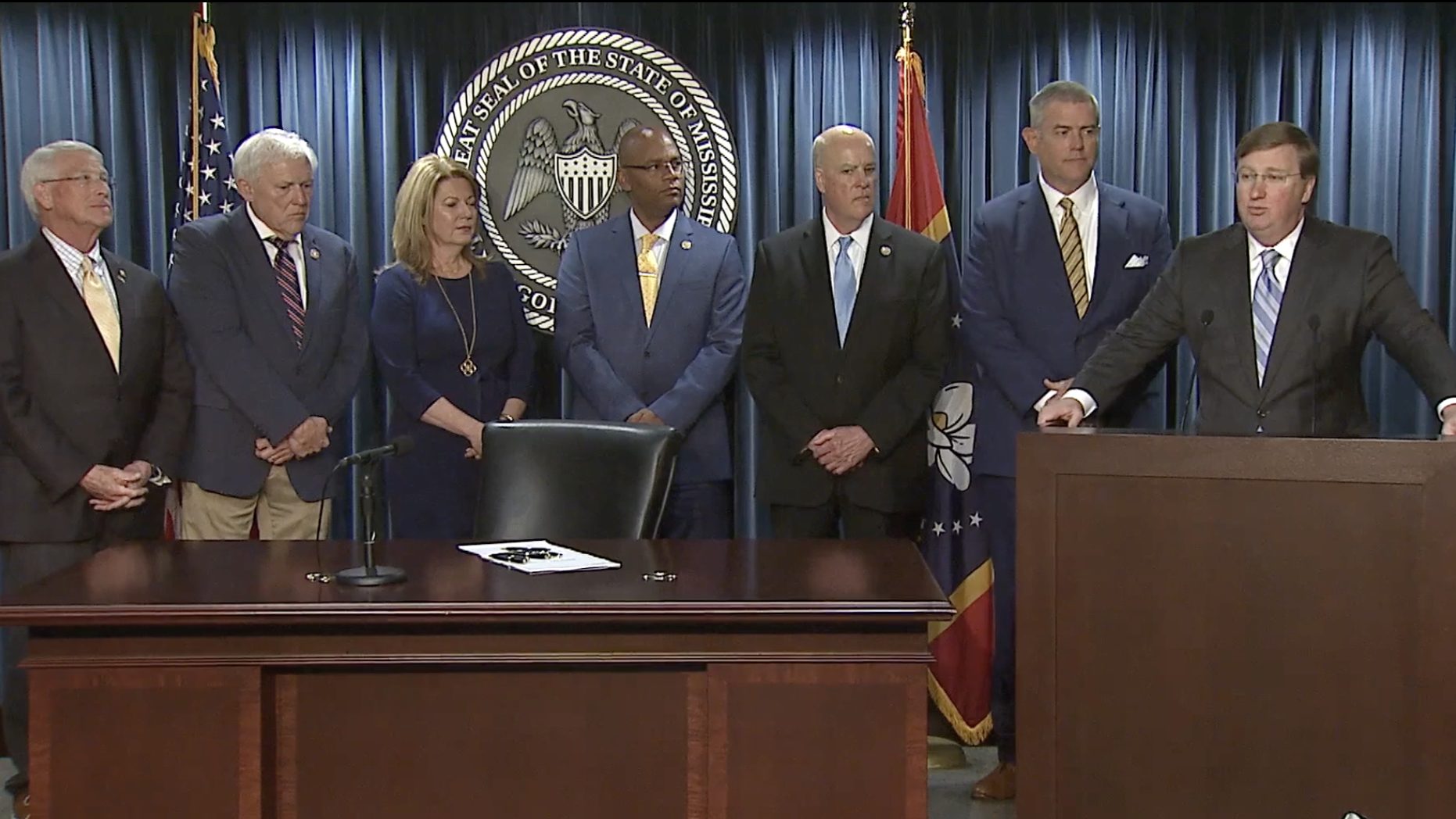

Mississippi is joined by Alabama and North Carolina in receiving the accreditation.

The National Association of Insurance Commissioners’ (NAIC) held their spring meeting in Kansas City, Missouri at the beginning of April. The meeting allows for the Financial Regulation Standards and Accreditation (F) Committee to vote to accredit state insurance departments. The Mississippi Insurance Department (MID) received one such accreditation.

The accreditation program was established in order to maintain standards to promote effective insurance company financial solvency regulation. This is so that state insurance departments meet baseline standards of solvency regulation, particularly with respect to regulation of multi-state insurers.

The accreditation process happens every five years. All fifty states, the District of Columbia, and the U.S. Virgin Islands are currently accredited.

“Accreditation is a critical component to ensuring a viable system of state-based regulation,” said Insurance Commissioner Mike Chaney. “I am proud of the continued work my office is doing to develop best practices and maintain standards that promote an efficient and effective process for regulation of our domestic insurance industry. In particular, David Browning and his staff in the MID Financial and Market Regulation Division are doing exceptional work meeting standards of solvency regulation and regulating multi-state insurers based out of Mississippi.”

Accredited insurance departments undergo comprehensive, independent review every five years to ensure they meet financial solvency oversight standards. All fifty states, the District of Columbia, and the U.S. Virgin Islands are currently accredited.

To become accredited, the state’s department of insurance must submit to a full on-site accreditation review. During this review, the team of independent consultants reviews the department’s compliance with the standards to develop a recommendation regarding the state’s accredited status.