvements. Old, promised projects languish in varying levels of dormancy. Time continues to pass, and we wait. We wait and argue. We wait and agree. Still, we wait. While we wait, things deteriorate. While we wait, we also work.

This year the needle moved. Thankfully, some last-minute wrangling and unique resolve from state leadership found a way to send MDOT additional state funds for highways. That coupled with an increasing amount of federal infrastructure dollars provided MDOT much needed albeit temporary relief in the midst of skyrocketing inflation. But these new monies have been praised by some as if our highway funding shortfalls are behind us. They are not.

Mississippi roads and bridges are crumbling faster than we can repair them. We chip away at our list of priorities at a ridiculously slow pace because we can’t and won’t outrun our money. Prior to this year’s one-time infusion of revenue, the fuel tax proceeds had been basically flat and falling. That is why the 2022 MDOT Budget of $1.2 billon barely matched the $1.2 billion dollar budget of twelve years ago. In 2023 our budget will be about $100 million more than a previous peak of $1.3 billion reached at a time prior to this commission and today’s legislative leadership team. Even with an additional $80 million in lottery funds (also not adjusted with inflation) we saw our MDOT budget drop to $1.1 billion during COVID.

Fuel taxes have been and will continue as the mainstay for funding the Mississippi Department of Transportation in the foreseeable future, although current fuel tax receipts leave worthy projects on the shelf. Maintenance also suffers when revenues are flat. State fuel taxes, currently 18.4 cents per gallon, do not rise with gas prices. In fact, if demand is slowed the overall collections can fall further.

The challenge is clear! Fix our highways. That costs money.

Additional and alternative revenues must be considered, and frankly discussions have already begun with ones willing to face reality. States like Missouri which have kept their own fuel tax rates low, annually supplement their DOT with state general funds beyond the expected shortfalls from fuel taxes. Nearby states, like Arkansas and Georgia have raised their fuel taxes to fund highway improvements. Colorado and others are implementing delivery fees on internet purchases to help fund highways. With Amazon, FedEx, USPS, and UPS moving to electric vehicles (EVs) that delivery fee keeps a modicum of the original user-pay theory of funding highways. Mississippi already has a modest fee applied to hybrids and EVs that brings in just over $1 million annually. Better and more convenient toll road processes in nearby Florida and Texas have also funded highways and bridges. Oregon goes so far as to charge an invasive and complicated mileage tax to its residents. Indiana has a wheel tax. The debate will increase in search of solutions.

Mississippians, business leaders, economic development professionals and elected officials will be addressing our transportation challenges one way or another. We will have a proactive response or a reactive response. Status quo cannot, should not and will not hold.

###

Submitted by Northern District Transportation Commissioner John Caldwell.