The State Auditor’s office released the yearly Single Audit of federal funds for Mississippi agencies and found potential Medicaid fraud from some beneficiaries.

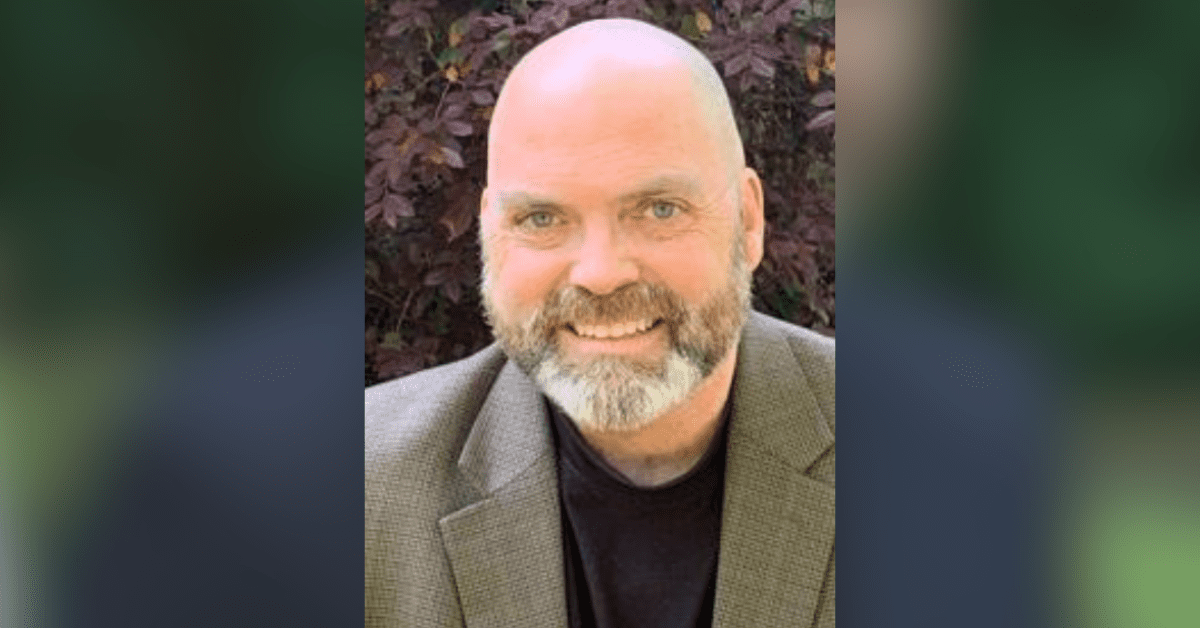

Auditor Shad White released the Single Audit of federal funds that are being used by Mississippi agencies. This audit will often show findings from previous individual audits but can also provide additional details regarding spending.

The auditors office specifically compared the income that Medicaid recipients reported to the Division of Medicaid with the income they reported on their state income tax returns.

“The use of these returns to figure out if people are lying to obtain benefits started last year in my office,”said Auditor White. “We now have enough data to show there are millions of dollars of potential savings if we can prevent ineligible people from getting on Medicaid. The benefits should only be going to those who deserve to be on the program.”

During the audit the office found that some of those recipients are lying to obtain additional benefits.

The audit looked at 180 different Medicaid beneficiaries and found that roughly 5 percent could be ineligible due to their high levels of income reported.

In particular two individuals who own multi-million dollar homes and declared high incomes on their 2020 tac returns also showed to be receiving Medicaid benefits. This point is highlighted in the audit.

White’s office reported that Medicaid had already pinpointed the individuals as potential fraud cases to investigate. However, Medicaid does not have any legal authority to obtain state income taxes when an individual applies for the program.

“Under current law, Medicaid cannot do the analysis we did here,” said White. “I stand ready to work with Medicaid’s leadership to argue to lawmakers that they should have this tool in their toolbox. It could stop ineligible applicants from being put on the program in the first place. We know this tool would be useful because Medicaid’s internal policies state they should ask an applicant for their return, but without the authority to get the return and a requirement to use it, the state is potentially handing out millions to

ineligible people.”

Medicaid represents 49% of the federal funds spent by the state of Mississippi.

“I want to thank the team of auditors who worked this year on the Single Audit,” added White. “With every finding, they are putting their licenses on the line. They do so to make our state better and out of fidelity to the taxpayers.”