Two days of hearings set for August 25 and 26th.

Legislative hearings on Mississippi’s income tax will soon begin before a joint select committee of eight Senators and eight House members. These hearings are in response to both Governor Tate Reeves’ call to phase out the income tax without tax swaps and House Speaker Philip Gunn’s push to eliminate Mississippi’s individual income tax while cutting taxes on groceries and increasing sales and other taxes in order to offset a portion of the lost revenue.

Governor Reeves recently irritated his call for the income tax elimination at the Neshoba County Fair, as did Speaker Gunn. In addition, Gunn has been traveling the state promoting his plan.

Back in March, Speaker Philip Gunn told Y’all Politics that the phase out of income tax needs to happen.

“The time is now. Our citizens need tax relief now,” Speaker Gunn said while in the 2021 session before the measure died. “This needs to happen this year, today, people need tax relief.”

Though the House passed Gunn’s plan, the Senate did not take it up. The Senate stated that the plan needed more vetting and vowed to study it over the summer and fall before the start of the 2022 session.

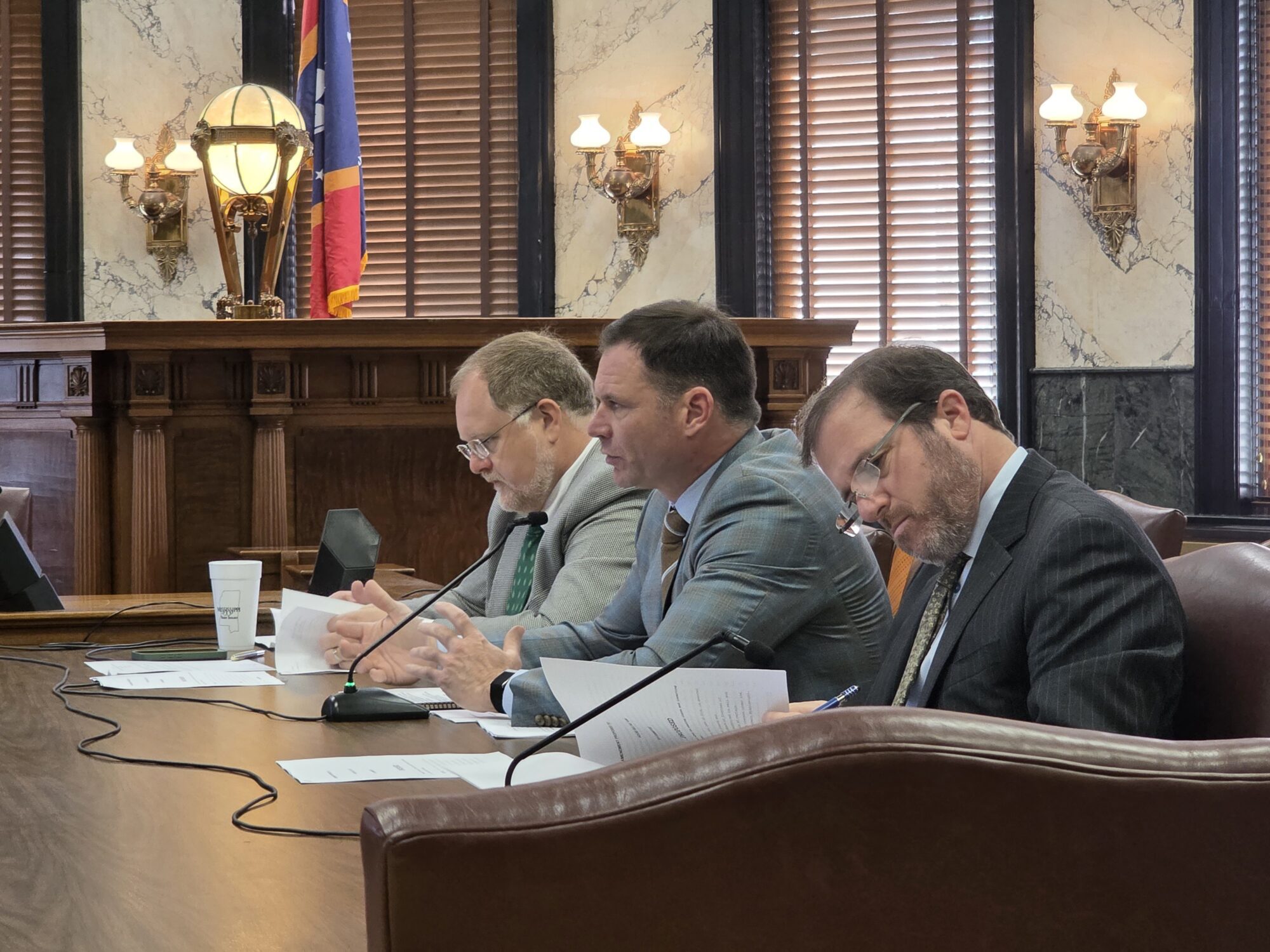

Senate Finance Chairman Josh Harkins told Y’all Politics that the upcoming hearings could feature a variety of experts in the field to testify, such as the Department of Revenue, economists, and various business people. Tax foundations and tax experts could also be brought into the hearings to provide research and data to present outcomes from states that do and do not have income taxes.

“It’s a matter of trying to get as much information from different perspectives and different sources,” stated Harkins.

Senator Harkins said legislators are going to try and get a good understanding of where the state’s money comes from and how it is spent, or where the diversions are directed. They will look at tax credits and the other considerations that make up the fiscal foundation of Mississippi government. Harkins stated that lawmakers want to study this in depth now because once they set an elimination of the income tax in motion, they have to make sure it is a process that works.

“You may have a lot of people say, ‘Yeah let’s eliminate the income tax,'” stated Harkins. “Well the problem is the $1.7 billion and how are you going to replace it? How are you going to function and fund the core objectives of the government?”

House Ways and Means Chairman Trey Lamar told Y’all Politics that most people focus on the initial swap of eliminating up to $40,000 of income for every taxpayer in exchange for raising the sales tax rate to 2.5%. Lamar says they don’t acknowledge that this would be the largest tax cut in the history of the state of Mississippi.

“Most people focused on that aspect of it. They didn’t focus on the second part of the plan which phased out the remaining roughly $700-$800 million of individual income tax over the next 10 years making it the largest tax cut in the history of the state,” stated Rep. Lamar.

Representative Lamar said that he has had many meetings and conversations with Chairman Harkins and other Senate leadership about the proposal that the House passed last year. Lamar added that he looks forward to discussing the merits of the plan and answering any questions they have to clear up any doubts.

Lamar believes people are starting to come around to the idea of eliminating the state income tax, but a few questions remain as to whether the House plan is the best way to do it.

“I feel very confident in the plan, as does the remaining House leadership, and there’s still a few minor details to work out,” Rep. Lamar said.

There are nine states with no income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

Speaker Gunn previously stated that these states are economically thriving and attracting more people, unlike Mississippi.

The joint legislative meetings on August 25th and 26th will feature discussions on where lawmakers want to go with the proposed income elimination and how they want to get there as they attempt to find common ground on the issue.