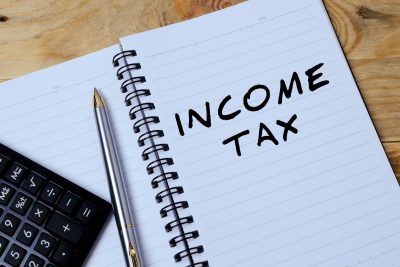

The House makes several concessions on original income tax plan, the Senate makes minor changes including a reverse repealer and a cut to the gas tax for 6 months.

The Mississippi House and Senate are handling each others income tax cut bills in the necessary committee’s today, prior to tomorrow’s floor deadline.

House Action

On Monday during a House Ways and Means Committee meeting, Representative Trey Lamar (R) offered a strike all amendment to the SB 3164 that addressed the Senate’s concerns regarding the House’s income tax elimination bill.

The bill changed several components of the House’s original language in the Senate bill:

- Does not increase sales tax, leaves it at 7 percent.

- Changes initial tax cut from $40,000 to $25,000 for an individual and from $80,000 to $50,000 for a couple.

- Moves additional triggers from 1.5% growth to 1.6% growth; First 1.6% of growth will go to the state budget.

- Places a cap on what can be used to buy down income tax to $150 million.

- Reduces grocery tax from 7% to 4% over 12 years.

- Set aside $500 million in Capitol Expense Fund

- Removes 50% car tag cut.

If passed by the Mississippi House, as amended, SB 3164 would go back to Senate for it to concur on amendments & send to Governor or invite conference negotiations between the chambers. The latter is almost certainly the path.

The bill was passed in committee and quickly taken up on the House floor. After some debate the legislation was passed on the floor by a vote of 83 to 33.

Senate Action:

The Senate Finance committee took up HB 531, the House income tax cut plan. Chairman Josh Harkins (R) motioned for a strike all to be added to the bill with the Senate income tax cut language, and included a reverse repealer.

There was a change from a four year phase in to an eight year phase in.

There was also included the move for a six-month suspension to the gasoline tax. This proposal was first mentioned by Lt. Governor Hosemann earlier on Monday as response to the rising inflation in the state.

High points of Senate changes to HB 531:

- Immediate reduction in the grocery tax from 7% to 5%.

- Reduction in the 5% tax bracket to 4.6% over years 1-4.

- Elimination of the 4% tax bracket in 5-8 years.

- A six month suspension of the state’s 18.4 cent gas tax

RELATED: Hosemann calls for six-month cut to gas tax in response to rising inflation

The bill was hotly contested by Senator Hob Bryan (D) who said a cut of the state’s income tax would do unspeakable harm to the state which already suffers from failing infrastructure and struggling schools.

WATCH THE SENATE DISCUSSION IN FINANCE COMMITTEE

He said this move to eliminate income tax is a response to Speaker Gunn and a handful of individuals who have made is an “obsession,” in Bryan’s terms.

“This is just an incredibly uncertain time. Why on earth would we be doing anything this long term with revenue when the state of the world economy is so uncertain. Isn’t the prudent thing to put some money aside?,” asked Bryan.

The bill was passed in committee and is expected to be taken up on the Senate floor Tuesday morning.

UPDATE:

On Tuesday, Speaker Philip Gunn held a press conference to discuss the House’s revised plan for income tax elimination.

**Contributions from Anne Summerhays, Capitol Reporter**